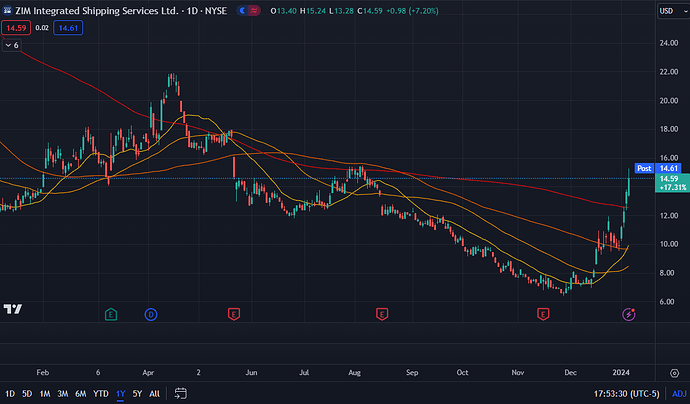

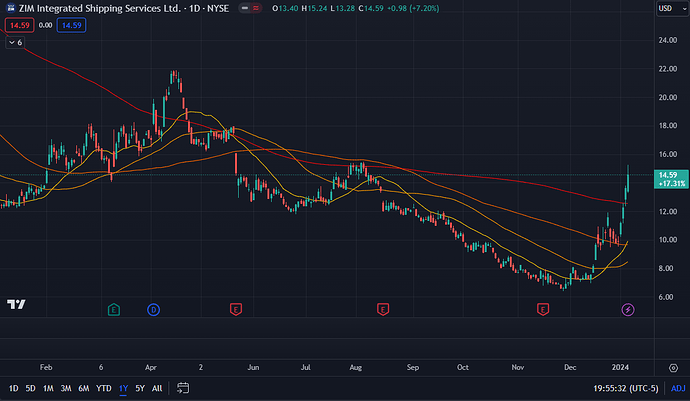

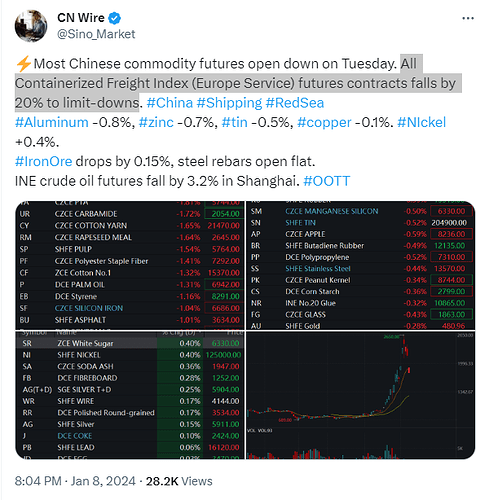

Closed half of these out for $0.66 (+153%). More than base capital returned.

ZIM continues to benefit from the situatin in the Red Sea: https://seekingalpha.com/article/4661278-zim-integrated-shipping-stock-prime-beneficiary-red-sea-disruptions-buy

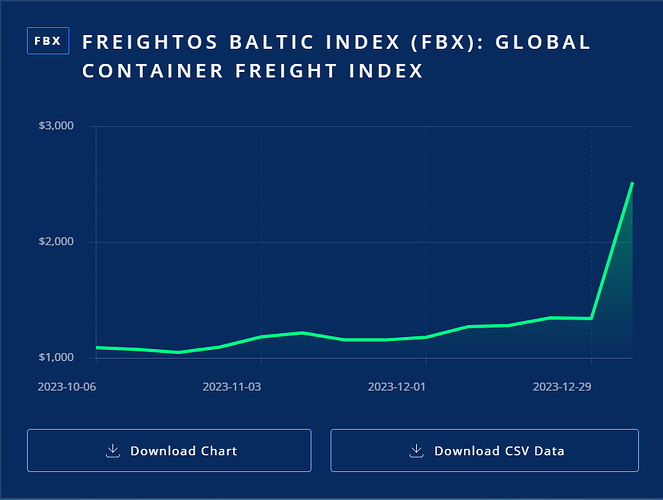

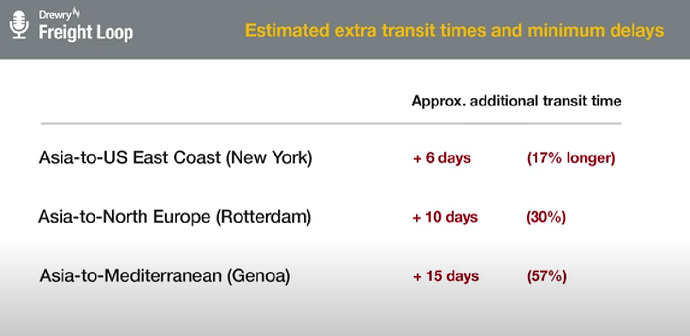

ZIM’s strength and weakness is its exposure to spot rates, which have skyrocketed (below). Thing about shipping is once a disruption happens, it takes a while for the effect to iron out as all the ships (all bigger than the Titanic) have turned around or away already, and it takes a few weeks at least for things to go back to a previous schedule. So ZIM stock prices should stay elevated, thuogh it’s not clear how much more room it has to run.

Good source to stay updated on the current situation: Global Ocean Carriers Halt Red Sea Transits – What to Expect

Latest post:

Updates on the Suez Canal: Carriers Adapting Routing Decisions and Freight Rates Continue to Rise

11 am ET / 8 am PT, Friday, January 5th

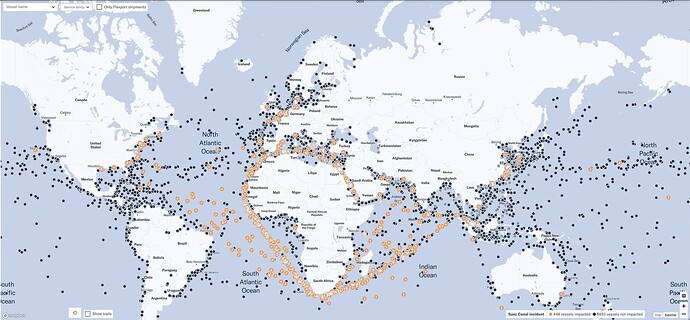

As of January 5, carriers maintain their routing south of Africa for almost their entire fleet with the exception of CMA which has continued using the Red Sea. Maersk, who previously elected to return to Red Sea transits and then paused, is now turning vessels away from the risk areas to transit the Cape of Good Hope. The Shanghai Containerized Freight Index’s (SCFI) publication shows rate increases, but not to the magnitude seen in the market.

Callouts:

- As of January 5, 389 container vessels accounting for 5.4 million TEUs of capacity (~22% of global capacity) are actively diverting, will divert, or have already diverted the Suez Canal. This is out of ~664 vessels that typically transit the Suez Canal.

- When considering carrier stances on Red Sea transits, it is important to note that vessel decisions are ultimately made by the vessel operator, and cargo with other carriers with slots on the vessel will be impacted by the decision. However, vessel-sharing agreements between carriers can influence the routing decisions of vessel operators as vessel utilization is key. For example, a vessel operator may be influenced by vessel-sharing agreements to use Cape Of Good Hope to maximize vessel utilization if their partners refuse to load on Red Sea vessels due to risk.

- The January 5th publication of the Shanghai Containerized Freight Index (SCFI) showcases the following increases:

- Shanghai to North Europe: +7% since Dec 29 and +179% since Dec 15

- Shanghai to the Mediterranean: +4% since Dec 29 and +131% since Dec 15

- Shanghai to U.S. West Coast: +9% since Dec 29 and +53% since Dec 15

- Shanghai to U.S. East Coast: +10% since Dec 29 and +40% since Dec 15

- While the SCFI shows increases, the magnitude is lower than what we see in the market. In times of high volatility, it is difficult for indices to keep up with the market freight rate changes. This was particularly apparent during the COVID economy. For example, the Drewry Container Index saw week-over-week increases of 115% from Asia to Europe and 25-30% from Asia to the U.S.

- Premium rates will come at higher levels to guarantee equipment and loading. We’re hearing about some carriers announcing premium levels at over $10,000 per 40-foot container into the U.S. West Coast for the second half of January.

- Rate increases have cascaded into the Transatlantic trade as well as we saw Maersk announce a peak season surcharge and CMA announce a rate restoration initiative.

- To a certain extent, shippers have their hands tied if they need goods in the next three months. They can either accept high rates now or delay cargo and have to navigate equipment shortages post-Lunar New Year which will also lead to elevated rate levels.

Orange dots represent all rerouted container ships. That’s 95% of container ships that would’ve transited the Red Sea are now going around the Southern Tip of Africa.

Incident map, for those who want to follow the blow by blow: Sign In

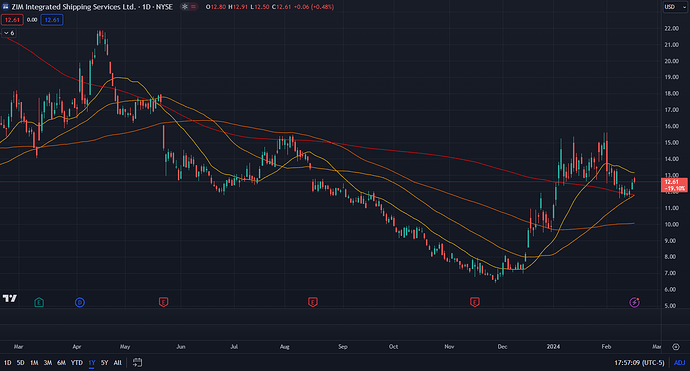

Thankfully, it’s not complicated with ZIM. It follows spot rates up, down and sideways. Nothing more, nothing less.

Drewry put out this summary video on the impact of the current Red Sea crisis:

These are the current estimate of delays:

Am also picking up some chatter on there being congestion in South Africa as ships stop to refuel - they are not set up to handle this massive volume of rerouting.

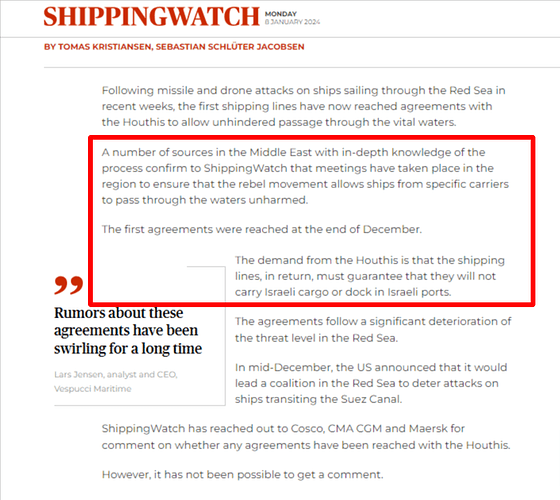

Meanwhile, Houthis continue to do Houthi things:

In a post on X, Al-Houthi said: “Every ship that goes through the Red Sea, Bab El-Mandeb (the strait that connects the Red Sea with the Gulf of Aden), or the Arabian Sea should broadcast the words, ‘we have no relationship with Israel.’

Sounds like an excuse to lob stuff at more ships.

All in, ZIM probably has a few more good weeks left in it, despite the massive runup already. Sentiment has also caught on - seeing it show up all over fIntwit too.

I don’t know what I would write this catalyst off just yet though. The Chinese liners likely made the deal, don’t know that the Euro and NA ones will just refuse to carry cargo related to Israel. Also, shpis are already routed, and not like they will turn back now. This could still be a thing into the Chinese New Year.

Btw another another great resource on ship movements: IMF Portwatch

Few things I came across as to the current pull back of ZIM

What is the source for this news item please, snood? It makes some interesting claims.

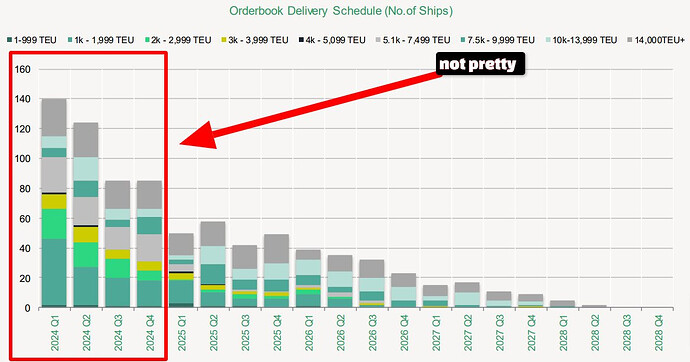

The orderbook is an issue, but over a much longer timeframe than this crisis. No doubt, rates will plummet later in the year, so this is a short term play.

The WTI comment is weird. It has little to do with shipping fuel - it’s bunker fuel, and stretched stockpiles in South Africa that is the issue.

Also, while rates rose with inflation last time, inflation was less because of rates and more because of increased demand and congestion at ports. Just rates themselves will likely have minimal impact unless rates go up 10x, like they did in 2022.

<@373882275429089290> seems like just an opinion piece but here is where I found it https://invezz.com/news/2024/01/05/heres-why-zim-integrated-stock-price-could-retreat-soon-wsj/

<@373882275429089290> here is DD on ZIM. It’s alright and has similar points that you’ve made. I think his positioning isn’t the best https://www.reddit.com/r/wallstreetbets/comments/1922zw4/zim_betting_on_red_sea_conflict/

Thanks, left a comment there a little bit ago ![]()

Meanwhile this happened:

Will have to see if it’s specific to the instrument, or if the rates are actually plummeting. Which would be because they are overextended.

Closed the other half out for $1.00 (+284%). ZIM’s been surprisingly stuff, and there’s only 2 days left on this, so not risking it.

Got these 15C/16C call spreads for next week for $0.16: Bull Call Spread | OptionStrat Options Profit Calculator

As @snoodking1 notes, freight rates have only gone up, while ZIM has kinda stayed in the same zone. Hearing of major demand out of China too.

I think it’s time ZIM were to return to its depths again.

Reasons:

- The extent of the rise was an overreaction, considering additional costs involved to deal with the re-routings

- Chinese New Year is over, and that demand support is gone

- Newbuilds are hitting the water with gusto, adding to tonnage supply

Will probably pick up a bearish (credit) call spread sometime next week.

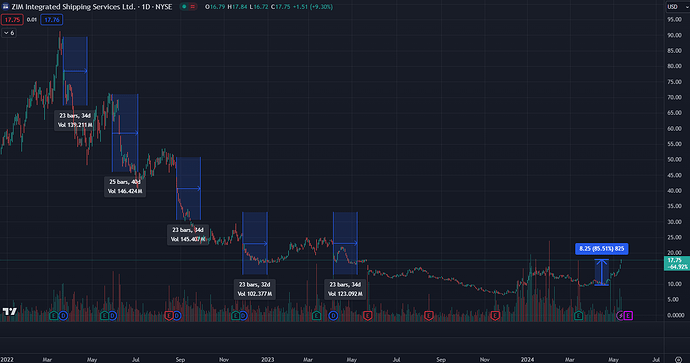

Kinda forgot about ZIM, but as expected, price fell in response to freight rates falling. ( (1)[https://en.macromicro.me/charts/947/commodity-ccfi-scfi], (2) [Shanghai Shipping Exchange] ) Attaching analysis I used to use to play the earnings every time in 2022 - for some reason folks can’t help be bullish into earnings, and then as soon as dividend was paid, price dropped. And it dropped much more than the dividend amount, which made front running this profitable. ZIM stopped having profits about a year ago, and so has had no dividends. Except, now there is chatter of dividends because they had better earnings from higher spot rates because of the Red Sea crisis. Just putting this on our radar now. Earnings are in 3 weeks. Might make for a nice short setup if it rises some more.

ZIM has moved up 85% from its recent bottom, thanks to persistent and increasing spot rates. Folks are excited about a dividend. I can’t see how the dividend would be big enough to justify this increase, and there is a lot of tonnage supply showing up later in the year which should add pressure.

Am thinking of getting LEAPS puts end of next week, as earnings are in 2 weeks. Here’s the blueprint I used five times to mint off of ZIM in 2022:

@brummel , do you have any thoughts?