Closed these out for $0.45 (+125%).

Buy order for these hit at $0.20. Thus, kept 87% of the premium.

Was thinking of holding until after divvy payment and either sell into IV crush or hope that ZIM closes above $12.5 on the other side, but given markets and ZIM kinda wobbling, considered it prudent to be happy with this.

At this point, all options positions are closed. Just holding commons now.

Just replying saying thanks for keeping this thread alive with relevant updates! Didn’t end up holding through earnings but sold my call options the week or so before for like a 500% gain. Best trade of the year for me so far. Cheers! Hope you kill it this year

ZIM goes ex-dividend tomorrow. Dividends are supposed to be paid out today. Disappointed that it never went above $25…

Expecting maybe a 20%+ fall tomorrow, as the dividend amount is $6.40. And then a steady fall to the $15 level, even. IV accounts for this though, so time to load up on puts would be starting tomorrow. Will decide on strike and duration based on how ZIM opens.

Dividend hasn’t come in, so still holding commons.

Got these bearish put spreads today:

- 5/12 17P/15P for $0.40

- 4/21 18P/17P for $0.26

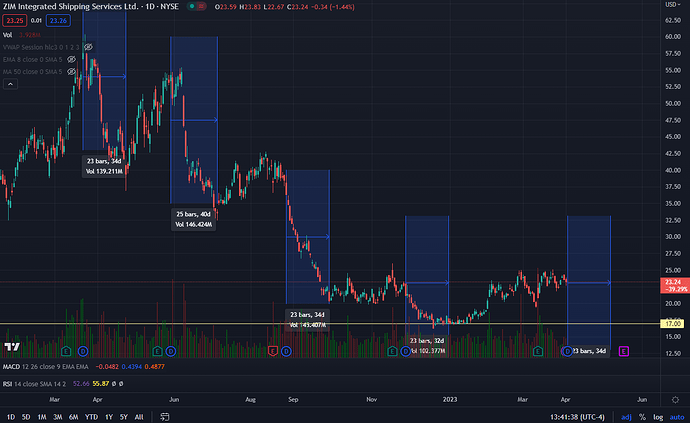

Looks like ZIM is following the post-dividend bleed-out pattern that has served us well so far like clockwork. Puts up nicely - April ones almost 100%, May ones about 50%. Global container rates still falling, so expecting this drop to continue for a while yet. Though should probably take some profits next week, out of prudence.

ZIM went up 13% today for no apparent reason. Both put positions above are underwater now, versus quite green yesterday. ![]() I still believe in the underlying thesis of the ticker following container rates, so added 5/19 17.5P/15P bearish put spreads for $0.45 near market close.

I still believe in the underlying thesis of the ticker following container rates, so added 5/19 17.5P/15P bearish put spreads for $0.45 near market close.

ZIM continues to show surprising strength even as spot rates remain at the bottom. Contract rates showed a tiny amount of recovery.

For:

Rolled the $$ proceeds from 5/12 puts into June ones after taking a -60% hit on them:

- 6/16 17.5P/15P for $0.50

The 4/21 will almost certainly expire worthless at this point. Holding the 5/19s as is, for now.

Closed these out for $1.01 (+124%).

The containership market is trying to decide if it wants to stay depressed or not. Drewry warned of continued weak market conditions, and containership charter rates are up (which is bad for ZIM), but spot rates are also up (which is good for ZIM). So decided to lock in those profits, and let the June put spread run for a bit longer.

Still thinking we can get close to the $15 mark. Still trusting those windows of post-earnings weakness we’ve been looking at for over a year, which suggests a bottoming in two more weeks.

Closed this out for $1.28 (+156%). ZIM showed relative weakness to the market and is at about break even. If we have a few more green days, don’t want this to go back the other way again for a while, and this return is plenty.

This closes out all my ZIM plays. It has been an exceedingly consistent play over the last year (folks can scroll up on this page) but for now, there is no clear direction. Will likely just watch for the next few months before going back in.

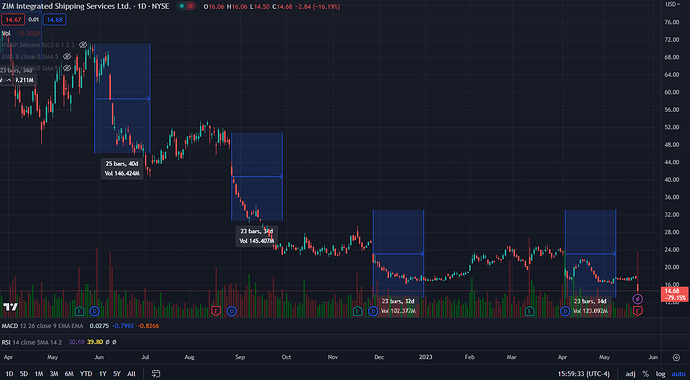

ZIM missed on EPS and revenue. No dividend in Q1, though still maintained 2023 guidance on better-than-expected H2. Which is surprising, since container rates are still low, and Q2 is looking to only be weaker still.

Got these puts as expecting selloff to continue:

- 6/16 15P/14P for $0.49

This was short lived. ZIM is bouncing back up after hitting $13, and I don’t understand why.

Closed this out for $0.50 today. A scratch.

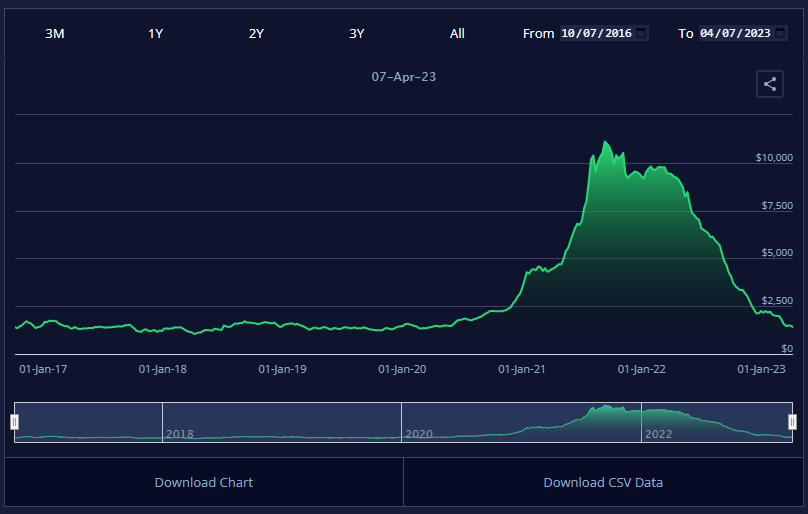

Their cash balance is 3 times market cap and FRI is currently under 2019 bottom.

Things are starting to stir up in the containership segment again:

-

Talks seem to be at an impasse between port union workers on one hand, and carriers and terminal owners on the other. Key issue is the latter are not budging from a 3-year wage freeze. A strike would cause freight costs to spike again.

-

Water levels at the Panama Canal are falling sharply. This will affect the massive ships that had diverted a lot of the traffic from the West Coast to the East Coast, forcing them to carry fewer containers so they can sail through the Canal, thereby increasing costs per container. Or cause them to go through the Suez Canal, which is a longer voyage, and so will have a similar effect of raising rates.

Owners and carriers have little incentive to cave to demands as shipping rates are near the bottom now, so they would be fine with a strike that causes ports to shut down, and rates to spike. They need to be careful though as anything prolonged could bring swift retaliation from Congress etc. as people are likely in no mood to go through another supply chain crisis again.

One to keep an eye on for now, as only if the strike materializes will rates really move. (Which they have not, yet.) Chatter of this was enough to bring back ZIM from the dead for a bit, though:

The video below has all the details. (Sal has been a reliable commentator on shipping.)

I know this thread has mostly been about trading zim, what do we think about it as a long term hold for shares?

Damn, will it really dip below IPO price o_O

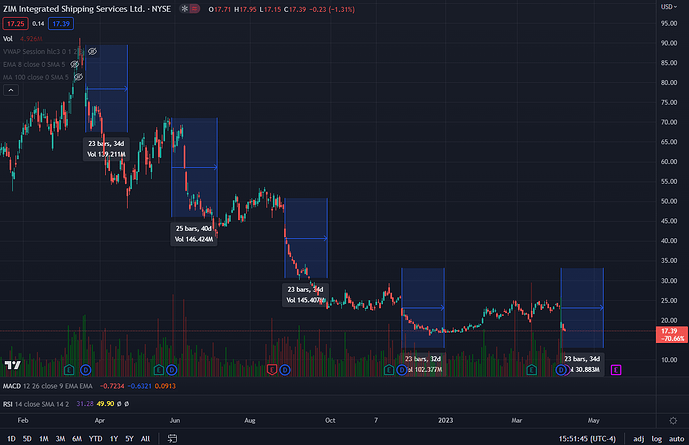

I no longer see ZIM as a long term hold, for a couple of reasons:

- There does not seem to be any systemic supply chain constraints, increased demand, or shortage of ships, that would lead to rising rates.

- Rather, docks seem to deal with loads fine, we are looking at a US and even global slowdown, retail outfits are still workign through their inventory buildups, and new ships are hitting the water for the next few years.

- ZIM isn’t expected to make much, if any money this year, so probably no dividend.

I don’t know if it will go much lower, but I don’t see it going higher, and there is no divvy incentive to hold.

Incidentally, came across this presentation from DHL that has a nice overview of global ocean bound freight.

Good read on containterships: ‘Dire’ scenario for shipping lines more likely as spot rates fall back

T;dr:

- Shipping lines face lower contract rates in 2024: The article reports that container lines may see a significant drop in their annual contract rates next year if they cannot push up spot rates in the last weeks of 2023. Spot rates have fallen back to the levels of early October, erasing the gains of Q4.

- Maersk CEO warns of ‘dire’ scenario: The article quotes Maersk CEO Vincent Clerc, who said that if spot rates do not improve in Q4, 2024 will be a “pretty dire situation” for container lines. He said that contract rates will reset much lower than this year’s, while costs are up 25-30% due to COVID-19.

- Zim could sustain cash burn for 2.3 years: The article cites an analysis by Clarksons Securities, which estimated that Zim, one of the container lines, could operate for about nine quarters with its existing cash reserves, assuming a quarterly cash burn rate of $300 million. The analysis also suggested that a market turnaround could occur in 2024 or 2025 if liners reduce ship capacity.

- Liners are still ordering new ships instead of scraping old ones. Many pundits and industry executives expected shipping lines to make the necessary capacity adjustments this year. They haven’t. Scrapping and ship idling have been much lower than predicted. ONE has ordered 12 new ships for delivery in 2025 and 2026.

The ZIM cash burn estimate here is a bit more aggressive than I’d estimated. Nevertheless everything together continues to pain a pretty bearish picture.

ZIM was spiking from the conflict in the Red Sea (Houthis attacking ships) until today, as various liners rerouted through the Cape. The pullback today is because of news that Maersk was going to go back to routing through the Suez Canal, after protection has been put into place. Bit of a gamble, but not sure this is totally done, so got some 1/19 call spreads for $0.26 each: Bull Call Spread | OptionStrat Options Profit Calculator

Great video from J Mintzmyer on the state of shipping, covering containerships like ZIM, as well as tankers and bulkers.