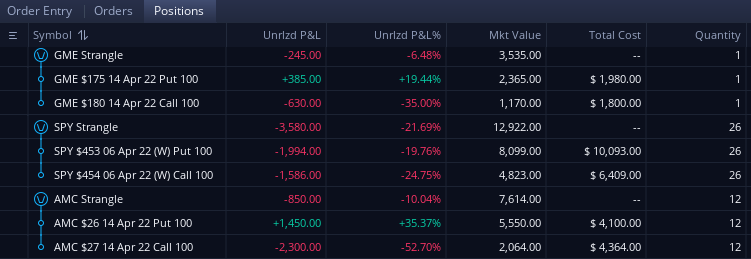

Reviewing my process today…

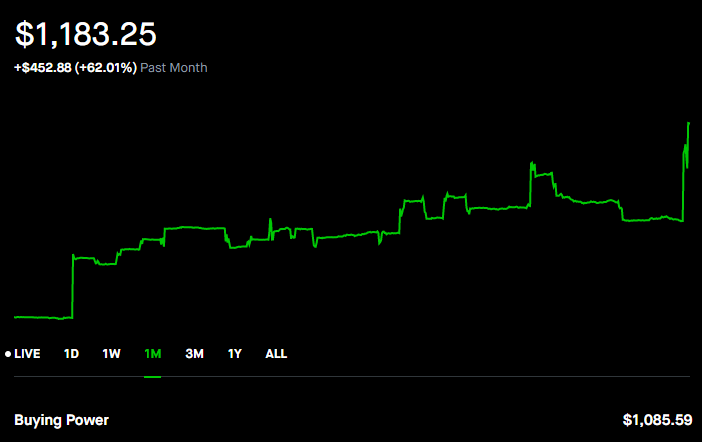

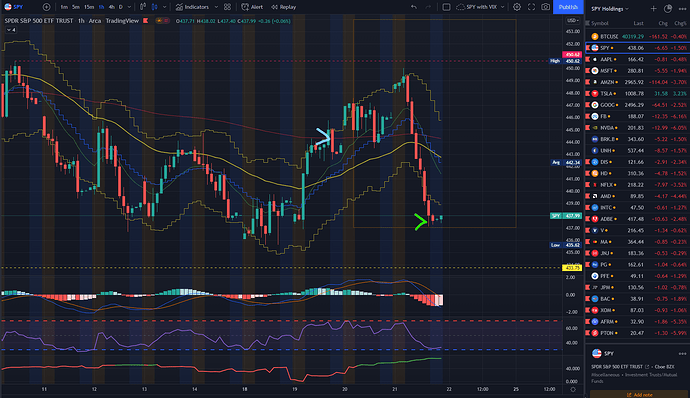

As SPY tanked yesterday, I was able to exit (green marker) with 10.38% gain.

Entry (blue marker) was March 19 end-of-day 445p/446c strangles, with the idea that TSLA will pump SPY or the FED will either pump/break the market.

TSLA did pump SPY a bit after their ER was released, but it was the market talks with FedReserve Chairman, Jerome Powell, that moved things forcefully intraday.

I still rely heavily on TA–since it gives me the most possible gains.

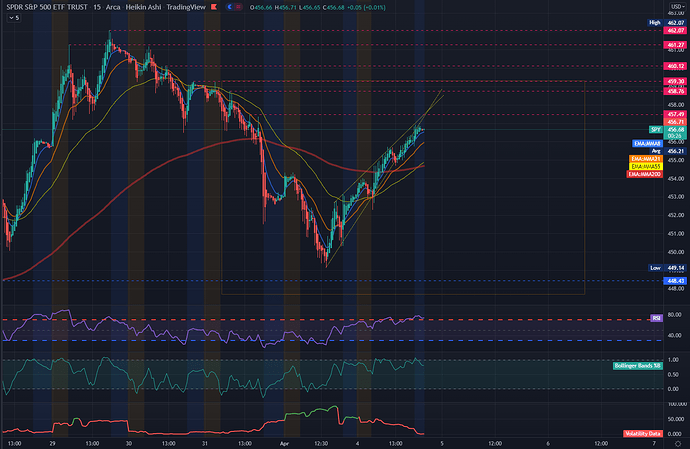

Here’s what I saw:

- Using regular candles on the 1 Hour, I saw the price was at the 200 Market Moving Average (red line).

- Price was also pushing against and poked out a bit at the top band (stepped yellow lines) of the Keltner Channel (I prefer this over Bollinger Bands now), signifying a possible push further upward, or move downturn.

- 13 MMA (green line) and 48 MMA (thick yellow) lines crossed upward, possibly extending a bullish move for a few more hours.

- I didn’t pay much attention to the MACD and RSI indicators this time, since News will be the deciding factor.

- Average True Range showed low enough volatility that day, good to enter.

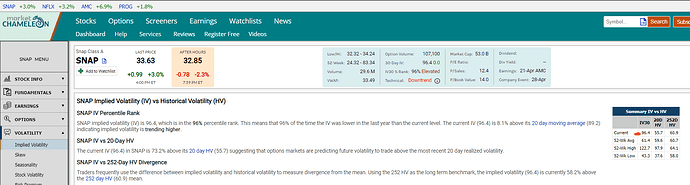

- Options Chain also verified low enough IV for SPY–can’t remember exact number now, but you want to see it at 19% or lower.

Those things above helped me decide to enter strangles, as I knew the market will swing one way or another with better volatility.

As you can see with the orange bounding box I drew, my break even price at the lower end was a bit over 437, but the expected higher volatility raised the options’ premiums and gave me my green way out.

I was only hoping for a 5% gain since my OpEx was on Monday, but 2x that is a big welcome.

What’s important at the end, is that I didn’t wait any longer.

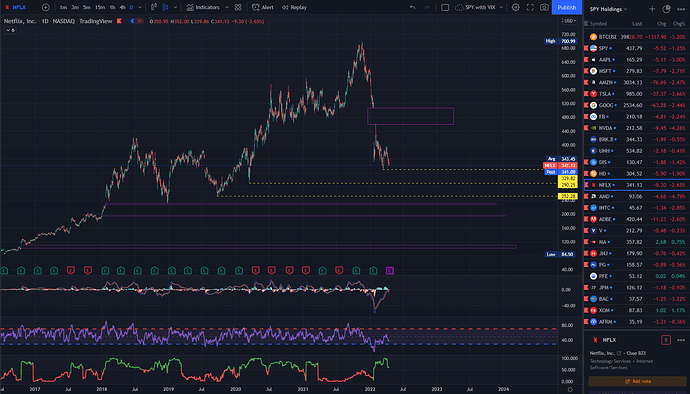

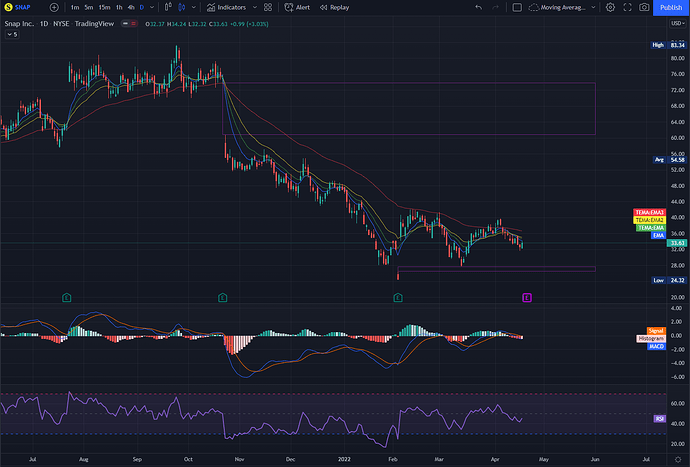

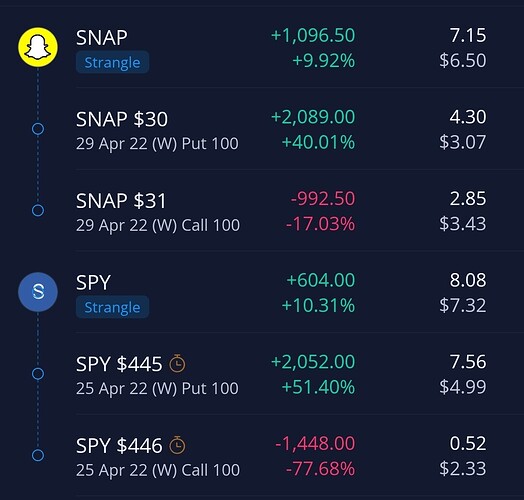

This was only on with SPY, SNAP ER did me good too–read my entries above.

Total 5day P%L is over $3k.

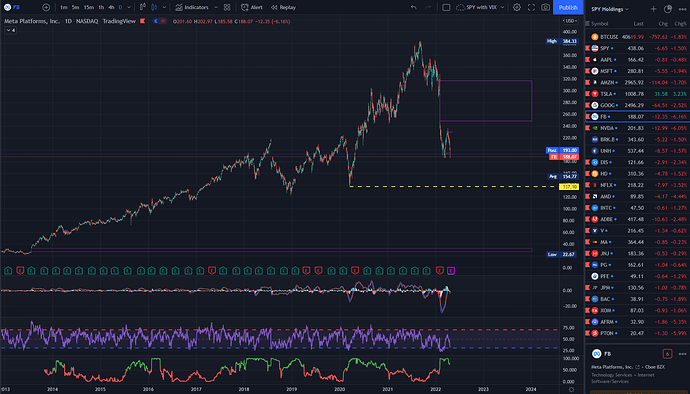

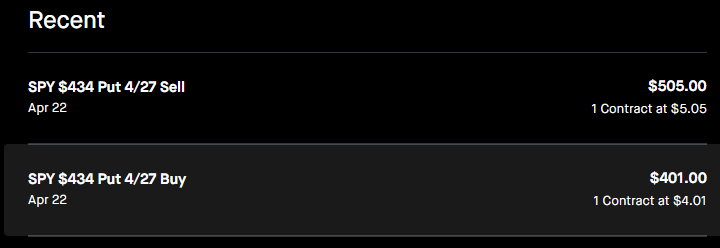

Now for my losing trades–the single-legged horrors.

AMD - Losing around $300, opex April29.

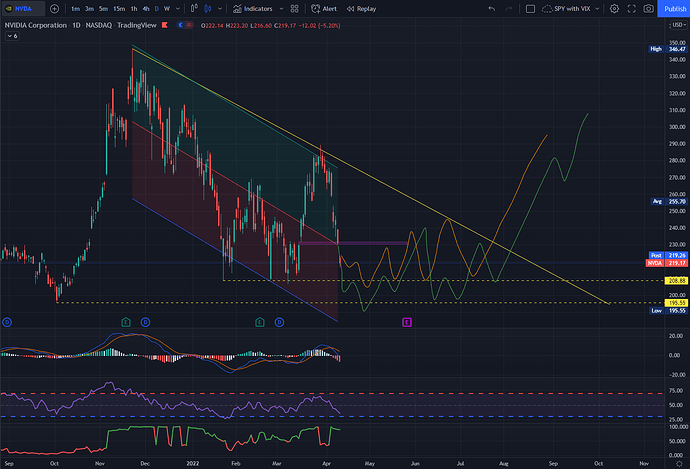

NVDA - Losing around $600, opex April29.

BEEM - Losing around $400, opex May20.

All these entries didn’t follow my process–they were taken on a hunch.

They were also peppered with hopium and retard mentality, so what can go wrong, right???

I thought there would be a short bullish rally since AMD and NVDA both have events and news since last week and almost every other week.

Turns out they were all insignificant.

Don’t get me wrong, once I have my own proven process for single-leg positions, I will take them again.

For now, I am profitable with strangles, so I will stick with them.