The Seven

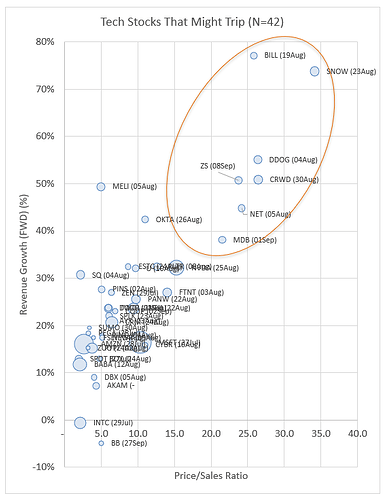

Earnings season is upon us, providing us with an opportunity to take advantage of tech stocks that might slip if they provide underwhelming guidance.

This applies to all tech which have revenue growth core to their valuation, especially in the absence of profitability, but perhaps applies more to those whose revenue expectations are particularly high. With the economy slowing, we can expect a bunch of them to guide for slower revenue growth numbers in Q3 and Q4, or even pull guidance altogether (like SNAP). When that happens, we can expect the market to punish them mercilessly, because many still have a lot of room to fall.

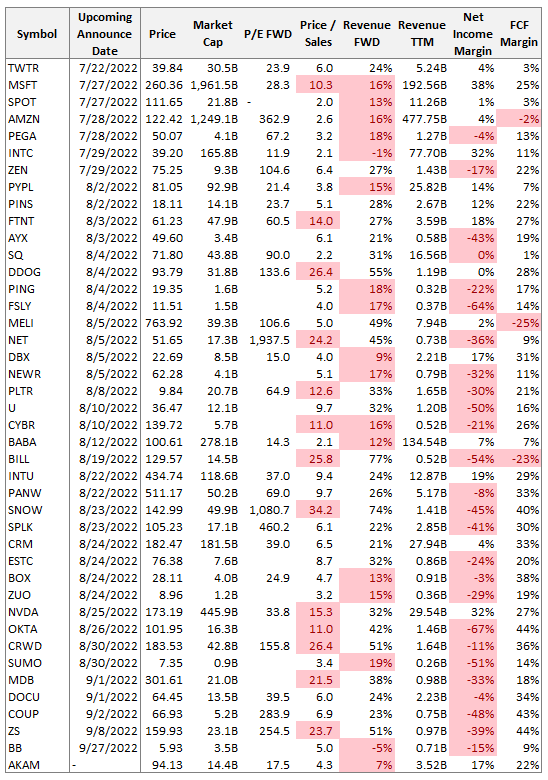

As an example, Snowflake (SNOW) has a 50B EV, but only 1.4B in revenue and net income margin of -45%. The market tolerates a P/S ratio of 34 and an absurd fwd P/E ratio of 1,081 because it is promising 74% revenue growth in the next year, and robust growth for years after. Now, they offer very well-regarded services and have exploded into the scene displacing competitors, so they are to be taken seriously. But the sky-high valuation seems quite precarious, and the tide would perhaps not have to go out much for the thongs to start showing.

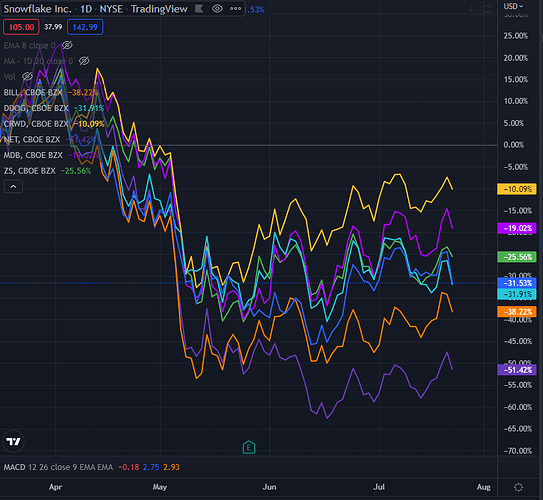

It is in this spirit then that we could consider these seven tickers which seem to have high valuations based on future growth prospects, and are mostly unprofitable: BILL, CRWD, DDOG, MDB, NET, SNOW, ZS:

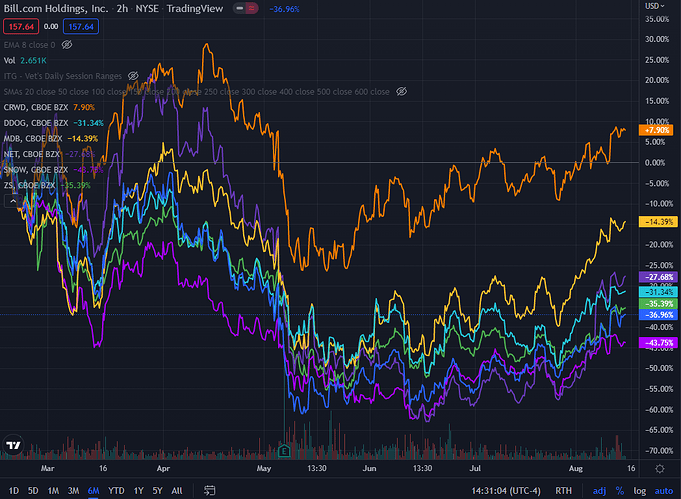

As we can see, they have been doing ok the last few months. Just to reiterate - these are not bad companies. In fact, they are very good companies, offering incredible products in many cases. And the market sees that. CRWD has been on a bit of a rally since May, for example. So the argument for an impending haircut is different than what we made a few months ago in the thread: The Dirty Doze of Bloated Tech - A Short Story.

Why These Seven

I went through the tech companies I track, and ran the numbers shown below. The seven are the ones which have the highest revenue growth and P/S numbers. The rationale is, if revenue growth numbers go down, so will the P in P/S. After all, we have a pretty neat diagonal line going on there. (Not drawn)

Of course, this is a rather simple exercise with mostly two variables, but didn’t find value in adding more. For now.

Here is the Excel file with all the data, if anyone wants to play around with it.

Tech 2022-07-22.xlsx (124.5 KB)

Of course, if there are other companies in the list we could consider high risk, or other companies to add to the list, please do share!

The Play

Because I feel like I cannot reliably guesstimate which ones will have downward revenue estimate revisions, the default play would be to wait for earnings, or pre-earnings guidance, and then short these once we know. So not planning on initiating positions on any of them yet.

However, if you have insights on which could suffer that fate, please do share that too!