I’m looking into Bookmap to gauge how useful it is for me personally and will be posting some observations and such here and welcome others to post questions and comments of their own.

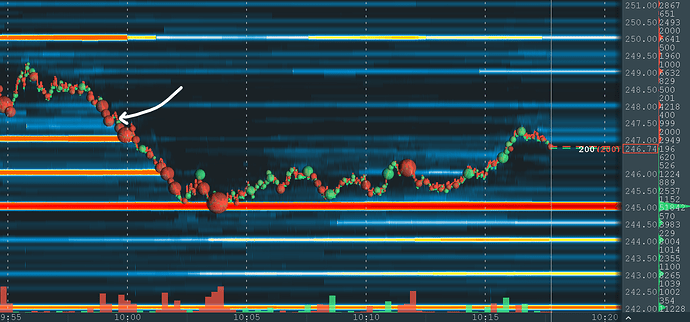

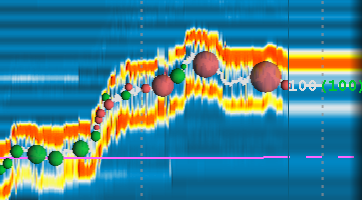

My first observation is in trying to trade SPY. The Bookmap is kinda useless tbh considering the way it trades, you basically just get this tunnel that the price action runs between:

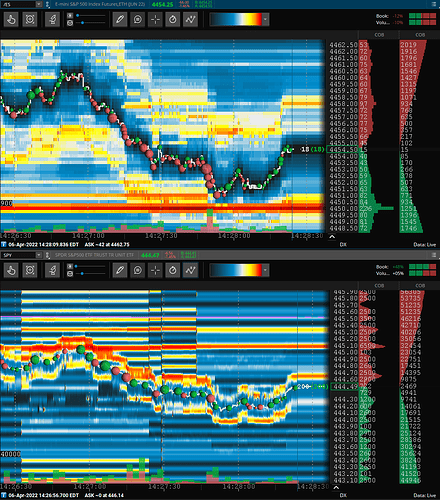

So the features of Bookman which is mainly the support and resistance heat mapping don’t really play out as expected… however if you use futures (/ES) you do get the traditional heat mapping that you’d expect (/ES is on top and SPY is on the bottom):

So if you look, the bounce points that are only briefly shown on SPY itself are shown as solid historic support on the futures. Now to answer the question; yes they move in tandem, obviously not in price moves, but in movements overall (SPY goes up when futures go up and they do so at the same time to roughly the same amount) and in most cases futures move before SPY which can be a slight edge if you have massive autism.

Will report back with more observations, I’m liking the tool thus far and think that it might actually become a staple in my trading setup.

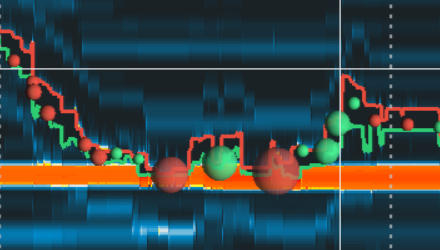

See @brummel’s thread about Bookmap scalping here for more information: Using Bookmap to scalp SPY on a choppy day

See my thread on how to add it to TOS here if you use TD (and if you don’t and can I think its the cheapest way to get it): How to add Bookmap to ThinkOrSwim (TD Ameritrade)