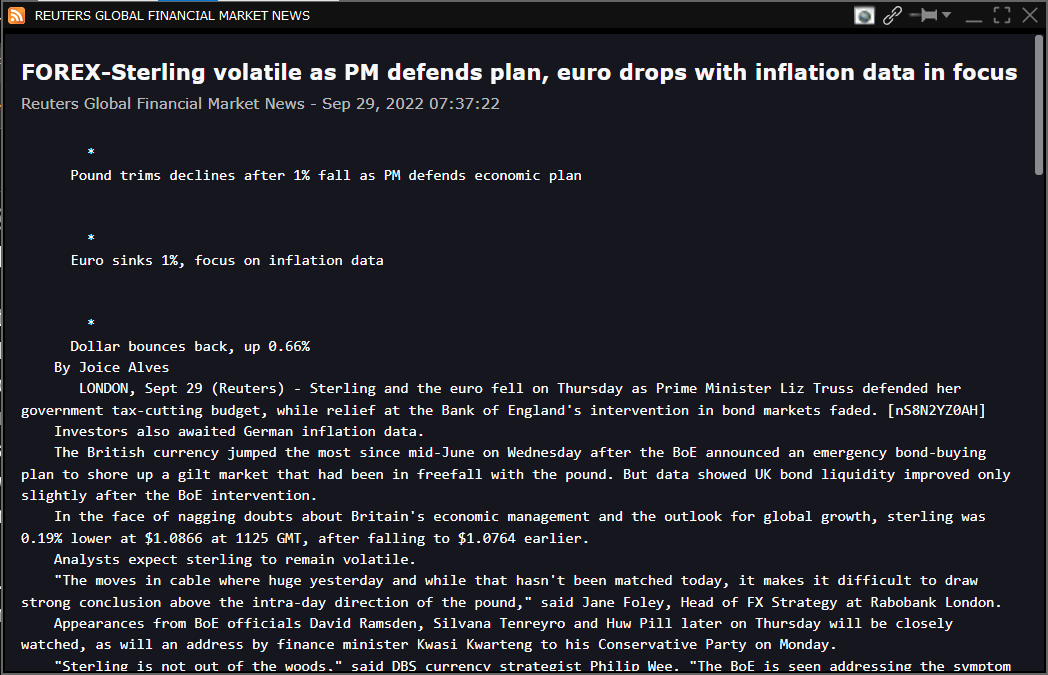

tl;dr - U.K. inflation jumped to 9%. Bank of England might have to reluctantly crank up rates bigly. GBP will reverse against USD if that happens, and we can capture that through the ETF, FXB.

U.K. inflation hit 9%; Brits in a bit of a bother

The U.K.’s annual rate of inflation jumped to a forty-year-high in April, the highest level recorded by an industrialized nation since the start of the global price surge last year.

Consumer prices in April were 9% higher than a year earlier, a jump from 7% in March and the highest inflation rate since March 1982, the Office for National Statistics said. The pace is now the highest recorded by one of the Group of Seven rich economies in about a year. (Source)

The rate is expected to pass 10% later this year.

Bank of England sounds gobsmacked …

The Bank of England Governor doesn’t seem too keen to raise rates much partly because much of the drivers are supply side, and partly because the economy is already slowing down. He recently said:

(^^ Good summary of what the Governor said; checked deets.)

The BoE kept its forecast for economic growth this year at 3.75%, but slashed its forecast for 2023 to show a contraction of 0.25% from a previous estimate of 1.25% growth. It cut its growth projection for 2024 to 0.25% from a previous 1.0%.

Those forecasts were based on bets in financial markets that the BoE would increase interest rates to about 2.5% by the middle of next year and the central bank signalled that was probably too much.

It said it expected inflation would fall to 1.3% in three years’ time, the biggest undershoot relative to its 2% target since the 2008-09 global financial crisis, after unemployment rises and the cost-of-living squeeze hits the economy.

Rates of 2.5% by the middle of next year… when inflation will be 10% by the end of this. Bit of a gulf there. Wider than the English Channel.

… But what if the Gov’ner goes “bollocks…!”, and pulls a Volcker?

Rapidly rising inflation opens up the possibility that the BoE actually increase rates much more, and more quickly, especially if it keeps rising faster. Bit like Volcker did all those decades ago.

It will have many effects, and one of them will likely be the rapid appreciation of the GBP as markets adjust not for the spot rate, but the estimated terminal rate. Precisely as the USD became even more #1 when Feds raised rates by a paltry amount of 0.75%, but markets projected a terminal rate around 3%. Which ended up causing this over the last year (USD-major currency pairs, along with Dollar Index DXY):

Wouldn’t it be nice to catch that movement in the other direction, if the GBP starts appreciating relative to the USD, thereby mean reverting? In other words, go long GBP?

There’s a cheeky ETF for that - FXB

One way to play this possible appreciation of the GBP is the ETF FXB. It basically gives spot exposure to the GBP vs the USD. FXB superimposed with GBP below as confirmation.

Depending on how quickly things move, the 10% reversion could happen in months. 10% doesn’t sound like much, but considering the less-than-a-year-timeframe and the fact that currencies have major momentum and so we don’t have to tend to this daily, it could be a decent place to get some slow-and-steady return.

Also, the USD has been on a bit of a tear lately, and unless JPow indicates a more accelerated rate hike schedule, the GBP could adjust a bit anyway. We might be seeing some of this, in addition to the rate hike expectation, in that little curl at the end of the graph there.

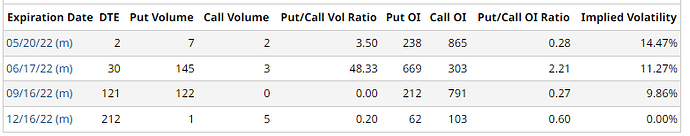

Unfortunately there isn’t much by way of option liquidity, so would not be advisable to play there. But IV is ludicrously low though - 14% in May and sub 10% in Sep, so if you can get an MM to be your counterparty, more power to you!

The move: Wait and see.

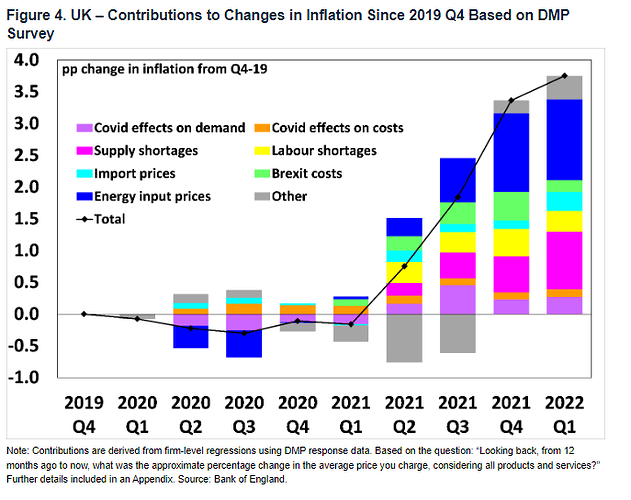

For now, I’ll sit and wait. Need just a little bit more confirmation. The Governor sounded like he was capitulating, not gearing up for a fight by channeling his inner Volcker. Part of it could be because supply shortages and energy input prices account for more than half of the current inflation, and demand destruction is such a sad way to have to address this.

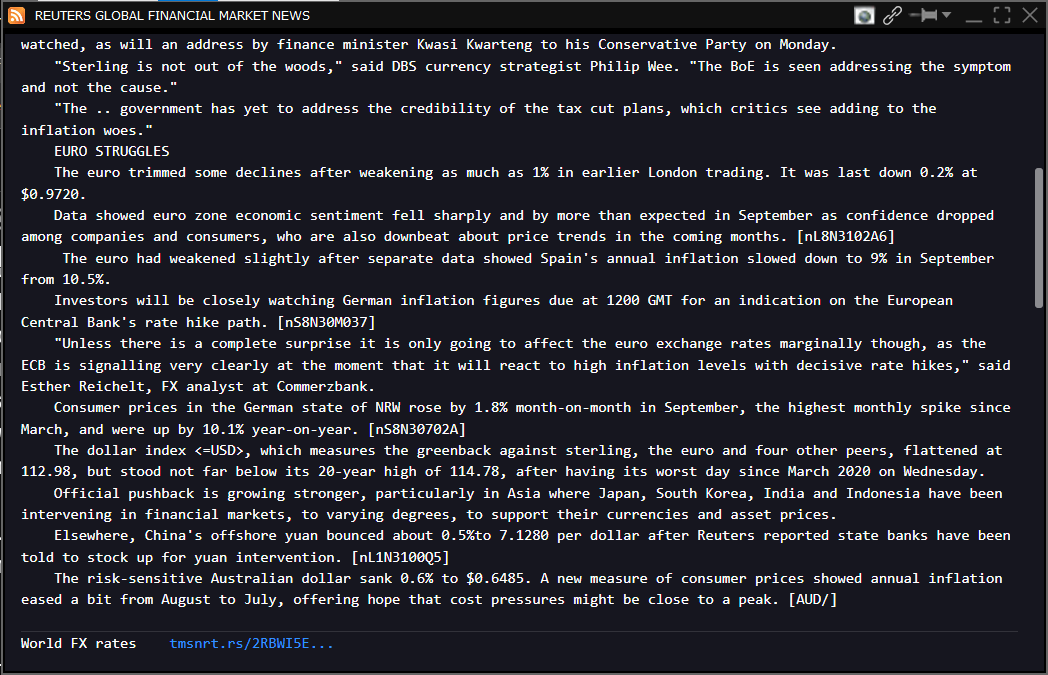

Nevertheless, neither of these things will ease, given China is being China and sanctions on Russia will only get stronger. At some point, he may be to pull the bandaid and crank up rates.

Wanted to put this on our radars now so we are ready and keep monitoring for that reversal.

And also to ask if anyone has any other plays we can consider around miffed Brits taking it to inflation.

Thanks to @macromicrodick for preliminary discussions on this on Discord that helped me think through some of these things!