The Bankers…

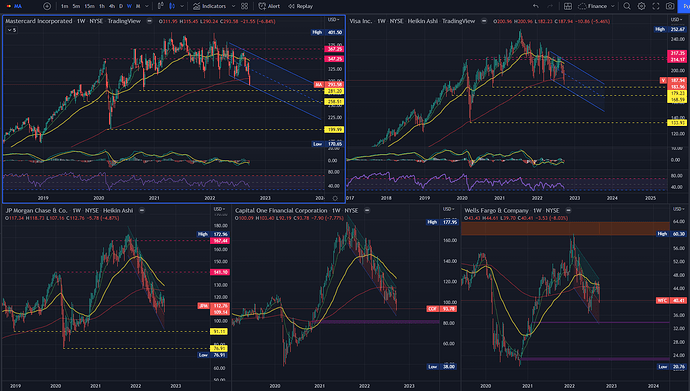

Tickers:

- MA, Mastercard

- V, Visa

- JPM, Chase

- COF, Capital One

- WFC, Wells Fargo

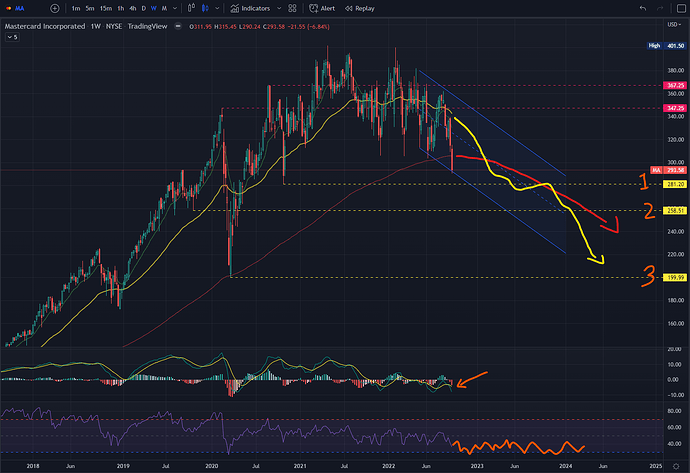

MA weekly chart…

Almost entering the 4th Phase of its Distribution Model, Signs of Weakness abound with Feeble Rallies.

I’ve drawn projections of the 200 EMA line (red) and the 45 EMA line (yellow) crossing down–time frame might be faster, depending on FED interest rate decisions.

- Long Put Target is 199.99, best for end of 2023.

- Easier Put Targets are 281.20 and 258.51, best for 4Q 2022 and 2Q 2023.

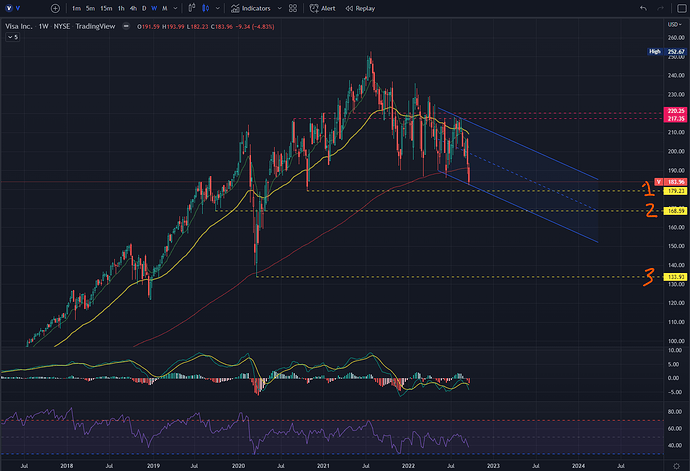

V weekly chart…

Same points as MA above.

- Long Put Target is 133.93.

- Easier Put Targets are 179 and 168.

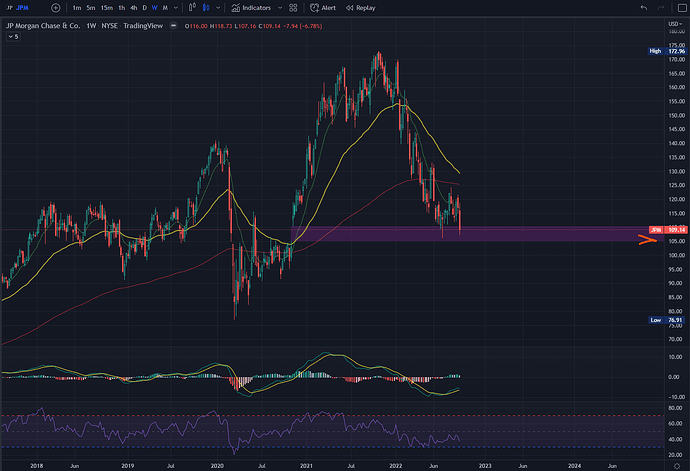

JPM weekly chart…

This one is most likely near the end of its Final Distribution Phase.

The only obvious target is the gap-fill to 105.

Support Line of 90 is most likely a strong area.

Low of 76.91 is a gamble, but watch out for news specific to Chase that might effect moving further down to that price.

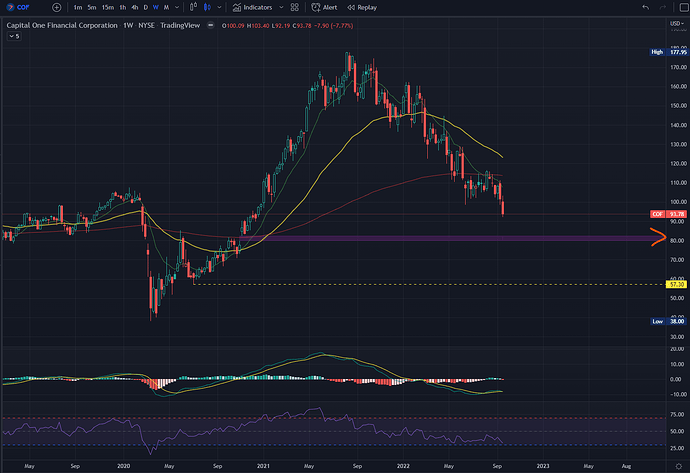

COF weekly chart…

Obvious target is the gap-fill to 79.

Strong Support Line should be 57.

Low of 38 is a gamble, best not to reach towards it unless Capital One report really bad earnings in succession.

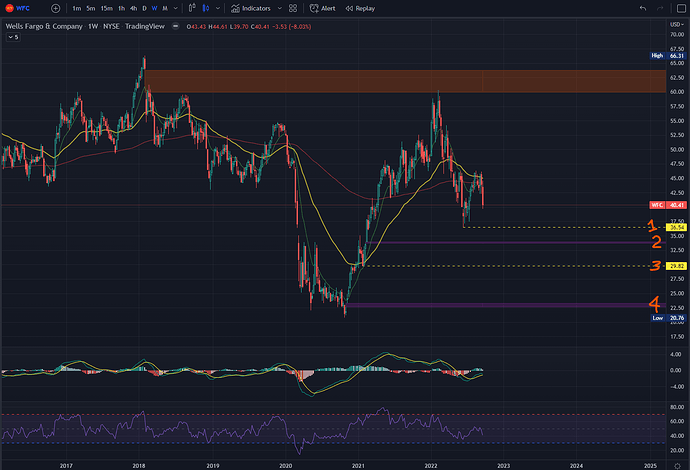

WFC weekly chart…

Immediate target is 36.54.

Gap-fill of 33 is the next possibility.

Support Line of 29.82 might hold the line, unless dire news piles on against Wells Fargo–it has happened before.

Gap-fill to 22.5 is a Long Put gamble, but it is there so it’s a good channel to help confirm absolute bottom on this stock.

- Financial institutions and other related business will keep getting hit until the FED starts to pull back on raising interest rates.

- Lending businesses like UPST, AFRM, and SOFI have already been beaten down ahead of the Bankers.

xxx