If it’s true what does that mean?

it means about a third of the free float would be shorted lol

I think I wouldn’t take the SI too seriously because whoever shorted it can realistically hold their short position until the stock returns back to the $10 lows, as it should easily do that at the latest in February when the merger occurs. I don’t see any real pressure for them to cover as all this recent upward move is most likely temporary.

even if this were someone’s pump and dump as long as the parties involved understand the mechanics of a gamma squeeze I think there is little risk of seeing a knife before the options chain gets expanded.

we’re in before the fomo buyers. Just sit tight and enjoy the ride.

So with the merger not taking place until February, is it possible after this month this cycle repeats again next month?

it will depend on what happens to the options chain with this squeeze, and how the oi is situated next month.

Would PUTS also be a play with high reward here? Since we know it’s going to see a big spike and a big drop probably in the same day?

yes and no. the IV is going to be through the roof so in order to see good gains the stock will have to tank hard and fast. selling calls will probably net a better ROI

Is there a way to calculate ESSCW based on ESSC price?

Friday AH looks like it had a nice little pop at the end there…

ESSC peaked at $15.50 and ended at $15.15 (+8.21% AH)

ESSCW peaked at $0.45 and ended at $0.42 (+39.09% AH)

It should settle at a certain percentage once volume picks up. Rough calculation based on current movement it looks like for ever $1 ESSC moves, ESSCW moves approximately $0.025 (+/- .003).

Hit a limit on half my shares Friday for 30% gain. May look for a dip on Monday pre market or open and roll back in. If no dip I’ll let my other shares ride a bit longer. Really appreciate this callout.

IRNT had ~1.3 million shares in its float with about 200% of its float in ITM options prior to the squeeze to $45.

The fact that ESSC has less than 1/3rd that float plus about 600% of its float in ITM options (if above $15) is it actually possible that ESSC breaks $60 this coming week?

A guy has done a DD on ESSC on Reddit, have a look,Take it with a pinch of salt.

Anyone who understands these things better than me have a look see if what the guy is saying makes sense or not.

Edit- looks like from the trading floor other members have found it and there’s a lot of missed information and jumping to conclusions. Will leave it up to the mods on whether they want to remove this post or leave it up.

When it comes to these plays I’ve always wondered if the options expiration you buy would be better or worse for the play itself, and if the price would fluctuate more in % depending on the expiration. I’ve already got a good entry with a couple of these and as I watched the 12/17 and 1/21 last week these seem to have either same or very similar prices at times.

Would love to understand which expiration would have the most % change while a stock is running (FDs or further). Appologies in advance if this is a rookie question, but even when searching online there are conflicting info about this.

Excited for this week!

An options profit calculator is probably the best way to answer your question.

Closer expiries will move more and be more risky than farther out expiries. You should learn about implied volatility and the greeks - these are essential to understanding options contracts and how to trade them. On the calc, observe contract prices and the IV for the Dec and Jan expiry. If you change the calc to show profit/loss %, you’ll see the Dec expiry react much more. This is good provided you can keep an eye on charts/call outs during market hours and can react to price movements down very quickly.

Good luck to everyone playing ESSC this week!

Good morning everyone,

Providing an update to this before open. It’s currently trading in line with what we’d expect. Current ITM OI is sitting at 380% of free float if the stock opens above $12.50. Should it open above $15, ITM OI is at 594% of free float.

SI I believe is meaningless to track in these movements so I’m not going to bother with it.

Today, I would expect a slight jump at open and then a likely pullback heading into 10AM. One thing to keep in mind here is that to our understanding, hedging is either done in premarket or it’s done later in the day. You should have plenty of time to enter a position on a pullback and buying the second the market opens isn’t usually the best option.

The move is not expected today and would be somewhat of a surprise, it is expected early this week though. The strategy here is to hold green if you’ve got it and to not worry about complex strategies like scalping and rolling strikes.

More soon.

ESSC is still trading in line with what we’d expect. The stock has low volume so drifting in absence of signficant buying is normal. Looking at the chain, best guess would still be that ITM OI will have been added today further increasing the upward pressure as we move later into the day and week.

If you have a position, my suggestion would be to hold here. But, that comes with the usual rider of “If you are good with the profit, take it.”

Commenting on the short squeeze potential I’m seeing touted on Reddit, the answer is a pretty resounding no. Shorts can easily hold their position in this stock through all the volatility we could possibly see and cover post merger. A short squeeze is not in play, but it’s also not needed. The current chain setup and ITM OI is more than enough to do the job.

It is more likely than not at this point that we’re facing an imminent gamma squeeze.

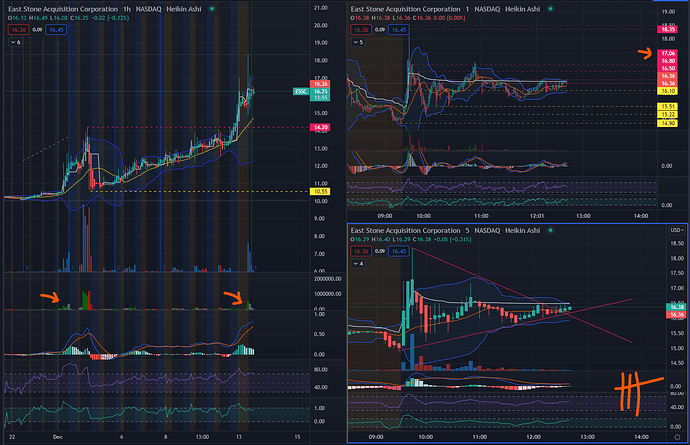

ESSC chart intraday update…

The 1hour shows we are yet to see critical peak buying volume.

We want to see volume equal or surpass that of December 2.

I want to see it break 17.06 before I can say it’s probably a bad idea to chase anymore.

Supports are marked in yellow on the 1min.

5min confirms ESSC is holding the momentum.

For those still waiting on the sidelines, it may be best to place orders 5-10min before market close.

Would anyone be able to work out roughly what percentage of the float may now be in the money due to ESSC closing above both the 15s and 17.5s (ignoring what happens in ah) Thanks