If anyone is wondering what their calls would be worth at a certain stock price - I recommend

Looks like with 17.5’s in the money, ITM OI is roughly 647% at 340k float. Correct me if I’m wrong, new to trading and just looked up the formula

Reposting this from @conqurer’s VC explanation regarding the CBOE delisting news:

From VC, 2 scenarios with this news:.

- it’s meaningless

- MM cannot expand the chain further, the current chain remains the same (MMs nightmare) = bullish - infinity squeeze, MMs will still need to cover the OI on the ITMs

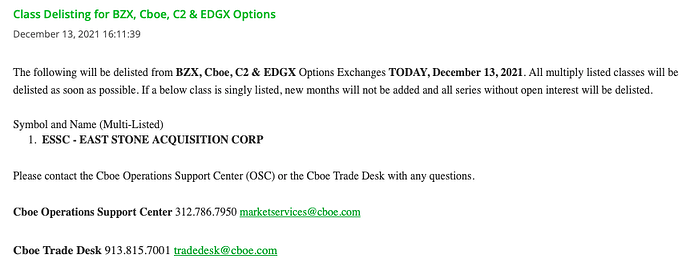

The following notice has been circulating:

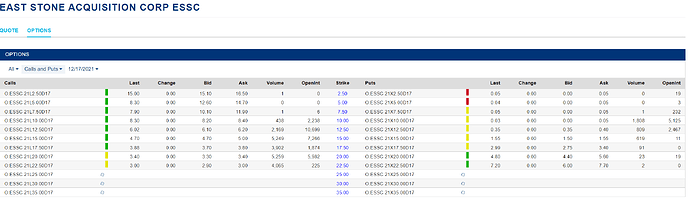

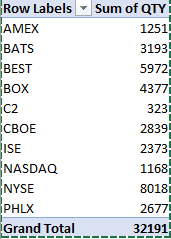

After (several) members spoke with CBOE over this, we’ve concluded that it’s likely absolutely meaningless. Per CBOE, this is being delisted because of the small float, they’ve also confirmed that this delisting is only for their exchanges and the options will largely be unaffected and will still trade normally. As you can see below, there are many exchanges that trade these options (this is specifically the 20 strike for ESSC):

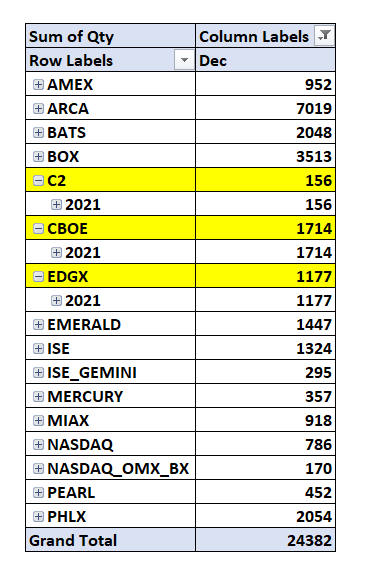

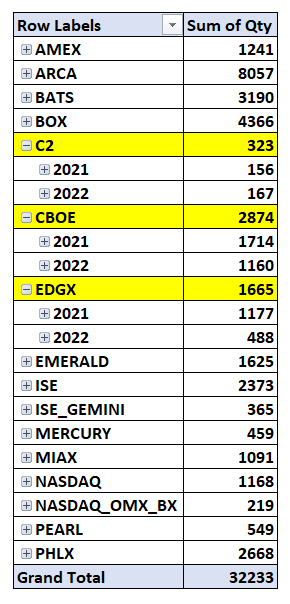

After some further research we’ve found that an extremely small amount of contracts actually trade on CBOE exchanges (around 3K volume on CBOE exchanges vs ~28K elsewhere:

So all in all, don’t panic. With our understanding of the rules and what we’ve heard from CBOE this is either extremely bullish or completely meaningless with next to no chance of being bearish. Sleep easy.

Similar findings.

This is data I got from MarketChameleon (sorted for just Dec options that traded today)

Now this is for all options that traded today for ESSC.

Grabbing info from NYSE, it looks like we got options extended to $35 strikes. Do not see weeklies yet though.

15c: 2.50 → 5.25 110% gain

17.5c 2 → 4.2 110% gain

20c 1.6 ->3.8 138% gain

22.5c 1.45 → 3.3 128% gain

assuming you bought the perfect dip following the early morning pop ~10:02 am and sold near close at 15:48

This tells me that the returns on the deep otms do not justify the risks. If ESSC were to have a pullback and not recover, those holding 20s and 22.5s would have been hurt the most.

Keep this in mind if you enter a position today.

Good morning,

So with today’s chain extension it’s safe to assume that we were correct in thinking that the delisting notice is rather meaningless as the lovely woman at CBOE had indicated.

Side note: Thanks to everyone who crowdsourced the funds to send Maria at CBOE an edible arrangements gift basket last night!

Today comes the first real test of ESSC’s longevity. The strikes have been expanded to include 25, 30 & 35 in the 12/17 expirations. This is done to offload the pressure from MMs who are over leveraged on strikes that are ITM. The goal is to get people holding ITM options to sell and roll to OTM ones. The current OI on the ITM strikes is more than enough to cause a gamma squeeze as it’s sitting at 694% of free float (up from 594% yesterday). So we’re nearing almost 7x the float, for reference, IRNT peaked at 479% of free float, near 5x only just before it ran.

Should the majority of the ITM OI resist the urge to roll to OTM strikes and remain on the chain, we’re facing an imminent gamma squeeze. With that said though, take profit when you see it (at least make sure your cost basis is covered).

More soon.

From JB

“ Called TD and they said the 3rd party group that sets the price for newly added contracts(ESSC up to 35) is delayed. Expect those to trade within 1-2 days.”

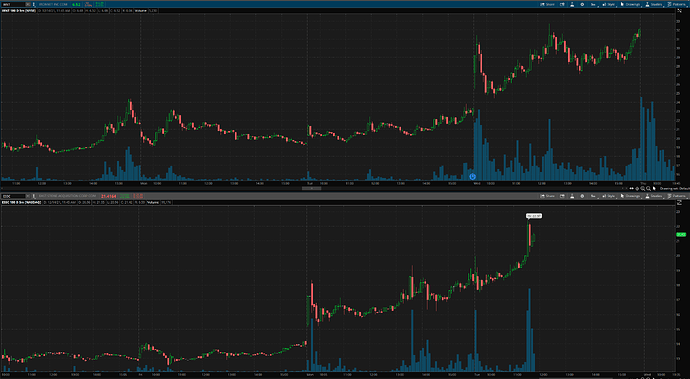

Alot of correlation but ESSC has begun to seem more bullish

A bit lol.

This is currently a nightmare scenario for market makers since the chain extensions did not go through for today and the entire chain is now ITM. This means that all of today’s options volume is now going into options that are already ITM, removing retail’s ability to roll today. This means every option bought today is added pressure to the movement.

We do not believe at this point that the movement is over and we expect a greater movement to come.

I closed out my position (all shares) during the large downward move. I closed it for a 40% profit. In shares. In a week. Nobody owes me an apology for how this play worked out, bc it was a big success for me.

Do we know the cause of this massive dump?

for those not in VC, my best attempt at a transcript of Conq’s announcement:

Conq says he’s deeply sorry. this movement is abnormal. but the movement, which makes this play viable, moves really fast. and people saw money that could have changed their lives, got scared, and got down and sold. there could be something in the later days for the reason for this drop but afaik it wasn’t normal and it was due to people selling. for that reason, looking at ITM strikes, the play is still on. Conq has his position, it’s at a loss now. the OI on this now, assuming all the 12.5 and (sic) are sells, this is still a gamma squeeze…sentiment is what took a hit here but the gamma is still on and there is enough OI to eat up the float. the question becomes if there is enough time to turn this around. we opened at 18 today. it can move back to where it was quite easily. so now Conq’s in a position where either he says we don’t play this again, take it off the radar, and go do something else, or do we still follow through? one thing he feels more important above all else, when in a play, you’re selling because the reasons are met, or the play’s gone right/wrong. that’s how he always treats the squeeze plays and from his pov it’s still on.

That’s the decision we have to make. And it’s a personal decision for each of us. For Conq and those holding, he’s going to treat it as a new play, with a stock trading above the 12.50 strike. There’s a chance this thing is trading sideways for a couple of days. But there’s also a chance that it can go back up.

He’s choosing to roll with this play with his full position and call it till Friday.

Thanks for transcribing the VC

This is correct.

Everyone that was wishing for a better entry earlier in the day now has one. Taking the volumes on the OI from the bottom of that drop, there is still likely over 200% of the float claimed by the OI on the chain in the worst case. This exact scenario is what we picked up on with IRNT when we called out that it likely wasn’t done.

This selloff was abnormal and I believe it was likely retail getting concerned, but with that said, I think that this is still in play and I am holding my full position.

With over 200% of the OI claiming the float, this still likely has to run.

Is the float still believed to be 341k shares? According to data over 20 million shares were traded today, which means each share on average was traded about 60 times. Is this a realistic number? Honest question, I’m a noob myself.

It’s still believed to be 340K, Each share being traded 60 times isn’t that weird considering that algos might be trading this too maybe ?

Maybe there is something we are not understanding about the market mechanics at play here.

Let’s say one person does own 100% of the float, and they refuse to sell any shares.

Does the MM have any methods to continue providing liquidity?