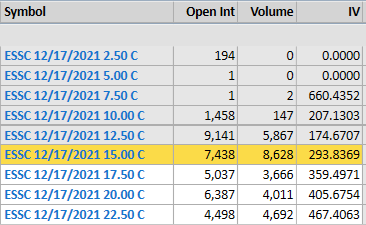

All of the 2.5 strikes today – all occurred before the dump

I’ve been waiting to get into this one. I feel extremely lucky to have been able to get in an option at the 12.5 level today. I’m so poor lol.

Update to my tracking of this Gamma Squeeze…

Idea 2 seems to be working well with this ticker.

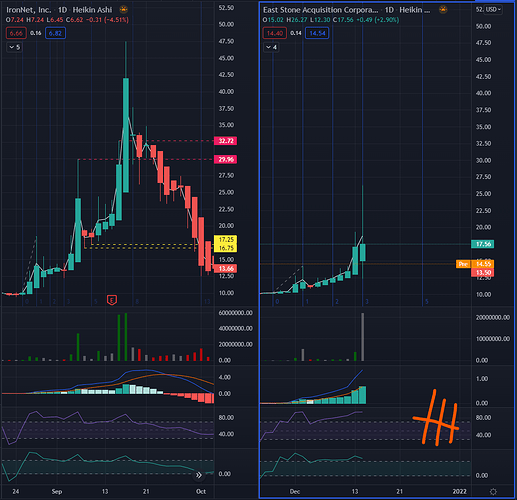

I marked Dec14 as the possible 2nd peak and that didn’t disappoint.

The marked price of 26 of idea2B was also miraculously accurate–we hit 26.27 yesterday.

Now if I’m going to go with the Fibonacci Time Zone tool, yesterday was also the perfect buying point.

Given you’d have had to time the bottom for best entry, but on 3-Peaks momentum runs, the fib time zone has always been a great tool.

I do believe ESSC is a 3-Peaks momentum run, like IRNT (good sentiment) and GRAB (weak sentiment).

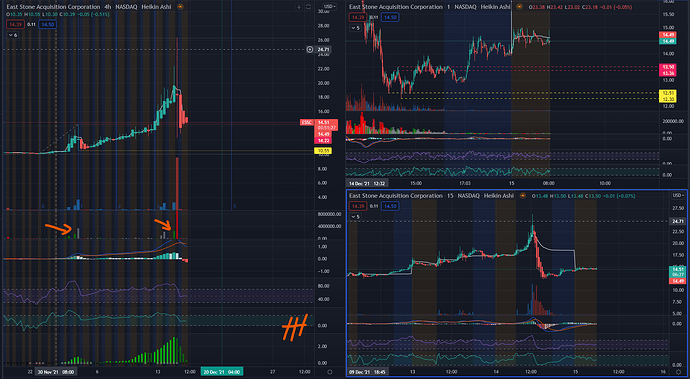

Consider today as another loading area–if you’re in the play or looking to enter.

Volume on the 4Hour was just getting good, until the sell-off at peak.

Support of 12.5 was strong, thanks to Conqueror for holding that line.

You will notice in the Daily and 4Hour charts how the stock really needed a break from buying pressure.

That has now been relieved and ESSC has started building back up again.

ESSC, pivot points today, Dec 15:

R3 - 36.72

R2 - 31.49

R1 - 22.75

Center Line - 17.52

S1 - 8.78

S2 - 3.55

S3 - -5.19

Today’s range is very wide due to and based from yesterday’s price movement.

I’d love to see a close above 14 today, or even better closer to 17.50.

I’ll be out for most of the day since I’m taking care of the wife–got her booster vaccine so.

Keep it green, plan your entries and exits accordingly and if it runs, don’t fomo.

Thanks again dude for being so on it with these charts and info, they are super helpful

Is there time for a 3rd peak prior to 12/17 expiry?

Yes there is

They mentioned this on VC yesterday, but the runup we experienced was over 3 days and there’s 3 days left until expiration. So there’s time.

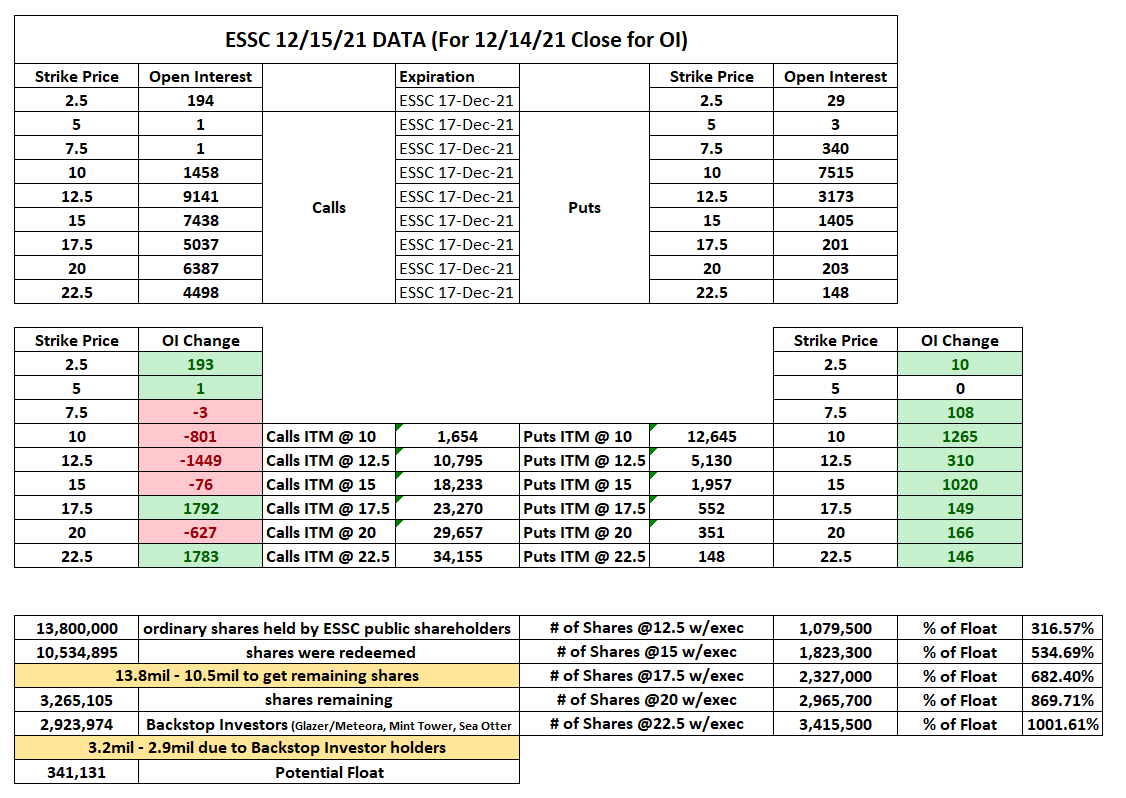

Yesterday was quite a day. However, as we somewhat expected the OI has remained intact for the most part, meaning that the ramp on this is even somewhat better than it was yesterday.

ITM OI is currently 317% of float (down from 694% yesterday) with the full chain having enough OI to claim 1004% of float. This very much is still a powder keg and the likelihood of a pop between now and Friday is extremely high.

Reddit has been busy being Reddit and likes to toss around the theory that the float on this is actually 3M shares. While we’re confident it’s not for several reasons, if it were to be the case, the current OI stands at 36% of float with the full chain being 113% of float, which is honestly why the argument is just petty because in either case, this is primed. Anyone pursuing the “tHe FlOat iS wRonG” narrative is just trolling or terribly misinformed about how these things work.

This play is still on.

It’s of note that over $15 this becomes pretty crazy once again since the 317% of float becomes 536% of chad float claimed by OI (60% of float using the illiterate Reddit float). The OI dramatically increases the amount of float claimed again over the $17.5 bringing us to 684% of chad float claimed (77% illiterate float) which is right where we were yesterday… aboard the wish.com rocket to the moon.

POSTING ON BEHALF OF @rhetoric as they cannot currently login to forum:

Crux of the matter really comes down to the fact that these agreements with the arb funds only exist because otherwise the business combination would fail. ESSC’s primary goal with these agreements is to prevent the shares from being redeemed (causing the failure of the merger) in order to do that they locked in a purchase price for the shares at 10.26 (which guarantees arb funds risk free profit) and sweetened the deal by throwing in an additional 400k shares after the close of the merger.

It doesn’t make sense that the arb funds would want to short these original shares (the 3M number getting thrown around) because anyone buying these shorted shares on the open market would have the ability to possibly redeem them, thus putting the merger in the position of potentially failing (and opening the arb funds to legal liability which would far exceed their anticipated profits).

It is very possible that these funds have already locked in a sale price on these 400k shares (by selling short at a price > 10.26 or some other method…) that they will receive in the future (remember these funds are all about 100% risk free profit) which is even greater incentive that they now have for the merger to actually succeed. In short the tradeable shares are probably somewhere between 341k and 741k… but definitely does not include 3m shares in the agreements.

Rhetoric sounds like…. a chad.

Updating this for market close.

ESSC closed above the $15 strike today bringing the total ITM OI (that we know about right now) bringing the total amount of float claimed by ITM OI to 536% (60% of illiterate float). Now, the thing is, today likely added OI throughout the chain. So we can reasonably expect the amount of the float claimed by OI tomorrow at open to be higher than the 536% it is now and the total float claimed by the OI on the 12.5’s through the 22.5’s to be higher than 1004%.

In my opinion, goal has been hit. With either float calculation, there is more than enough OI to run this stock. I think tomorrow may prove to be very interesting.

Been craving some sushi.

Thank you, as always, Conq.

Tomorrow are we looking for the same movement as today (peak in morning followed by sideways all day) or is the biggest move expected tomorrow?

Nice volume today across the board, but especially on the ITM strikes.

Hopefully more buys than sells.

was the really big run the week after expiration as they were covering the all the calls, or was it during the week of expiration?

The dd in this thread and the comments seems to mention it running after the week of expiration, in that case would it actually be better to have a balance between calls and shares?

https://www.reddit.com/r/Shortsqueeze/comments/rgpb82/mega_dd_update_essc_the_1_gamma_squeeze_that_is/

This is wrong, IRNT ran up Sept 16th the day before 9/17 OpEx

thank you!