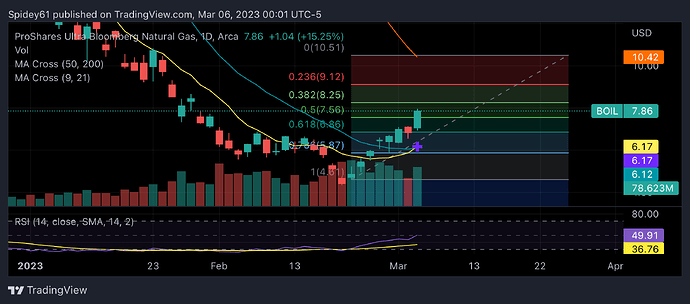

So Natural Gas Futures are currently down 10% as of writing this. Assuming this holds or this drop continues then we should see a drop in UNG and BOIL tomorrow morning. My current thought is that it will probably drop tomorrow since it was overbought on Friday. This drop is probably short lived since there is colder weather for the next 10 to 12 days. Seems like Freeport is still coming up to full capacity which probably won’t happen until closer to April but will probably start rolling into some longer dates options now. Look forward to tomorrow and this week. Should be interesting.

I had been meaning to get on here to see if Valhalla was doing anything with NatGas. I’ve been watching and started getting in beginning of February with 200 Shares and a few 2024 Calls. The 9/21 MA threw a Golden Cross on Friday that it had been working towards. I’m hoping the price goes sideways for a few days as the 1 Day RSI is nice and neutral just about.

Nat gas futures are up almost 2% which is most likely just a bounce from yesterdays slaughterfest. With JPow talking today anything can happen. My thought is that we range today and tomorrow but we might see a little movement based on the EIA oil, gas, etc tomorrow but not a lot of movement. Thursday is when EIA NG rollover change occurs and we see how much of a deficit there was. I think there will be an increase in the amount used but it probably will still be under what is normal for this time of year which means NG will probably just range the rest of this week. Over the next few weeks we may see increases or decreases in the price all dependent on the weather and Freeport exports. It seems that NG producers will probably try at some point to make Freeport exports the main topic of the news cycle to being the cost up but again time will tell. My plan is to buy up more April dated calls when NG dips and just be patient.

Posting a couple articles that @snoodking1 and I posted in TF this morning just to keep this thread up to date with what we’re looking at for nat gas trading.

And another with some TA, if you want to check against your own.

Lots of good information in here:

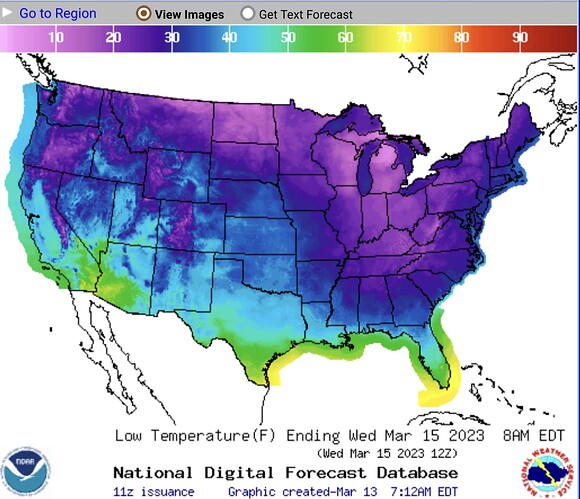

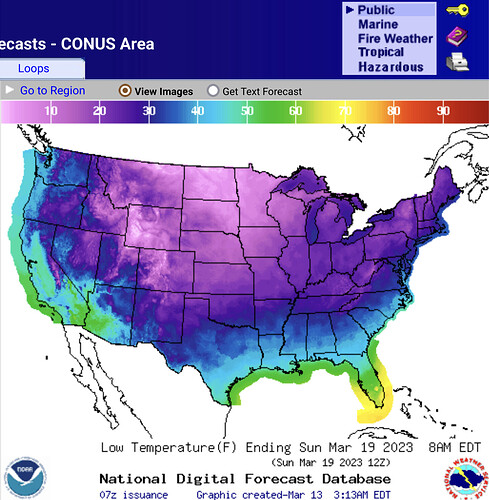

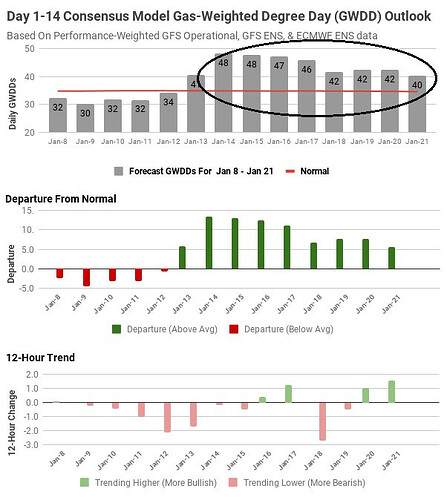

Looking at the current forecast it looks like temps are now looking colder through the 19th which will probably cause natural gas to slowly rise in cost over the next few days. We will also see what draw is on Thursday but I’d expect it to hover around the same amount or be slightly higher. If weather stays the same then next week draw will be higher. Also Freeport was given the go ahead to return to full capacity. Plan this week is to average down what I have and hold until I reach 10% or 20% profit and sell.

Looking at the latest weather forecast it seems like NG is going to spike today since it changed again ![]() . Looks like next 4 days are the coldest but later weather could change. We will have to wait and see on that one. The other factor that is affecting UNG, BOIL and NG is the banking situation. This week has been a de-risking situation for volatile stocks which natural gas has been very up and down recently. I’d expect the price to go up the next few days but we also need to see what the EIA reports today.

. Looks like next 4 days are the coldest but later weather could change. We will have to wait and see on that one. The other factor that is affecting UNG, BOIL and NG is the banking situation. This week has been a de-risking situation for volatile stocks which natural gas has been very up and down recently. I’d expect the price to go up the next few days but we also need to see what the EIA reports today.

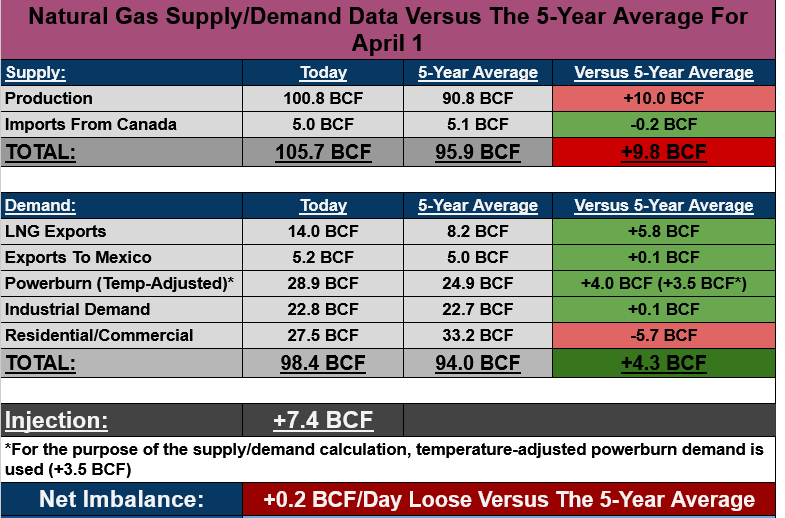

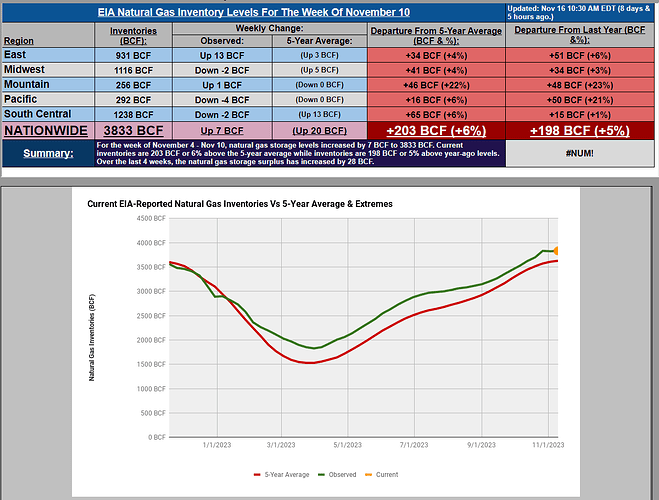

The UNG pain trade will likely continue for a while. There is a current surplus of about 4 BCF/d (image below), even with Freeport back at full capacity. Until Mother Nature cooperates, we’re likely to see depressed prices for a while. No significant additional export facility is coming online for the next year or so, iirc, so Europe potentially in a tighter spot this winter may also not help us much.

(Source)

My UNG position is down a fair bit, even with the averaging down. Won’t acquire anymore for now, as its not clear how low this can go on sustained imbalance. Think USO circa April '20.

Dropping this follow up article from Elliott Gue substack. A great follow up piece on nat gas outlook for 2023 & 2024 for anyone still following nat gas.

With summer approaching I will be paying closer attention to the EIA natural gas storage reports and the Baker Hughes rig counts. They come out every Thursday/Friday, respectively. Mimir drops that data right into the trading floor thanks to Beaker and Conq. Each of these reports has resulted in some nice price action over the last month or so, especially last Friday when the rig count showed production cuts.

The EIA Natural Gas Stocks Change tomorrow at 10:30am presents a day trade opportunity.

Consensus is a storage build of 116Bcf. Anything over that and I think natural gas will sell-off dramatically, especially since we rallied over such a short time from the production cut news on Friday. Since demand has been light I think there is a smaller chance of storage coming in less than +116Bcf.

I like KOLD (inverse ETF) compared to UNG or BOIL for this trade. I am watching May 26 $75 or $80c for a storage build of greater than 116Bcf. When looking at KOLD options it’s important to look at the strikes with high OI. Liquidity can be an issue if you choose a strike with low OI. This idea is a day trade only.

$KOLD

<:pepecelebrate:899174757969317898>

update: actual number was less than expected at 99Bcf. That is bullish for nat gas and produced a giant red candle on KOLD. I felt some intense fomo, however I did not jump into anything on this. There’s always next Thursday or tomorrow for rig counts.

Yeah just saw that. I’m looking at farther dated calls for UNG. Will probably start to slowly roll into them. A few things of note:

- There is an increasing probability that El Niño happens. The data shows surface temps rising, so hotter temps are possible: May 2023 ENSO update: El Niño knocking on the door | NOAA Climate.gov

NG is gaping higher, no doubt helped by news of all the heatwaves. Not taking positions as am loaded up on UNG still, but noting since there’s good interest in playing BOIL.

Summer drawdowns are nothing like winter ones though, so am expecting prices to come down back near the lower trendline before a sustained move to higher levels into the winter.

“The deal will give Berkshire control of one of just seven operational US facilities that can export LNG…”

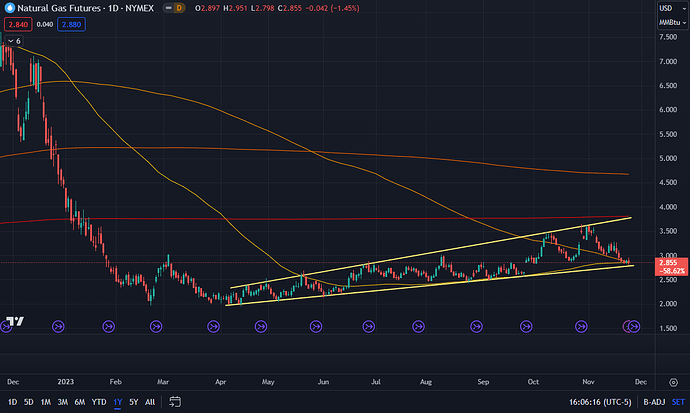

This megaphone pattern continues to hold relatively well, and is at the lower trendline again. As well as around the 20SMA and 50SMA.

Added to UNG at $6.

Will dump the older positions that are quite underwater in a little over a month to tax loss harvest.

Fundamentals still weak though - inventories are higher than the 5-yr average, production exceeds consumption, and export terminals still coming online. Might need longer than this winter to escape the clutches of the widowmaker.

UNG and BOIL holders might get a reprieve this week, with cold weather moving in. Worth keeping an eye especially on BOIL, as it does hold a ton of future options which could cause a squeeze if prices rise high enough. (BOIL moves 2x as /NG, and holds about a 1/4 of the Mar /NG OI.)

(Source)

So north Texas getting snow MSN

This could be bullish for BOIL and UNG as long as power stays on. Could be bearish if power goes offline but this may be offset by other states that have adequate winterization of the electrical grid.