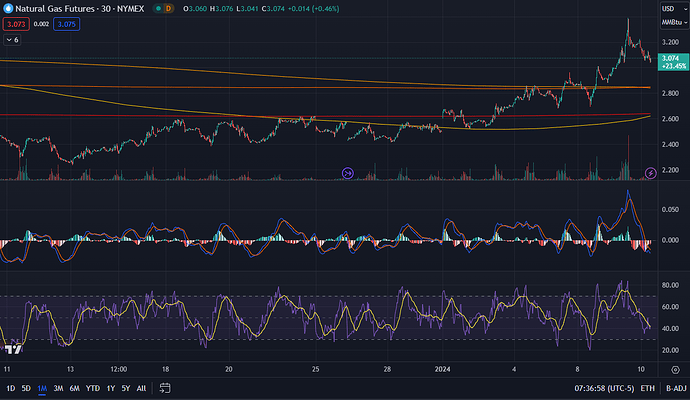

/NG continues to keep moving up. Reports of cold weather moving in are increasing. Might get some BOIL calls today.

I think its time for long term puts to be honest. It’s January and natural gas functions off contracts. They locked in sales for a few years off fear but if not this year then next year those contracts could possibly be gone and they will have to sell at the current market price of 2.99 versus 9 or so peak ukraine war

My bad the term I was looking for is hedging. It’s how companies like apple manage to produce profits despite seemingly odd margins. If they buy x material for $1 and the current market price is $1.2 then they can charge the same for their phones as their competitors while keeping profit margin of $1 cost. Except it’s the reverse in this case. As a natural gas company goes into the future their profit margins drop to the current price. I don’t see any catalyst for natural gas to rise if we are already in january and countries are fine. Please let me know if I missed something https://www.reuters.com/business/energy/us-gas-producers-skimped-price-hedges-now-face-reckoning-2023-02-14/

Sorry for the spam but trying to remember stuff. Again I don’t think it will fall hard this year but I believe the bullish case was over with last year.

I think the drop in stock prices will be delayed as they keep positivity talk in earnings but its bound to happen at some point?

dunno my winter could be over by february. maybe some cold spots here and there but I think countries still have the reserves to not be bothered.

if you have a short term plan I guess it makes sense. good luck to you all

Not sure if this was here yesterday but ung strikes are split between old and new on webull

another thing to consider is supply and demand. with current natural gas prices you would think there would be buyers but when people looking to hedge prices for their inventory during the ukraine was supply issues that caused people to buy contracts that are now under water. What this means is even if they want to buy new contracts at the lower price it’s not a current interest cause they still have to accept shipment of the previously purchased contracts. In short until the previously locked prices are gone there is no benefit to buying more

Seems some of the natural gas companies start their earnings next week. The minor players next Thursday and a good chunk of the big wigs going on February 22nd

Freeport got shut downa gain. Less exports mean more buildup, which is making natgas tank more.

Also snow expected late February to early march so we will see<a:nyaShrug:643747914715496461>

How much do we think this will effect OXY and their earnings next week? Will it finally lose that 55/56 support??

If the truce in israel becomes a thing and they agree to something, isnt that also bearish for natural gas/oil? thoughts

<:pepedetective:899174786922606592>

It’s more so the stockpile of futures contracts countries loaded up on during the fallout from Ukraine supply chain leaving no need to buy more. Supply demand thing. Question is when their contracts expire so they can start buying at the current low

All the countries that hedged on the way up to the high of $9 in natural gas are basically stuck paying those prices. Dunno how this applies to oil