The best way to find out is to play it with the real account. Play one just for fun and see where it takes you. I do agree with Swole, paper account and money account are not the same.

Gotcha, Alrighty I’ll try it on my live with a market order and see what happens

Hello. In looking a little ahead to November consider the following dates:

FOMC- Nov 1-2

Mid-term elections Nov 8

CPI-Nov 10

Veterans Day-Nov 11 (market Open)

When CPI drops on 11/10, Veterans Day follows on a Friday and the market is open. However some may be partaking on the glory of this amazing country so it may be one of those wierd trading days

Just an fyi

Love!

Just a bit of a news breakdown for the week:

Gonna be another slow one for us like last week which brings us to our slow but sure drift up. With early earnings remaining pretty strong (with some exceptions, most notably SNAP), we’re going to have to play mostly on whatever the market wants to do. Support and resistance will be key for us and will need some news, earnings, and psychology to break those levels.

Some of the news drops I’m looking to watch over the week:

-

Monday, October 24

- Manufacturing/Composite PMI - 9:45 AM - Any score above 50 implies that businesses are growing rather than contracting. This could be bearish for the markets, and it seems right now the markets expect around 51. If this falls below, that would mean that the belief that the fed is loosening the belt in the coming days would be justified as it would mean the pain is coming if they don’t (probably hopium, just my two cents)

-

Tuesday, October 25

- Consumer Confidence October (CB) - 10:00AM - Just a point of interest for me, I continue to watch it. This is one of those ones where bad news is bad and good news is good. Strong consumer confidence is bullish and weak consumer confidence is bearish. The market is currently expecting a 1.5pt decrease from last month (to 106.5 from 108).

-

Wednesday, October 26

- Everything related to housing on this day at 8:00AM (Permits) and 10:00AM (New Home Sales). Both of these news drops are another good is bad and bad is good type of drop. The markets are expecting an increase in permits but a decrease in sales.

-

Thursday, October 27

- GDP is king. At 8:30AM we drop our GDP numbers and the markets are expecting 2.1% growth from last quarter. Good is good and bad is bad here, if we see above it will have a bullish response. Below will be bearish. The markets don’t fuck around with GDP.

-

Friday, October 28

- Income and spending both drop premarket at 8:30AM. We would want to see a reduction in both to sustain the bullish rally. The market is expecting general flatness, but anything below would also mean that the fed policy is working and would justify fed pauses or reconsidering rate increases.

Good luck this week everyone!

Here’s a somewhat belated dump of some relevant things happening, as backdrop for the FOMC next week. (I’ve been a little behind in terms of keeping up with the latest stats as was having too much fun with futures, so was distracted ![]() )

)

- Atlanta Fed’s GDP projections for Q3 are … 3.1%! What recession…?

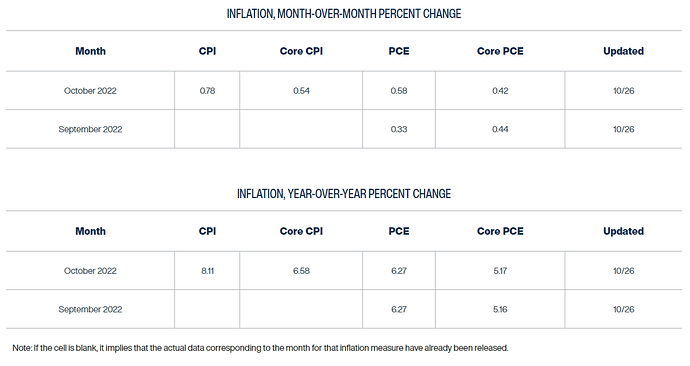

- Cleveland Fed’s Inflation projects are 8.11% headline, and 6.58% core. That’s roughly where consensus is, and this is still toasty.

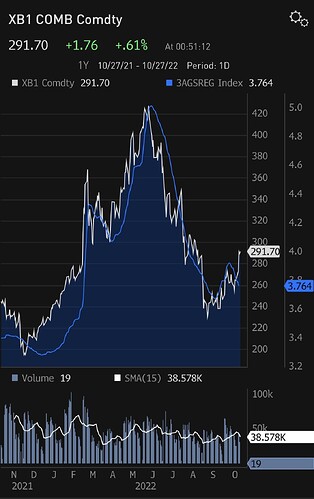

- Gasoline futures are looking like they want to move upward again. SPR tapping has to stop around Nov, and Saudis have already tightened the taps. Energy was a major driver of inflation, and if energy costs flare up again, there runs away inflation again.

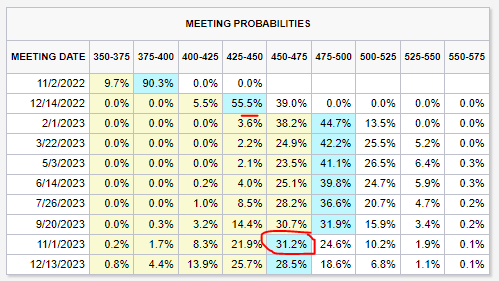

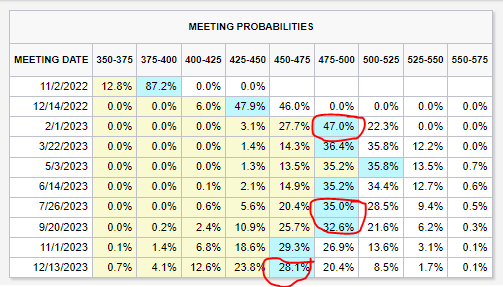

- And here’s the current rate Fed Fund Rate expectations - 50bps in Dec seems a bit more certain, with a fair bit of reduction on probability of 75bps. And we see a slightly increased tendency of a pivot in Nov 2023.

All in all, bond market seems pretty chilled out, and we’ve seen equity markets are on a tear. Yet… the storm clouds of inflation are not only not dissipating, but perhaps getting more ominous. We should be prepared for the Fed to come in heavy next week, especially if GDP today (Thu) and PCE on Friday reinforce what we see here.

This is the rate profile today. This optimism is getting a little irrational - this is pricing in a heck of a Pause. FOMC will be interesting; let’s keep an eye out for whisperings from the Fed Whisperer too.

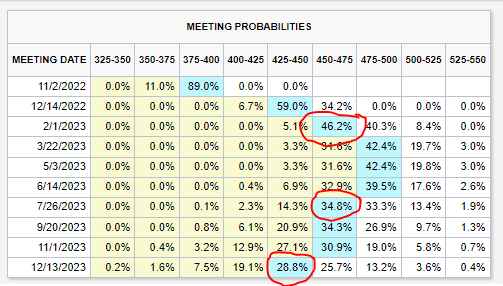

Ah the joys of watching a very confused bond market… this was Friday.

This is today - all the boxes circled red have moved to the right by 25bps:

Why, might you ask? Two developments from today.

First, the Treasury is signaling issuing more debt than planned earlier. There does not seem to be a govt-related activity tied to this, so seems like it’s quite possibly to do the Treasury buybacks if and when JPow breaks the long tne.

https://twitter.com/financialjuice/status/1587157807157198848

Second, the reverse repo removed 100B from the markets today (2.18T → 2.28T). This is the safe space for financial institutions, so this might signal they are getting jittery too.

https://www.newyorkfed.org/markets/desk-operations/reverse-repo

The number of job openings increased to 10.7 million on the last business day of September, the U.S.

Bureau of Labor Statistics reported today. The number of hires edged down to 6.1 million, while total

separations decreased to 5.7 million. Within separations, quits (4.1 million) changed little and layoffs

and discharges (1.3 million) edged down.

That’s 400K+ more than last month, and about 700k-1M more than was expected. This implies that the labor market is still very tight, increasing the risks of wage-price spirals getting more out of control.

This also moves the “vacancies to unemployed” ratio in the wrong direction, from 1.68 to 1.86 - something that JPow has noted he wants much lower. (Closer to 1, at least.)

Difficult to see how this does anything other than make the Fed more hawkish.

What are your thoughts on the mythical beast referred to as a soft landing we have been led to believe is still possible.

Wouldn’t this require jobs to stay hot while inflation is subsiding ? If we get the inflation destruction housing destruction and umemplyment through the roof. That would likely be no soft landing and full blown recession.

So couldn’t the ideal scenario the fed and all of us would like to see is decreasing inflation numbers while the jobs market stays healthy ? I believe early this year as the increases started JPOw and gang were touting all along how strong the economy was. To me continued job growth in many sectors along with some declining sectors in regards to an inflationary climate wouldn’t necessarily be an awful thing. Especially those that were running hottest housing being top of the list. Clearly rate hikes are creating some demand destruction but at some point the fed may need to realize and JPow said himself the supply chain needs fixed and they can’t do that. Once supply catches up which there are signs it is. Then the rate hikes and demand destruction would have more grasp.

However if job growth can remain strong and unemployment lowish. Wouldn’t this signal a soft landing scenario ? I’m not of belief either way here. But I do believe the only path to “soft landing “ is if sectors of the economy IE job growth can remain remotely resilient. Without creating additional ridiculous wage growth.

Interesting question. I think a soft landing would require both price levels and the labor market to be in equilibrium by the time the Fed is done, without the economy going through a hard recession. (A mild one will still qualify as a soft landing, I think.)

Unfortunately, a prolonged tight labor market moves things in the wrong direction by triggering a wage-price spiral. Because there are fewer people available to work than positions, it is an employee’s market where they can demand higher wages. Companies will pay those higher wages because they need the people. The people will then go and spend this money in the real economy, which will drive up prices. Assuming it’s still relatively the same about of stuff out there; GDP is relatively flat, so we can sort of assume this. (There’s a BIS paper linked in a prior post that might be of interest.)

There are two ways in which a heated labor market cools. Demand for labor is reduced, or supply of labor is increased. Since we’re unlikely to get more foreign workers, that leaves destruction of demand for labor, which in turn means companies need to get hurt. (A third is increasing productivity of the labor force, but that needs a long time too.)

How much hurt are we talking about? The US has about 165M people in the labor force. Say we need to get job openings down to 5M (pre free-money numbers…), and unemployment needs to go up by another 1% (1.65M), as per Fed models for balance - that means the economy needs to lose 6.65M worth of jobs.

That’s a full 4% reduction in positions businesses are telling us they have. This level of employment reduction has only happened at times of extreme distress - the GFC and COVID in recent times.

And to make matters worse, we’re going in the wrong direction. Job openings are up. Unemployment is down just a smidge. Even more people were hired recently.

All in, a soft landing thus seems unlikely because: a) a tight labor market triggers the wage-price spiral, and b) the market is only getting tighter, for now.

Want to take a moment to digest what happened today and why, despite the change of tone, and what at least the next few days heading into CPI might look like. I put these in sections so if you don’t want to read the recap you don’t have to.

[size=4]A Sucky Recap[/size]

Another Sunny Day

Markets were super happy with the FOMC decision. The two page presser contained language like:

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run.

…and…

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals. The Committee’s assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

The gist of this blurb basically says “Hey, we’re gonna keep hiking rates until it looks like employment’s getting fucked up.” JOLTS data this week showed that the labor market is strong, but it is starting to level out. Understanding this, the immediate thought is that 75bps in December is not a foregone conclusion and the markets reacted bullishly in the hopes that JPow and crew launch a 50bps hike. And hey! There’s good reason now to believe that they will in fact start tapering back as we are finally seeing some signs of shakiness in the economy based on fed tightening.

Clouds Rolling In

The market took a significant down turn during the Q&A session with JPow, in which he said (and I’m paraphrasing):

Our terminal rate is now potentially higher than we even thought in September.

The last FOMC rate decision was made on September 22, 2022. At this time we got our target rate hike of 75BPS but the panel said something that gave everyone pause and made the markets tumble - we are looking at higher terminal interest rates than we previously expected. The result was a $7 drop almost immediately on SPY as soon as that information was digested. The market recovered and then Jpow said some inflammatory things about housing and the SPY bled off $12 over the course of 1.5 hours.

Today was really no different than September. SPY shed $14 after it’s FOMC elation pump and market close after Jpow spoke, and the reason is because he said again “Hey we might have to go higher than we thought to achieve restrictive rates.”

[size=4]What Should Be Next[/size]

The market is in a constant state of “be the first to price it in”. If we didn’t have news drops coming tomorrow and Friday, I would expect over the next 24 hours some more losses in the market. In September the next 48 hours resulted in another $14 in loss in the markets, and I wouldn’t be surprised to something equitable here (don’t hold me on price targets, and don’t take Friday $360Ps just because I said this, because I’m also going to outline why we might regain what we lost by Friday).

What’s really important is that the number one thing that they were quoting was the relative strength of the job market. This is almost a context clue of the next data drop we can watch, which coincidentally has a significant data drop tomorrow morning - Initial Jobless Claims at 8:30AM. Immediately following that we have non-manufacturing PMI drops, which gauges the relative health of business (or rather, how people feel about it), and earlier this week it proved to be a significant catalyst.

Following that on Friday is our Non-Farm Payrolls and Unemployment Rates. If any of these data points show signs of a contracting economy, the market is going to react bullishly to try to turn Jpows “well we might have to go higher while letting our foot off the gas a little bit” into “we’re just going to let our foot off the gas a little bit”.

As an overview, here’s a handy grid on how we can play these employment related data drops over the week:

| KPI | Consensus | Bullish If… | Bearish If… |

|---|---|---|---|

| Jobless Claims - 8:30AM Thursday | 220K (minor increase) | Above 220K | Below or Equal To 220K |

| Nonfarm Payrolls (jobs added) - 8:30AM Friday | 200K (20% reduction from last month) | Below 200K | Above or Equal To 200K, the closer it is to 263K the worse the reaction will be |

| Unemployment Rate - 8:30AM Friday | 3.6% (1% uptick from last month) | Above 3.6% | Below or Equal To 3.5% |

If any of these numbers come in favorably to the inflation reduction narrative, I expect us to recover the losses from today and maybe then some. If they do not, the pain will be in and we could be looking at the next leg down. But these numbers and CPI are going to set the tone for us for at least the next week.

TLDR - Don’t stop watching the news drops. Employment is a heavy focus. Bad news is good and vice versa with these news drops. Neutral news is also bad given the freshness of JPows blows on our markets.

Here are the estimates for tomorrow’s nonfarm payroll data.

The consensus is around 200k adds, with a range of 80k to 300k.

200k jobs added is still high given that about 100k is needed to keep unemployment rate changed. Sliver of good news is we’ve been going in the right direction recently, though again, probably way too slow for the Fed’s liking.

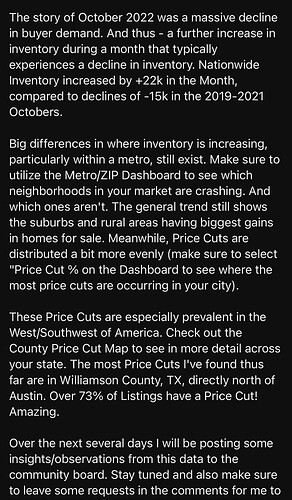

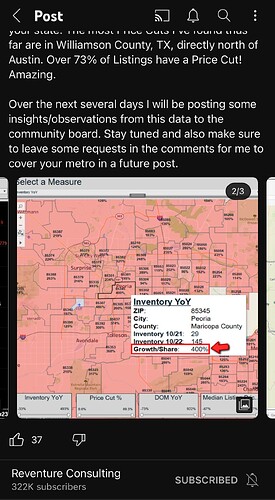

Source: Reventure Consulting on YouTube

I’m a channel member so I’ll share as much as I can when I have time but I thought this was pretty informational🙏🏼

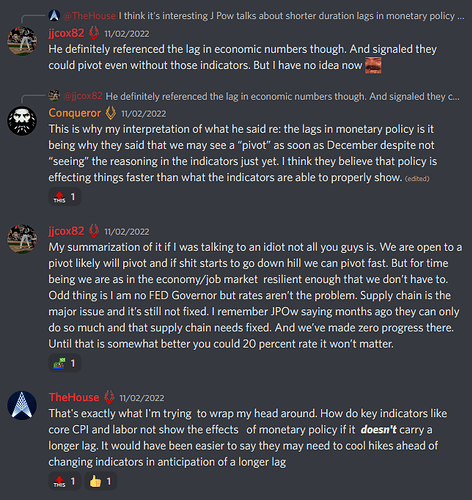

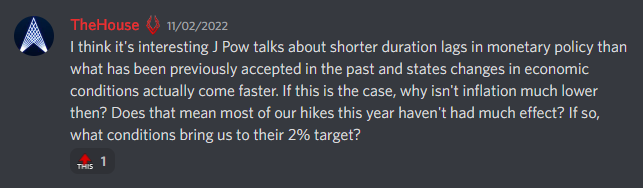

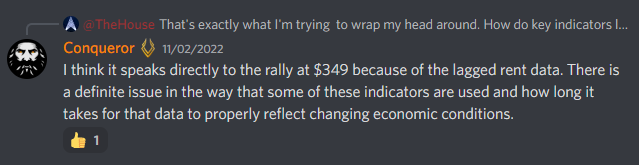

The following exchange is from the Legends channel in Discord. The channel was established to sort out differences in opinion on macro events to make sure we’re not giving too confusing of a picture on TF (obviously created around the time I was yelling a lot and to secondarily give me a place to yell that isn’t TF ![]() ). This conversation happened just after the Powell press conference and it was a good explanation of my current feelings so I’m mirroring it here for the sake of time.

). This conversation happened just after the Powell press conference and it was a good explanation of my current feelings so I’m mirroring it here for the sake of time.

As I’m sure most have seen, I’m pretty busy with dev work but I’m looking to start contributing more again as the larger features get closer to being fully fleshed out.

This is being posted in response to these commends from Evans

https://twitter.com/financialjuice/status/1588601565765664770?s=20&t=2MwDwu6dGX0312pznhfJuw

https://twitter.com/financialjuice/status/1588602544489644035?s=46&t=kgSYFbEUqucXjisoTs0xNg

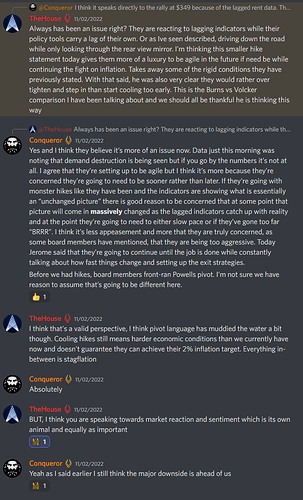

Like I said in the above, the fed board front ran Powell’s pivot from inflation being transitory and there really isn’t good reason to assume that isn’t going to be the case again. We’re seeing more and more warning signs that the thesis that they are genuinely concerned that we’re going too fast is correct especially now that the narrative is advancing from the possibility of smaller hikes, to speaking about them as though they’re a certainty in the near future. After Powell’s admission that we could see smaller hikes as soon as December, we’re now moving to seeing discussion about a full on pause “even if it’s a year away”.

Now to be clear, this isn’t commentary on whether this move is right or wrong, it is just what the messaging seems to indicate.

In the event this is the real path, we’re looking to continued upside in the markets in the near term as signs of inflationary pressures easing continue to stroll in little by little as the market has proven that it’s looking for literally any indication that pressure is easing. The real test comes when one of two scenarios play out:

- Inflation data suggests that pressures are slowly easing (i.e. peak)

- Inflation data comes in sharply lower

In the first scenario the market will react bullishly as it is forever optimistic and trades based on the nearer term. In this scenario a “soft landing” looks to still be in the cards. Second scenario is bearish on the outset but this is where I think the “exit strategies” the FED has been setting up come into play. The danger here is “BRRRR” and as Powell stated, they’re not afraid to. For those wondering where option 3 “inflation doesn’t come down and we spiral into the abyss” is, it doesn’t exist because I don’t believe that the data we’re seeing combined with the continued aggressive rate hikes indicates that we’re likely to see inflation continue to climb in the future and FED commentary seems to support that given that they’re (in my opinion) very clearly starting to signal a pivot (in the new definition @Kevin) is coming sooner rather than later. To give a visual, the data as I’ve seen it seems to indicate that we’re in the crown of the arc.

In the above exchange I also state that I think the major downside is in front of us and that is true. None of this deals with the actual state of the economy which at some point will be bad as the amazing folks in the “Stagflation Thread” have exhaustively covered. The point where the market prices that in, to the best of my knowledge will still likely be around earnings as policy effects on balance sheets start to show.

So that’s where I stand at the moment. I think we should be looking to data as it comes in and trading based on whether or not it shows any signs at all that inflation is easing. That’s how the market is trading and that is how we should as well.

I’d like to add that the prior two meetings saw a consensus if not unanimous vote on rates and perspectives going forward. This last meeting, the language out of the Fed doesn’t seem to be uniform and we’re back to before August.

So it’s definitely difficult to decipher for me, anyway, a coherent position on the Fed and looking forward to the FOMC minutes and how things were voted to gain more insight on their policy stances.

A prime example is today where JPow tried to chill the markets yesterday, morning data was mixed, and then the Fed comments were interpreted as bullish and we ran. Even more reason to be fluid intra-day because while I believe Conq is right (that we need to be more data-driven than ever) comments from the Fed are feeding into market desires and accentuated. This makes for even more volatility intra-day.

Love the macro discussions! As long as we’re not doing hard econometrics and modeling (too much for stoopid me).

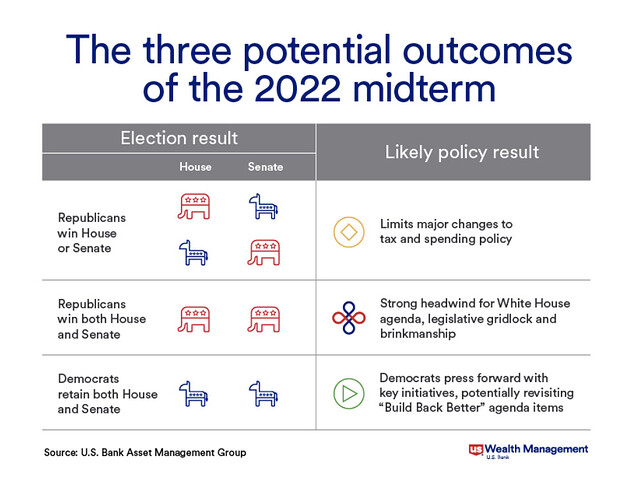

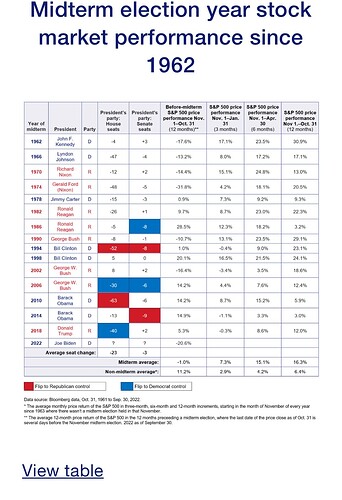

Thanks so much to @Fllwoman (always dropping nuggets of knowledge) for this article that discusses the effects of the midterms on the markets.

This is a key catalyst to start this week that I do not feel like we have enough thoughts on. The mid terms can be a major swing in the market that’s essentially locked in for 2 years.

In my opinion there are several plays there in regards to midterms. So to list a few scenarios below.

R wins house and senate.

1:) long term bullish for Oil Gas Coal although can’t get anything done with out the bills getting past Oval Office. Also means unlikely for tax hikes or stimmys etc.

2:) Probably the real play bearish as all hell for solar wind EV type of companies. IE no more government handouts for this type of clean energy programs.

R takes back one wing.

1:) the most neutral scenario. Meaning where we are now what bills and laws are currently in tact remain. Nothing is getting re written and essentially a stalemate for next two years. So then we rely on current economic policy and stance. Without much more going into effect or passing.

Ds hold both wings.

1:) very similar to opposite of R wins. Bullish for EV solar wind type companies.

2:) bearish for oil coal etc. no drilling or mining means no product.

Def something we need to monitor Tuesday.