First thing we have to talk about is what happens as the Fed reduces the balance sheet.

Depending on who purchases the securities after they roll off the balance sheet, different outcomes can happen. For example, if banks purchase the securities, then the amount of cash they paid with to purchase the securities is reduced from their reserves. If, for example, money market funds purchase the securities, they can either use the cash they have deposited in banks, withdraw from investments they have in the overnight reverse repo, or both.

More info as to how this works can be found here.

The reduction of the Fed Balance sheet, as far as I understand, has three goals:

Reduce the Money Supply

Increase Long-Term Interest Rates

(Indirectly) Bring Down Inflation

- Reducing the Money Supply

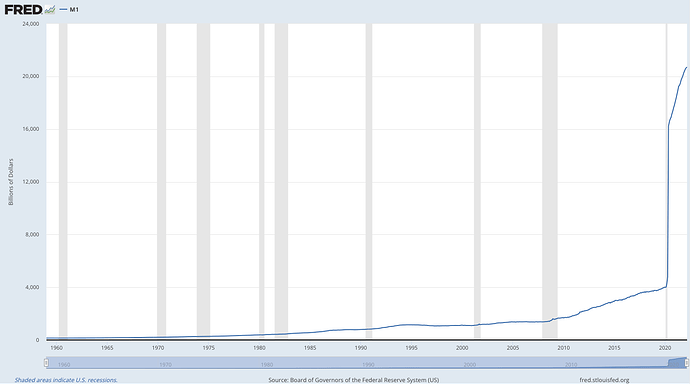

It’s no secret that Powell turned on the money-printer during the Pandemic

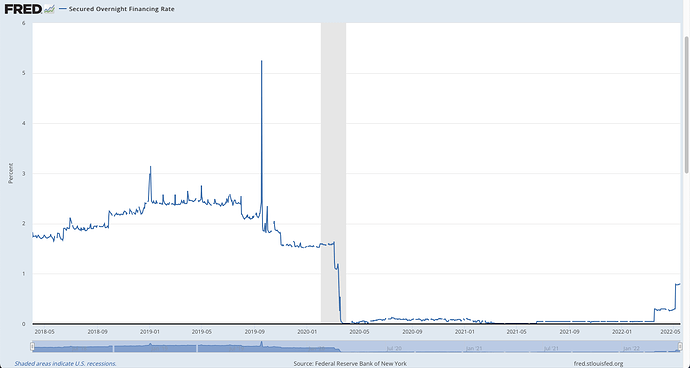

As I described before, depending on who purchases these securities rolling off the balance sheet, different outcomes could happen. One common factor in these different outcomes is that money supply in circulation decreases, as either banks withdraw from their reserves in order to purchase securities or MMFs withdraw from deposits at banks or from ON RRP investments to purchase securities. Either way, liquidity will be drained from the system. In 2019, too much liquidity was drained, leading to a spike in the Secured Overnight Financing Rate, leading the Fed to believe that they had overshot the reduction of the balance sheet, or reduced too quickly, which led to easing of monetary policy.

A big difference between QT now and QT in 2018 was the reserve requirement. Back then, banks had a minimum requirement of how much cash they had to hold in reserves based on the amount of net transactions that occurred.

As of March 2020, and still ongoing, reserve requirements are effectively zero.

I would guess that reserve requirements will change in the future if demand remains strong and inflation stays elevated.

- Raising Long-term Rates

As of April, total outstanding treasury securities have reached around $23.2 trillion

As of April, the Fed has around $6 trillion of treasury securities on their balance sheet.

With the Fed making up around 25% of total treasury security purchases, long-term yields have been surpressed (basics of bonds is higher price paid lower rate, lower price paid higher rate. There’s also incentive/supply&demand stuff that goes into rates but that’s for another time). A 2017 Fed paper indicates that long-term rates have been suppressed as much as 100 basis points by the Fed’s purchasing.

This was back when QE was in full force right before QT, but the pandemic brought on a shit ton (yes this is technical jargon) more of treasury purchases and overall asset purchases onto the Fed’s balance sheet.

How much QT is priced in? A decent amount, I would say.

Looking at the spike in long-term yields since the Fed announced they would be open to reducing the balance sheet, this spike is way more than 100 bps. Is the Fed paper outdated? Is this time different? Well, the truth is no-one knows. QT of this size has never been done before. What I can say is the Fed can’t go back on their QT until inflation is under control, due to political implications.

- Bringing down inflation

Reducing the balance sheet will affect interest rates, from loans to mortgages. Raising interest rates will hurt demand, bringing down inflation (there’s an important discussion to be had as to how this will affect earnings, but that’s for another time). A Fed paper written in 2018 implied that the reducing of the balance sheet will not only impact long-term interest rates, but will impact short-term interest rates, as well. The reduction, the paper said, would have an impact on the Fed Funds rate, the ON RPP rate, and other short-term lending rates:

- Estimates indicate that a reduction in reserves of $100 billion will increase the effective federal funds spread by 0.5 basis points and the overnight repurchase agreement (repo) spread by 2.1 basis points.

- Assuming the reduction in securities holdings is related one-to-one to a drain in reserves, estimates indicate that because of the liquidity effect, by January 2019, when the Fed will have reduced its portfolio by $500 billion, the repo spread will be 10 basis points greater and the fed funds spread will be 2 basis points greater than in October 2017, all else being equal.

- Results suggest that the impact of the Fed’s balance sheet reduction on short-term interest rates will be stronger at the end of 2018 than they were a year earlier. This is in part because the reduction will gradually increase from an initial $10 billion per month in October 2017 to $50 billion per month in October 2018, but it is also because the liquidity effect will be stronger when the supply of reserve balances has already shrunk substantially.

- Because the Fed’s overnight reverse repo (RRP) facility acts as a buffer to a drain in reserves, as reserves become relatively scarce, market participants will reduce recourse to the RRP facility and provide funding to private money markets, thereby dampening the policy-induced drain in reserves.

"Assuming the Fed’s balance sheet reduction plan proceeds as outlined in June 2017, the built-in reduction in reserves will put upward pressure on short-term interest rates. Indeed, the balance sheet reduction and the short-term policy rate target both affect short-term rates, potentially conflicting with or reinforcing each other. Policymakers should be aware of these forces when deciding on a desired path for short-term interest rates—for both the level of rates and the timing of rate changes.

Current forecasts about the future path of the short-term rate should be re-evaluated and maybe revised if they do not include the liquidity effect resulting from the balance sheet reduction. Communicating this effect may be important for a continued smooth and gradual removal of policy accommodation during this tightening cycle. Neglecting the liquidity effect in forecasts about short-term rates may also affect long-term rates through the expectations hypothesis."

Let me just clarify that this time is different. Effectively, no one knows how this will play out, not even the Fed. Some things that are different this time around are that the Fed will be much more aggressive in the reduction, the balance sheet is substantially larger, the Repo Facility can aid in adding liquidity to the system if the Fed overshoots in their reduction, for the time being reserve requirements are effectively zero giving banks the chance to lend more money, inflation is rampant so the Fed can’t go back on their QT without political impacts, etc.

This Reuters article is a good summary of what Balance Sheet reduction is, what happened last time, and what’s different this time.

What should you do? Well, as far as I understand, longer term interest rates will rise, making the yield curve healthier than it has been so far. This is good for banks and their earnings, since they borrow on the shorter end of the curve and lend on the longer end. Longer term rates rising also impacts corporate debt. Investing in companies with healthy balance sheets and tons of Free Cash Flow is also a good idea. You can read more here as to how to invest in a higher-rate environment.

TL;DR No one knows, but rates could go higher.

Edit: Forgot to mention, @Machetephil brought up REITs and Private Credit Funds, which are also good in rising interest rate environments.