Some more good thoughts from Alf, another respected member of Twitter FinTwit:

(Original)

Some more good thoughts from Alf, another respected member of Twitter FinTwit:

(Original)

So yesterday (Wednesday) was CPI report. I’ve been reading the news this morning and they are still doom & gloom about inflation. At best they say “inflation may have peaked, but we will likely be at these levels for some time”. Others think the worst has yet to come.

PPI & jobs report today is likely going to be just as mediocre, and we will get a continued decline today in the market.

American Perestroika.

How do you mean ![]()

Keeping politics aside, do we think this is a good thing or a bad thind? Some will say this will make inflation worse in the here and now, and screw us structurally in terms of energy security for decades. Others will say that we won’t benefit from this for years and years, and by the looks of $60 oil futures, not even the market thinks there will be an oil shortage - 2030 futures are pricing $65 a barrel.

Curious to hear what you think about the impact of this move on inflation and recession, either way!

Update

Didn’t scalp a ton today, the price movement on the indexes have been a little harder for me to read the last few days. Slow declines with quick short advances. In the back of mind I have been anticipating some sort of relief rally, nothing moves in a straight direction either way. Was getting mixed signals with my favorite indicators, but meme stocks pumping always makes me cautious so I pulled my position sizes back and did alright minus whatever PTON and ARKK were doing today.

Current Port

A few names that have been mentioned plus a few runners in SPY and IWM that I bought ah. Nothing crazy, looked a lot better before the eod pump, but green nonetheless.

Will share more market thoughts this weekend, but will be running the same strategy tomorrow.

Hope everyone has a great evening.

Thanks for sharing @TheHouse. Looks like you have about $12k invested currently. Do you park the rest in cash? Also, of the $44k account value, how much is growth in 2022 or what is your ROI so far this year? From what I’ve seen, you are performing tremendously.

Hey thanks man, I appreciate it. I Invested roughly 4k, got it to 13k then added 12k more to get over the PDT rule. So 16-44 or almost 3x. Its been pretty volatile, ive made an insane amount of mistakes, but as Ive spent time trying to get better on the trading / risk management side, my down days haven’t hit as hard. 10-15k is about the max I have been leaving overnight, has been pretty minimal, but Im starting to add some longer strikes so that will hopefully change slightly to the upside as they raise in value. But also depends on market and events. The rest I have available for any plays that come up and scalping. My scalping size outside of my longer plays depends on what the market is doing but avg is prob around the 2-10k range in play at any one time

Congrats, 3x to $44k is phenomenal. You’ve got my attention.

One thing I forgot to post here is that there are two potential investment alternatives to hedge against inflation: REITs and private credit funds. Specifically, I am going to focus in the coming days on the large Multi-Family REITs like EQR and AVB to analyze where good entries might be for long-term investing as a hedge against the risks identified in this incredible thread.

In addition, I’m going to look at what publicly-traded funds have a similar makeup to BCRED, which is Black Rock’s private credit fund. Floating-rate corporate secured debt is a great way to increase returns when interest rates go up while limiting downside risks by sticking with secured debt that is (at least in theory) fully secured by the corporate borrowers’ assets.

Hello… just parking this here for e-commerce figures coming out May 19 for Q1 2022

As well as retail monthly

A few data points by way of keeping track of where things are:

The Goldman Sachs US Financial Conditions Index continues to tighten, though still 100, so still considered accommodative:

As @juangomez053 noted above, the S&P PE continues to fall, though still not quite at the historical mean of 16:

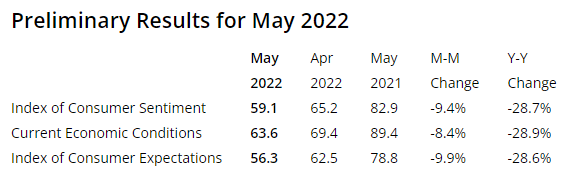

UMich Consumer Sentiment dropped quite a bit MoM:

Various indices from the simplistic RSI to the more involved TRIN all suggest the market is a bit oversold.

This is all to say that we might be getting close to the market taking a breather. We may have just about sweated off the COVID Stimmy bubble.

Doesn’t mean that we’re out of the woods. 3% fed rate in 2 years is barely going back to normal, which makes it seem like we haven’t even started to price in more tightening that the Fed will have to do. But that will likely depend on a few more months of data. Hence, the possibility of a breather.

Definitely seems like a bear market “breather” rally might be coming. @Yongsooyuk6 and I went over some technicals/news that could point to a short-term bounce in his Tech Anal Thread.

@TheHouse excellent gain these past few and great job getting everyone(at least me) acclimated to the bear market.

I had posed a question which may have been digested in the forum previously, but curious on a basic crayon level what could be played once the fed starts unloading its balance sheet.

I have looked at the feds statement as well as a white paper that helped give some details. But overall just looking to see what the best play now before June 1 hits and they stop reinvesting

Seems like the China economic numbers may have flipped futes red tonight? Been busy all weekend so haven’t been keeping up as closely but this is what I found quickly

CHINA APRIL RETAIL SALES -11.1% Y/Y; EST. -6.6%

CHINA APRIL INDUSTRIAL OUTPUT -2.9% Y/Y; EST. 0.5%

CHINA JAN.-APRIL FIXED INVESTMENT RISES 6.8% Y/Y; EST. 7%

It wasn’t a great report. DXY started showing weakness leading up to the report, and the weak numbers released at 8:30 only added to the decline.

From the report:

“After growing strongly last month, business activity declined in New York State, according to firms responding to the May 2022 Empire State Manufacturing Survey. The headline general business conditions index dropped thirty-six points to -11.6. New orders declined, and shipments fell at the fastest pace since early in the pandemic. Delivery times continued to lengthen, and inventories expanded. Labor market indicators pointed to a modest increase in employment and the average workweek. Both the prices paid and prices received indexes moved lower, but were still elevated. Looking ahead, optimism about the six-month outlook remained subdued.

The general business conditions index retreated thirty-six points to

-11.6, its second negative reading in the past three months. Twenty percent of respondents reported that conditions had improved over the month, while thirty-two percent reported that conditions had worsened. The new orders index fell thirty-four points to -8.8, and the shipments index plunged fifty points to-15.4, marking a sharp reversal for the two measures, both of which increased last month. The unfilled orders index fell to 2.6. The delivery times index held steady at 20.2, pointing to continued lengthening in delivery times, and inventories increased.”

According to MarketWatch:

“The decline is not a good signal for the economic outlook. This is the second negative reading in three months. Supply-chain woes and higher prices may finally be cooling off demand.”

Hope everyone had a great day today.

I spent the weekend in Montana exploring some beautiful country, a little time in the mountains sure helps me feel recharged and focused. Today was low volume with big intraday swings, this points to indecisiveness in the market. We have a full agenda tomorrow, could be some of the reason why.

I think Conq’s post today is a great summary of what to look for tomorrow.

Here is the post below:

The only thing I would add is to pay attention to WMT and HD earnings before the bell. These are 2 heavy hitters in retail that will report right before retail sales numbers go live. The combination of the two should set the stage for the day.

First thing we have to talk about is what happens as the Fed reduces the balance sheet.

Depending on who purchases the securities after they roll off the balance sheet, different outcomes can happen. For example, if banks purchase the securities, then the amount of cash they paid with to purchase the securities is reduced from their reserves. If, for example, money market funds purchase the securities, they can either use the cash they have deposited in banks, withdraw from investments they have in the overnight reverse repo, or both.

More info as to how this works can be found here.

The reduction of the Fed Balance sheet, as far as I understand, has three goals:

Reduce the Money Supply

Increase Long-Term Interest Rates

(Indirectly) Bring Down Inflation

It’s no secret that Powell turned on the money-printer during the Pandemic

As I described before, depending on who purchases these securities rolling off the balance sheet, different outcomes could happen. One common factor in these different outcomes is that money supply in circulation decreases, as either banks withdraw from their reserves in order to purchase securities or MMFs withdraw from deposits at banks or from ON RRP investments to purchase securities. Either way, liquidity will be drained from the system. In 2019, too much liquidity was drained, leading to a spike in the Secured Overnight Financing Rate, leading the Fed to believe that they had overshot the reduction of the balance sheet, or reduced too quickly, which led to easing of monetary policy.

A big difference between QT now and QT in 2018 was the reserve requirement. Back then, banks had a minimum requirement of how much cash they had to hold in reserves based on the amount of net transactions that occurred.

As of March 2020, and still ongoing, reserve requirements are effectively zero.

I would guess that reserve requirements will change in the future if demand remains strong and inflation stays elevated.

As of April, total outstanding treasury securities have reached around $23.2 trillion

As of April, the Fed has around $6 trillion of treasury securities on their balance sheet.

With the Fed making up around 25% of total treasury security purchases, long-term yields have been surpressed (basics of bonds is higher price paid lower rate, lower price paid higher rate. There’s also incentive/supply&demand stuff that goes into rates but that’s for another time). A 2017 Fed paper indicates that long-term rates have been suppressed as much as 100 basis points by the Fed’s purchasing.

This was back when QE was in full force right before QT, but the pandemic brought on a shit ton (yes this is technical jargon) more of treasury purchases and overall asset purchases onto the Fed’s balance sheet.

How much QT is priced in? A decent amount, I would say.

Looking at the spike in long-term yields since the Fed announced they would be open to reducing the balance sheet, this spike is way more than 100 bps. Is the Fed paper outdated? Is this time different? Well, the truth is no-one knows. QT of this size has never been done before. What I can say is the Fed can’t go back on their QT until inflation is under control, due to political implications.

Reducing the balance sheet will affect interest rates, from loans to mortgages. Raising interest rates will hurt demand, bringing down inflation (there’s an important discussion to be had as to how this will affect earnings, but that’s for another time). A Fed paper written in 2018 implied that the reducing of the balance sheet will not only impact long-term interest rates, but will impact short-term interest rates, as well. The reduction, the paper said, would have an impact on the Fed Funds rate, the ON RPP rate, and other short-term lending rates:

"Assuming the Fed’s balance sheet reduction plan proceeds as outlined in June 2017, the built-in reduction in reserves will put upward pressure on short-term interest rates. Indeed, the balance sheet reduction and the short-term policy rate target both affect short-term rates, potentially conflicting with or reinforcing each other. Policymakers should be aware of these forces when deciding on a desired path for short-term interest rates—for both the level of rates and the timing of rate changes.

Current forecasts about the future path of the short-term rate should be re-evaluated and maybe revised if they do not include the liquidity effect resulting from the balance sheet reduction. Communicating this effect may be important for a continued smooth and gradual removal of policy accommodation during this tightening cycle. Neglecting the liquidity effect in forecasts about short-term rates may also affect long-term rates through the expectations hypothesis."

Let me just clarify that this time is different. Effectively, no one knows how this will play out, not even the Fed. Some things that are different this time around are that the Fed will be much more aggressive in the reduction, the balance sheet is substantially larger, the Repo Facility can aid in adding liquidity to the system if the Fed overshoots in their reduction, for the time being reserve requirements are effectively zero giving banks the chance to lend more money, inflation is rampant so the Fed can’t go back on their QT without political impacts, etc.

This Reuters article is a good summary of what Balance Sheet reduction is, what happened last time, and what’s different this time.

What should you do? Well, as far as I understand, longer term interest rates will rise, making the yield curve healthier than it has been so far. This is good for banks and their earnings, since they borrow on the shorter end of the curve and lend on the longer end. Longer term rates rising also impacts corporate debt. Investing in companies with healthy balance sheets and tons of Free Cash Flow is also a good idea. You can read more here as to how to invest in a higher-rate environment.

TL;DR No one knows, but rates could go higher.

Edit: Forgot to mention, @Machetephil brought up REITs and Private Credit Funds, which are also good in rising interest rate environments.

Both Walmart and Target (target) have seen a buildup of inventory and a slowdown of sales. These guys know how to do inventory management better than most others. Sure, they may have overcompensated for supply chain issues, but it seems like consumers actually changed buying behavior more than they were expecting.

With profits lower, it is only a matter of time before employment takes a hit. Seems like we’re really barreling through the different stages of economic responses at a very rapid pace. (shared earlier)

Meanwhile, the Governor of the Bank of England used words like “apocalyptic” and “helpless” when talking about inflation in England, which reached 9%. Would have been nice to see a breakdown like the one below for the US:

It’s a little surprising how quickly things are getting worse.

Sent it in TF, going to dump in here, too. Hiring freezes coming in from top companies. AMZN, FB, NFLX, TWTR, COIN, UBER so far.

https://twitter.com/topstockalerts1/status/1526898194935951362?s=21&t=-TGRunmH7KdHpXGJ3-v6SA

https://twitter.com/topstockalerts1/status/1526569674657366017?s=21&t=-SilRu4muizwhq8bB1PvqA

https://twitter.com/unusual_whales/status/1524790903835172864?s=21&t=pq5VHb_BgOk31cqf3STbew

https://twitter.com/unusual_whales/status/1523640147845148673?s=21&t=KZ5Umc6U5p4HxADvghh72g

https://twitter.com/unusual_whales/status/1527117983100723201?s=21&t=6-nEMQzIQo6BXUsF1NWRVw

https://twitter.com/unusual_whales/status/1527010216277065728?s=21&t=KwYAR0lUs0f31UQGtcPo3w