New Fed note about Balance Sheet reduction’s effects on economic policy came out yesterday.

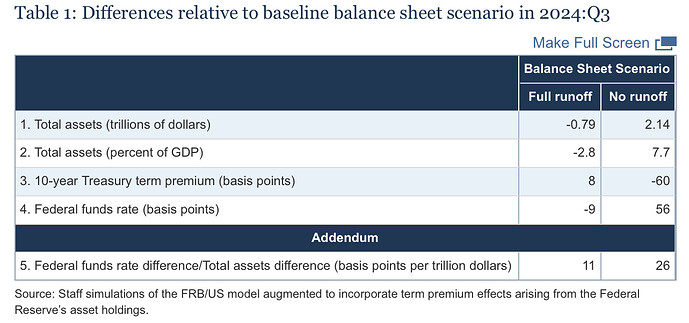

The main point of the note seems to be that a reduction of $2.5 Trillion is equal to a FFR hike of about 50 bps, which seems really low but in line with what Fed Governor’s have been saying recently.

FED’S DALY: I SEE THE BALANCE SHEET TRIMMING DELIVERING ABOUT 25 BPS OR 50 BPS OF TIGHTENING.

FED’S WALLER: BALANCE-SHEET REDUCTION IS COMPARABLE TO 1.5 TO 2.5 25-BPS INTEREST RATE HIKES.

First a primer on the Fed’s tools and what they do:

“Policy rate actions and communications influence the economy by affecting the cost of short-term borrowing and expectations about the path of short-term interest rates. Balance sheet policies primarily influence the term premiums embedded in medium- to longer-term yields by changing the supply—current and expected—of longer-term securities held by the public.”

How does the model work?

The model manipulates nominal ten-year yields and reductions of Ten-Year bonds from the balance sheet and equating these manipulations to a certain raise in the FFR.

“The model implies that a one-time permanent reduction in the Federal Reserve’s holdings of 10-year equivalent Treasury securities equal to 1 percent of nominal GDP raises the term premium on a 10-year Treasury security by about 10 basis points, all else equal. In the model, this amount of policy tightening can also be achieved by raising the average expected path of the federal funds rate over the coming decade by about 10 basis points.”

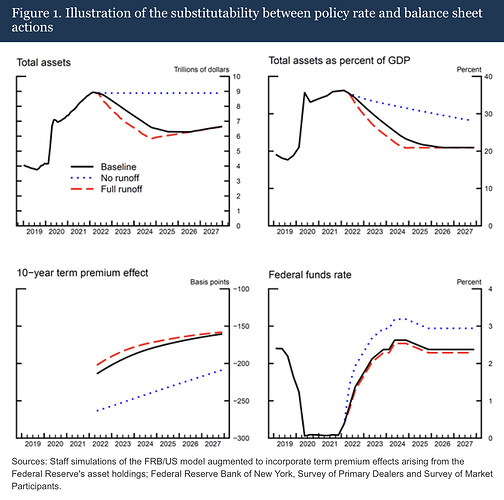

The model uses three scenarios, a baseline, a no runoff scenario, and a full runoff scenario:

- “Baseline: Shrink the balance sheet starting in June 2022 in a manner consistent with the FOMC’s Plans for Reducing the Size of the Federal Reserve’s Balance Sheet, as captured by the illustrative baseline balance sheet scenario featured in the 2021 SOMA annual report. After a three-month phase-in period, let up to $60 billion in Treasury securities and up to $35 billion in agency MBS run off the balance sheet per month.”

- “No runoff: Keep the balance sheet size constant in dollar terms by rolling over Treasury securities and agency MBS until growth in the demand for Federal Reserve liabilities provides a basis for resuming organic growth of the balance sheet.”

- “Full runoff: Shrink the balance sheet through the full runoff of all Treasury securities as well as maturing and prepaid agency MBS starting in June 2022, without any phase-in period (about $105 billion per month, on average over the runoff period).”

What I found interesting was that the difference in the economic impact between gradually increasing the amount of run-off per month (baseline scenario) and starting run-off at full capacity (full runoff) was relatively small.

What was also interesting was the relationship between the FFR and the Ten-Year term premiums/Yield Curve:

“The differences in policy rate paths across scenarios are roughly equal (but with an opposite sign) to the corresponding differences in 10-year term premiums. These offsetting effects on term premiums leave the 10-year real and nominal Treasury yields little changed. However, as the addendum to table 1 shows, there is no fixed relationship in the model between dollar reductions in the balance sheet at a point in time (or, alternatively, in terms of the peak-to-trough reduction) and offsetting changes in the federal funds rate.”

They make the case that runoff won’t have that big of an impact (50 bps after $2.5 Trillion while Fed is raising 50 bps in three consecutive meetings) because GDP has grown relative to the holdings:

”At the time of runoff, the macroeconomic effects of asset holdings may be reduced because these holdings form a smaller share of nominal GDP than when they were purchased.”

Of course, the model isn’t perfect. They say that things like communicating future policy rate changes and the reaction in markets that come with the signaling can’t be implemented into the model:

“In a similar vein, we emphasize that our analysis only features portfolio balance effects (as captured by the duration risk channel) and, thus, does not take account of other possible transmission channels, such as those associated with flow effects or with signaling of the intended course of the policy rate.”

And, of course, they hedge their bets by saying financial markets could struggle with the large amount of supply flooding the market from runoffs, and that yields could go higher than assumed:

“Notably, in the early months of the pandemic, asset purchases played an essential role in supporting smooth market functioning, an aspect not captured by the model. As policymakers turn to reducing asset holdings, market functioning and financial conditions are much improved, which, all else equal, could make the effects of asset reductions smaller than those of asset purchases. On the other hand, if financial markets were to find it difficult to absorb large amounts of runoff, then the effects on yields could be larger than we assume.”

Ultimately, no one knows what will happen from QT this size because it’s never happened, and they admit this themselves:

“Finally, we stress that there is significant uncertainty regarding the transmission of balance sheet and policy rate actions to medium- to longer-term interest rates, as well as the transmission of the resulting yield curve movements to the broader economy.”

TL:DR Fed is hopeful that the economy is strong enough to absorb the excess runoff and that it will result in some, but relatively minimal in my opinion, tightening.