Relevant to $JNK and $HYG:

https://twitter.com/specialsitsnews/status/1530973271604314112?s=21&t=claUQqw-jKTPjYhiAuda1g

Relevant to $JNK and $HYG:

https://twitter.com/specialsitsnews/status/1530973271604314112?s=21&t=claUQqw-jKTPjYhiAuda1g

I have been periodically watching my local real estate market on zillow, mainly watching prices and inventory. Within the last week things have significantly changed. It looks like an increase in inventory and nearly everything else has had a recent price cut. Started looking into it more and found a report from redfin from a few days ago that showed 1/5 homes in the US dropped their price in the last 4 week period ending May 22nd.

I mentioned it a few months ago in this thread, I believe the biggest threat to the housing market and equities is when assets start to turn into liabilities. Real estate is the largest asset class for household wealth in the US, and I think the world, but I dont feel like looking it up right now. I think this feeds into the “wealth effect” or “wealth illusion” discussed earlier in the thread. But home equity has also served as a piggy bank for some americans through HELOC’s. This just means buying power. So when values go down, so does the credit expansion that has been generated from significant equity appreciation.

Inventory data I believe is still near all time lows, but its hard to imagine with the new uptick in price drops that wouldn’t change. Another thing to watch.

I have a housing market watch list, but there isnt anything in there that I have alot of comviction on. So I think that means I need to re visit them. Would love any ideas on how to play this continuing housing trend, as I think there is still some good opportunity there.

On the bear side ofcourse ![]()

This chart from FRED shows monthly inventory as a ratio of new houses for sale vs. new houses sold. We’re reaching 2010 levels in terms of inventory:

In terms of actual inventory and not just new homes, numbers are creeping up, but still low:

Thought I’d also post this distribution to the discussion:

Real estate becomes more and more important the lower the wealth percentile group you belong to in terms of your net worth.

Source:

Mortgage 30yr rates in US and Housing inventories.

9 months of inventories now

From: Credit From Macro to Micro

@Credit_Junk for the Chart

———————————————

I keep hearing and reading about the high migration to the south to areas like Texas Florida North Carolina and Tennessee. Most of these states are businesses friendly and jobs a plenty. The last housing crash in 08 these areas where hit the hardest as they are the areas that overbuilt back then. It’s going to be interesting heading into next fall, I keep getting messages from my loan officer how rates have dropped twice this past month already due to lack of demand . 5.35 to 5.20 then again down to 5.10, I was in the market but want to see how it will play out. My rent is currently cheaper than if i owned and we are not the biggest fans of TX.

I don’t believe anything has changed narrative wise when loan officers where trying to get 5.60+ on a 30 year. Now that everyone has turned their back it’s interesting to see them lower their lending rates… how low can we go to get buyers like me back in ?

Well written opinion piece on how Biden’s plan to fight inflation isn’t effective

You know you’re in trouble if the WaPo takes such a strong stance against you ![]()

It’s true though - what we are facing now is the result of a decade-long binge on QE, coupled with full employment and global supply chain issues. Both parties are squeezing as much out of this as possible for political grandstanding, but at the end of day it’s all vacuous stuff.

Correcting structural maladjustments of this magnitude is beyond the remit of any one president, let alone the Fed, although they can tweak at the margins. We’ll just have to take this one on the chin over the next year or two as the US and global economies find a new equilibrium.

Interesting read, makes similar case I did above (if you haven’t read it: Stagflation leading to Recession - The Kodiak Bear Thesis - #221 by juangomez053) (QT will lead to a drain in liquidity in the system) but makes the argument that the drain will mainly come from banks and their deposits. Due to a shortage of T-Bills, they’re arguing that there will be more demand in the RRP due to the short duration and elevated returns on that short duration. They argue that there could be a total drain of $1 T from the banking system and that this year, deposits could decline overall. Then he makes the case that the rout in assets could continue as people compete to get cash and start asking for lower and lower prices to get that cash (draining liquidity leading to lower supply of cash).

The economy has clearly not gotten the memo yet - growth continues to be strong according to the Fed’s Beige Book released today, and based on recent job data.

This suggests that inflation will continue to be persistent for a while yet, and the Fed will have to do a lot more clubbing to get inflation under control.

From the Beige Book:

Job Data (summarized nicely in this tweet from Jim Bianco):

Here is a tweet by the person @EV1 posted about a month ago with the thesis of QT being offset by record high bank deposits and liquidity facilities from the Fed. It’s quite long (20+consecutive tweets) and I’ve only just skimmed it. From what I gather his theory is that the drain on liquidity by balance sheet roll off will be offset from record high bank deposits and the TGA account by the Treasury to inject liquidity into the market should they choose.

Anyways, it’s appears to be a well-thought out alternative to the bear thesis for the coming months.

https://twitter.com/dampedspring/status/1532006483826728960?s=11&t=Fsfq8-CURwFIf6OERS5Vyg

Very interesting read and useful to get a more rounded picture. Thank you for sharing! I think the main thing that concerns me is how will midterms affect the TGA and issuance. QT will be in full force by the time we get a real plan on spending (post-midterms) and will that seriously impact anything? Quote from an article from the person’s website:

We expect gridlock through the midterms and beyond to limit any real possibility of additional spending in 2022 over current forecast. However, we recognize that a bipartisan priority for Military, Domestic production, Energy Production, and alternative supply chain infrastructure spending could be a stimulus for more deficit spending and issuance. But the details of each of these things are so partisan that any agreement would be hard to contemplate prior to the midterms. Our assumption is that spending is fixed and has no net impact on issuance plans.

Is that a fair assumption? Find out next time on Dragon Ball Z

The strong dollar is catching up to company earnings:

After one year of gaining strength despite decades-high inflation and record numbers of supply, tumultuous markets, weakening financial conditions abroad, and uncertainty from things like War in Ukraine and COVID lockdowns continue to make the Dollar the safe haven for many investors, adding more fuel to the rally:

Not just MSFT, but all of tech/international business should be starting to feel the pain on their profits due to the Dollar’s strength:

And, further to this point, it’s not just MSFT feeling the pain with a strong dollar:

CRM took a hit on guidance from a strong dollar.

ABBV took a hit on guidance on a strong dollar, saying “At current rates, we expect foreign exchange to have a 1.5% unfavorable impact on sales growth.”

https://www.deere.com/assets/pdfs/common/news/deere-2q22-news-release.pdf

DE cutting guidance on a strong dollar citing “foreign currency exchange rates and their volatility, especially fluctuations in the value of the U.S. dollar” as concerns for their business.

What’s the problem with a strong dollar?

Excerpt from WSJ article:

“*A stronger national currency has benefits and drawbacks for the country that issues it. On the plus side, Americans are seeing their money go farther when they buy goods and services from overseas. Imports become cheaper. A cup of espresso in Paris or a bowl of noodles in Tokyo cost less, in dollar terms, than before.

On the other hand, the stronger dollar means that American products are less affordable to foreigners. That makes it harder for people from other countries to visit the U.S., hurting hotels and other tourist-dependent industries. By the same token, the dollar’s strength also cuts into international sales for all kinds of American businesses.*”

https://www.wsj.com/articles/how-a-strong-dollar-hits-microsoft-other-big-u-s-companies-11654196946

I think the dollar could become even stronger as QT goes on, with Sovereign Reserve Managers seeking safe haven in Treasury bonds start selling their local currencies and buying USD in order to purchase Treasury assets. From the person @macromicrodick linked above:

“The strength in the USD is likely to generate higher local economy exports which will once again challenge the Sovereign reserve manager to invest all of these USD Balance of Payments capital account inflows. For China who until very recently saw its currency even stronger than the USD wants to control its appreciation or even devalue for its stimulative effect locally it will need to print Yuan sell it for USD and buy UST. We think that dollar strength and CNY outperformance will result in increased demand for UST.”

Short Yuan, Short Yen, Long USD, America number one ![]()

Updated shit list Im playing this red day.

New names are:

AN

WE

DOCU

XHB

RIOT

Most are moving, watch out for reversal, take profits

This may be worth a read. https://www.zerohedge.com/commodities/oil-soars-markets-realize-what-opec-did

It shows Russia is reducing output quite drastically. BofA and JPM are bear and bull on this but one thing stands clear which is that Russia limiting the tap could mean higher chance for global recession.

Took profits across the board around this area except #an as I think that trade will evolve in the next few weeks. left runners on each ticker roughly 25% of original position with SL’s.

This Week in Macro

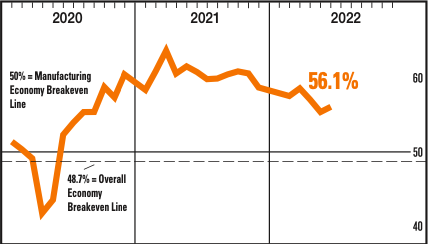

Manufacturing PMI Shows Unexpected Growth

https://www.ismworld.org/supply-management-news-and-reports/reports/ism-report-on-business/pmi/may/

Manufacturing grew in May, as the Manufacturing PMI® registered 56.1 percent, 0.7 percentage point higher than the April reading of 55.4 percent. The Manufacturing PMI® continued to indicate solid sector expansion and U.S. economic growth in May. Four of the five subindexes that directly factor into the Manufacturing PMI® were in growth territory. All of the six biggest manufacturing industries — Machinery; Computer & Electronic Products; Food, Beverage & Tobacco Products; Transportation Equipment; Petroleum & Coal Products; and Chemical Products — registered moderate-to-strong growth in May.

“The U.S. manufacturing sector remains in a demand-driven, supply chain-constrained environment," the ISM chair Timothy Fiore said in a statement. He noted that while the employment sub-index actually fell below 50, “companies improved their progress on addressing moderate-term labor shortages at all tiers of the supply chain.”

“Sentiment remained strongly optimistic regarding demand, with five positive growth comments for every cautious comment,” Fiore said, adding that companies still see “supply chain and pricing issues as their biggest concerns.”

New Orders minus Inventories, considered a leading indicator of the PMI, is starting to show weakness in recent months, suggesting either demand might be starting to weaken or inventories are building up fast. Is inflation peaking?

Private Payrolls Miss Expectations

https://adpemploymentreport.com/2022/May/NER/Report

U.S. private payrolls increased far less than expected in May, which would suggest demand for labor was starting to slow amid higher interest rates and tightening financial conditions, though job openings remain extremely high.

Private payrolls rose by 128,000 jobs last month, the ADP National Employment Report showed on Thursday. Data for April was revised down to show 202,000 jobs added instead of the initially reported 247,000. Economists had forecast private payrolls increasing by 300,000 jobs.

Jobs Report Friday Hints at a Cooling Labor Market

https://www.bls.gov/news.release/empsit.nr0.htm

Employers added 390,000 jobs in May, the slimmest gain in over a year, the Labor Department said Friday. The unemployment rate held steady at 3.6% as the number of people seeking work increased. Wages rose 0.3% from April, continuing a deceleration that—if it is sustained—could make Fed officials slightly less anxious about an overheating labor market.

Retailers, an outlier in the jobs report, cut staff in May as they struggled with bloated inventories and the squeeze from high inflation. Meanwhile, employers more broadly staffed up ahead of summer, including strong hiring at hotels, restaurants and entertainment venues. The retail sector shed 61,000 jobs in May.

The jobs report is unlikely to influence the debate on September rate hikes significantly because Fed officials have said they are more focused on monthly inflation readings right now and because there will be three more monthly employment reports to digest before the September meeting. To ease concerns about high inflation, Fed officials would like to see the pace of job growth slow, labor-force growth pick up and wage growth moderate.

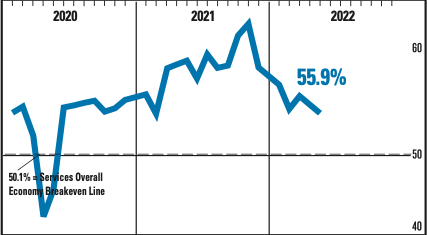

ISM Non-Manufacturing PMI Falls But Still in Growth Territory

Economic activity in the services sector grew in May for the 24th month in a row — with the Services PMI® registering 55.9 percent — say the nation’s purchasing and supply executives in the latest Services ISM® Report On Business®.

The Business Activity Index registered 54.5 percent, a decrease of 4.6 percentage points compared to the reading of 59.1 percent in April, and the New Orders Index figure of 57.6 percent is 3 percentage points higher than the April reading of 54.6 percent. The Prices Index dropped from the all-time high of 84.6 percent in April, decreasing 2.5 percentage points to 82.1 percent. Services businesses continue to struggle to replenish inventories, as the Inventories Index grew, but at a slower rate, registering 51 percent.

The 12-month average is 61.2 percent, which reflects consistently strong growth in the services sector. This month’s reading, however, is the lowest figure since February 2021, when the index also registered 55.9 percent. The May reading indicates the services sector grew for the 24th consecutive month.

Just FYI:

PMI usually leads EPS

Elon Cutting Tesla Staff by 10%

Tesla plans to cut around 10% of salaried jobs, Elon Musk said in an email to staff on Friday, according to people familiar with the matter.

The memo followed emails to staff earlier this week in which Mr. Musk told employees at Tesla and rocket company SpaceX they had to return to the office at least 40 hours a week or seek employment elsewhere.

The latest message about the potential job cuts appeared to clarify one Mr. Musk sent Thursday in which he linked staff reductions to what he called a “super bad feeling” about the economy.

Macro Releases Next Week:

Tuesday:

Trade Deficit: 8:30

Consumer Credit: 3:00

Friday:

CPI: 8:30

5-Year Inflation Expectations: 10:00

New Fed note about Balance Sheet reduction’s effects on economic policy came out yesterday.

The main point of the note seems to be that a reduction of $2.5 Trillion is equal to a FFR hike of about 50 bps, which seems really low but in line with what Fed Governor’s have been saying recently.

FED’S DALY: I SEE THE BALANCE SHEET TRIMMING DELIVERING ABOUT 25 BPS OR 50 BPS OF TIGHTENING.

FED’S WALLER: BALANCE-SHEET REDUCTION IS COMPARABLE TO 1.5 TO 2.5 25-BPS INTEREST RATE HIKES.

First a primer on the Fed’s tools and what they do:

“Policy rate actions and communications influence the economy by affecting the cost of short-term borrowing and expectations about the path of short-term interest rates. Balance sheet policies primarily influence the term premiums embedded in medium- to longer-term yields by changing the supply—current and expected—of longer-term securities held by the public.”

How does the model work?

The model manipulates nominal ten-year yields and reductions of Ten-Year bonds from the balance sheet and equating these manipulations to a certain raise in the FFR.

“The model implies that a one-time permanent reduction in the Federal Reserve’s holdings of 10-year equivalent Treasury securities equal to 1 percent of nominal GDP raises the term premium on a 10-year Treasury security by about 10 basis points, all else equal. In the model, this amount of policy tightening can also be achieved by raising the average expected path of the federal funds rate over the coming decade by about 10 basis points.”

The model uses three scenarios, a baseline, a no runoff scenario, and a full runoff scenario:

What I found interesting was that the difference in the economic impact between gradually increasing the amount of run-off per month (baseline scenario) and starting run-off at full capacity (full runoff) was relatively small.

What was also interesting was the relationship between the FFR and the Ten-Year term premiums/Yield Curve:

“The differences in policy rate paths across scenarios are roughly equal (but with an opposite sign) to the corresponding differences in 10-year term premiums. These offsetting effects on term premiums leave the 10-year real and nominal Treasury yields little changed. However, as the addendum to table 1 shows, there is no fixed relationship in the model between dollar reductions in the balance sheet at a point in time (or, alternatively, in terms of the peak-to-trough reduction) and offsetting changes in the federal funds rate.”

They make the case that runoff won’t have that big of an impact (50 bps after $2.5 Trillion while Fed is raising 50 bps in three consecutive meetings) because GDP has grown relative to the holdings:

”At the time of runoff, the macroeconomic effects of asset holdings may be reduced because these holdings form a smaller share of nominal GDP than when they were purchased.”

Of course, the model isn’t perfect. They say that things like communicating future policy rate changes and the reaction in markets that come with the signaling can’t be implemented into the model:

“In a similar vein, we emphasize that our analysis only features portfolio balance effects (as captured by the duration risk channel) and, thus, does not take account of other possible transmission channels, such as those associated with flow effects or with signaling of the intended course of the policy rate.”

And, of course, they hedge their bets by saying financial markets could struggle with the large amount of supply flooding the market from runoffs, and that yields could go higher than assumed:

“Notably, in the early months of the pandemic, asset purchases played an essential role in supporting smooth market functioning, an aspect not captured by the model. As policymakers turn to reducing asset holdings, market functioning and financial conditions are much improved, which, all else equal, could make the effects of asset reductions smaller than those of asset purchases. On the other hand, if financial markets were to find it difficult to absorb large amounts of runoff, then the effects on yields could be larger than we assume.”

Ultimately, no one knows what will happen from QT this size because it’s never happened, and they admit this themselves:

“Finally, we stress that there is significant uncertainty regarding the transmission of balance sheet and policy rate actions to medium- to longer-term interest rates, as well as the transmission of the resulting yield curve movements to the broader economy.”

TL:DR Fed is hopeful that the economy is strong enough to absorb the excess runoff and that it will result in some, but relatively minimal in my opinion, tightening.

Last week, Yellen acknowledged that she got it wrong about inflation being transitory/manageable/not a problem. It was the same day that she and JPow met Biden, who then came out to say that inflation was the nation’s #1 problem.

A few things seem to have happened here:

They may have also looked at the 10Y over the last month, and noticed how it had taken a precisely 0.5bps rate hike’s worth off the table. This seemed to primarily reflect the sentiment that the Fed would turn dovish at the first sign of economic difficulty.

Since then, after some more Fed chatter, it’s come back up 25 bps again, with a decent chunk on Friday after the jobs report, as the numbers were pretty decent.

Recounting all this to set the stage for the question: what does this mean in terms of what the Fed will do next?

Markets don’t seem to think Fed has the balls to keep tightening, Biden wants to show he can control inflation before midterms, Fed has taken the first step of addressing its credibility problem by acknowledging its mistake, and labor market is still pretty robust. (Please see earlier posts for various nuances on these summarized observations.)

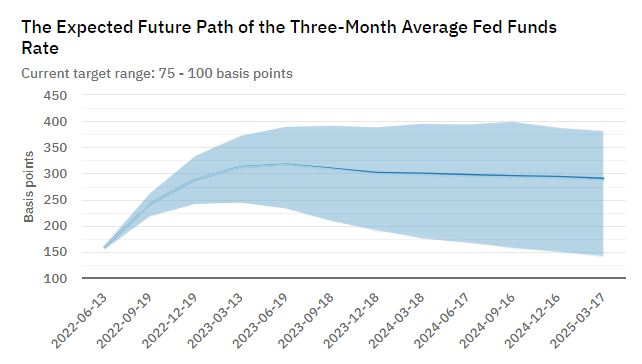

Btw the view of the markets for the 3-mo fed fund rate is below - check that lower bound, where rates getting capped at 2.5% is seen as a real possibility:

So… based on this past week’s events, it seems that it is much more likely now that the Fed will be more hawkish than expected and keep clubbing, because of political pressure, the need to restore their credibility (now that there has been a mea culpa), and because a stubborn labor market affords it to do so. Maybe even past the point where it’s clear that adequate demand destruction has taken place, just to be sure.

This may mean 50bps rate hikes right into the end of the year. A total 2.5% worth on top of where we are now (75-100 bps).

Let’s see if the Fed telegraphs any of this on Wed’s FOMC (6/15).

Glad to have Valhalla’s resident wizard back in action after traveling all over. Appreciate your perspective as always @The_Ni.

I agree with your take on the feds current situation and I want to add a chart to the thread to help illustrate the fed funds rate historically.

This chart shows us the fed funds rate (blue line), balance sheet (red line), and recessions (gray columns) going back the last 5 decades.

Now, you will notice a few patterns in the last 50 years.

First, every hiking cycle has always led to a recession**, immediately followed by the fed cutting rates to help ease financial markets.** One of only two mandates the federal reserve recieves from our federal government. The other is controlling inflation…

The next thing you will notice is that only once has the fed funds rate gone higher than the previous tightening cycles peak rate. You will see this on the chart in the mid 70’s into the early 80’s. This is due to the then fed chair Paul Volcker taking extreme measures to combat runaway inflation.

As mentioned above, everytime the economy has gone into a recession, the federal reserve pivots their monetary policy to be more accommodating, thus lowering interest rates and recently (08), starting Quantitative Easing.

If you look back to the thread inflation leading to stagflation, there are charts that compare the S&P 500 to the fed funds rate. Equities generally move as you would expect in relationship to monetary policy. But this time is a much different ball game.

As bad as 2000 and 2008 were, in the past the fed had “cushion” in the fed funds rate, meaning they had the luxury of significantly cutting rates to help the economy during the recessions.

Today is uniquely different because if we do get a recession, we do not have the same cushion. In 2000 fed funds rate peaked around 6.5% then were cut to roughly 1.5% by 2001. In 2008, fed funds rate peaked around 5% then were cut to near 0% by 2009 with QE.

So if we were handed a recession this year, it would be significantly more challenging for the fed to step in to help. What would they do with their balance sheet? What would they do with rates? Wildly ironic isnt it?

But unfortunately inflation always makes things worse. We are already in stagflation, and make no mistake, stagflation is not a better alternative to a recession because stagflation has always lead to a recession, but first, prolonged suffering.

So here are the 3 possible outcomes I see.

#1 - The economy continues to slow into a recession. Stock market capitulates, demand is crushed, unemployed rises, and inflation cools off. The fed will then have to figure out how to help with a 9 trillion balance sheet and rates sub 3%.

#2 - Inflation stays elevated, bussinesses and Americans alike continue to face higher expenses, Americans continue to have less discretionary income, ER’s continue to look weaker and the fed has to take more extreme measures to bring inflation down. They raise rates high and fast, Stock market capitulates, demand is crushed, unemployed rises, and inflation cools off. The fed has more “cushion” in this scinerio, but now a much more severe financial crisis.

#3 - The fed achieves a “soft landing” meaning through their dialog and tightening, all demand and markets around the world decline just enough to cool off global inflation but not enough to cause a global recession. Scarce commodities such as oil, wheat, or lithium becomes abundant. Supply chain issues subside, real wages increase, consumer confidence improves, and geopolitical tensions disappear.

My trades reflect 1 or 2.

Same story, wait and see what the fed says and does. However, as anticipated, inflation has gone mainstream. It is loud, in everyones face, and everyone is talking about it. Now that American’s are starting to feel the real pain that inflation brings, buying behaviors are changing, and it is buying behaviors that cause recessions. Its easier to pay attention to and believe the fed when things still feel normal. But as things turn south, all credibility is lost. Then what?

Man, you have been killing it with these posts.

I appreciate it @juangomez053