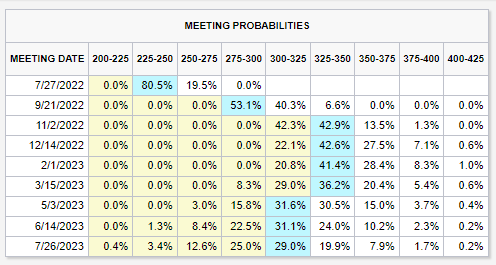

Incidentally, here are the updated rate probabilities from just 11 days ago - we’ve priced away 50bps of rate cuts for December compared to then.

(Source: CME)

The market is basically betting that the Fed must pivot, irrespective of what they are saying right now. I.e. Fed’s words have very little credibility with market participants. So it’ll probably ignore anything JPow or his lieutenants say on and after FOMC.

How likely is it that the Fed will stop after two 50 bps hikes, after the 75 bps one in a few days? It really depends on whether we think the Fed will ease up because the economy is hurting (as @TheHouse notes above), even though inflation is not under control. We have discussed the prospect of stagflation at some length already; I suppose what surprises me is how much the market is leaning toward the Fed pumping the economy quickly (the “Fed Put”), ignoring inflation pains.