First, for FOMC minutes, I posted a thread with detailed charts of the day from all FOMC minutes this year: Charting the FOMC Minutes Days

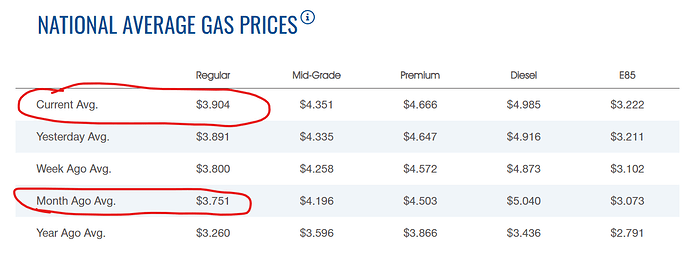

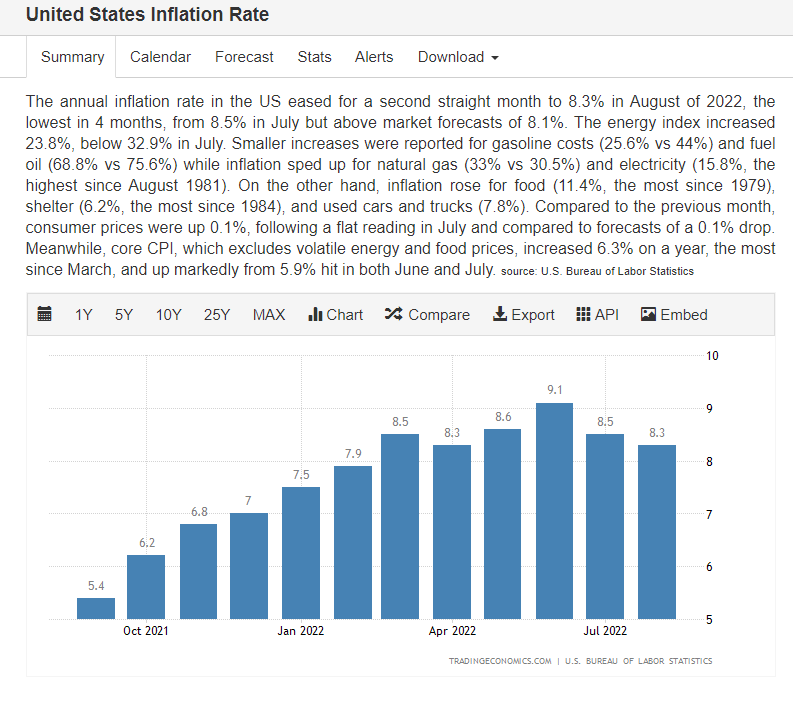

I think we could possibly see headline CPI drop simply due to the dip in gas prices last month. But all signs are pointing to oil prices going back up and it’s going to be a real back & forth struggle between tight supply and demand destruction. Food prices continue to go up that I’ve seen at the store. (Shocking, I know…)

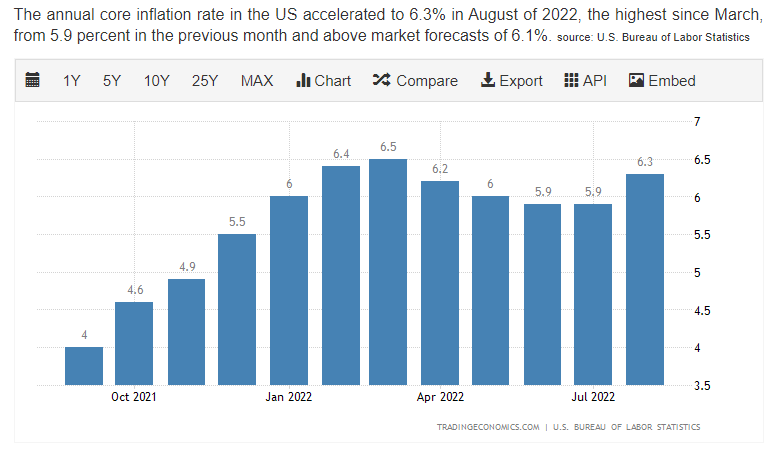

Unless something magical happens, I don’t see CORE dropping any, everything is becoming too entrenched simply because we haven’t seen any real demand destruction yet and has been pointed out employment is still running way stronger than anticipated. I feel like companies think they can outlast the fed and expect a pivot soon so nobody wants to lay off any significant amount of workers.

As we also seen from CORE CPI, a single monthly drop does not a trend make, so even if we go down a hair this month I’m still not holding my breath until we see continued improvements for multiple months. (MoM last time went up from 0.5% to 0.6%).

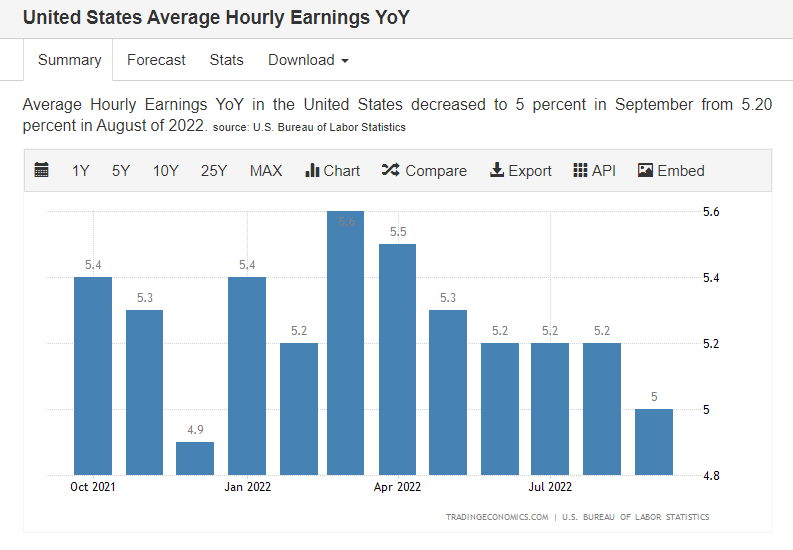

Let’s also talk about Friday’s wage number. While inflation is still up above 8%, workers are only seeing a 5% increase in pay. So in reality they are taking a 3% pay cut simply due to inflation. As long as those numbers are inverted we are slowly chipping away at the middle class. THIS IS THE MOST DANGEROUS ASPECT TO PROLONGED PERIODS OF HIGH INFLATION. You will end up pushing more people into poverty simply because there is no way wage growth will be able to keep up as you will be fighting a cycle of everything going up. The fed has to break the cycle now.

I also agree that we are likely to see strong earnings from this past quarter, simply because we didn’t see the demand destruction that everyone was hoping for. It’s going to boil down to forward guidance and even then last earnings there were plenty of misses and bad guidance yet stocks were going up because people thought they were buying the dip because the bottom was near.

Honestly to me, all signs point to the Fed continuing their path and probably aiming to push rates even higher simply because things are not easing up as was expected / projected. With everyone trying to fight the fed thinking they will give up and flinch first, the soft landing everyone was hoping for is now looking like it’s going to be a mile long train wreck. Keep in mind, before 2008 crash we were at 6.25% fed fund rate and everyone was happy. Since then the market got used to interest free loans, and now that era is coming to an end.