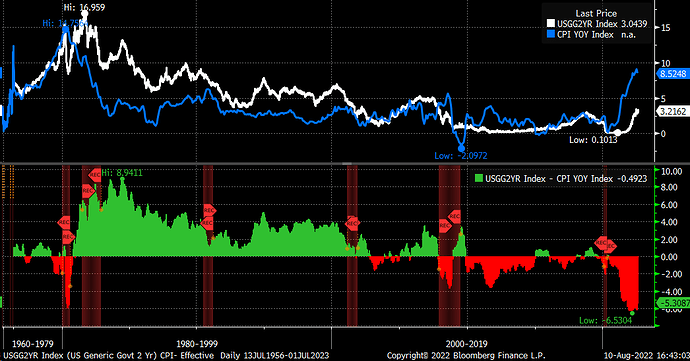

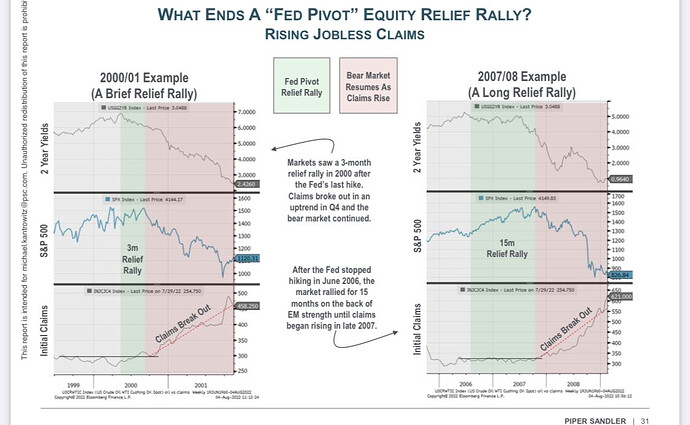

Thanks for the input guys, something that I have been thinking about aswell that the Mav pointed out is the psychology of the fed. Throughout this year we have seen the fed play “good cop, bad cop” depending on how the market has reacted to new data and their policy decisions. Something that Bernanke talked about in the video I posted a few weeks ago.

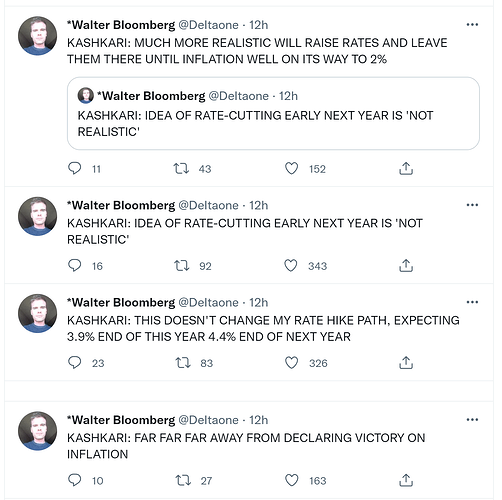

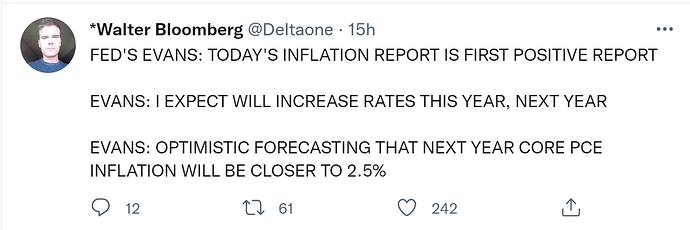

This is how they have been guiding the market to try to achieve their “soft landing” on the equities side of things. Not too hot, not too cold. However, I don’t recall such a blatant disregard for their perspective happening like we saw yesterday. Typically when things have moved too hot, the fed will send out a few presidents and they will cool things off by saying some hawkish statements.

“I think anything is on the table for next fomc meeting”

“I think we need to be more aggressive with persistent inflation”

“I support a larger rate hike at next fomc” etc.

Then the market reacts and they send out the dovish tone.

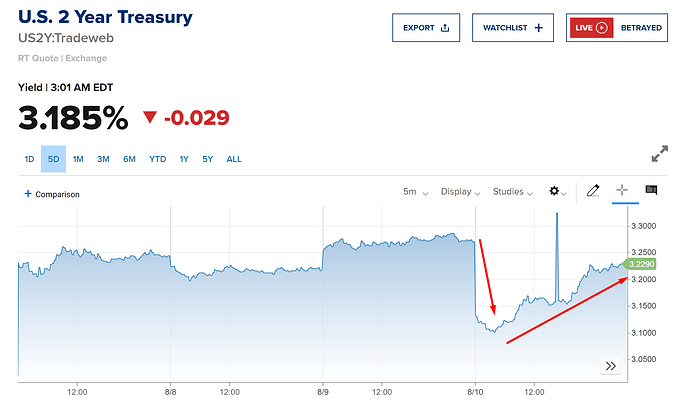

But the market did not react to their statements at all yesterday, and the market actually continued to go up. This could be a new problem for the fed and it is completely due to them giving weak guidance and flip flopping their tone all year. The market is basically saying, sure keep doing and saying whatever you want, inflation has peaked and you will pivot, onward to new all time highs!

This of course will ultimately lead to a lot more pain as the fed continues to raise rates with QT in a weak economic environment, but if credibility thus their ability to shift the markets perception is lost, how will equities trade?

Id imagine we see much bigger swings, euphoric cocaine fueled rallies with deeper more violent declines.

Should make for some great trading.

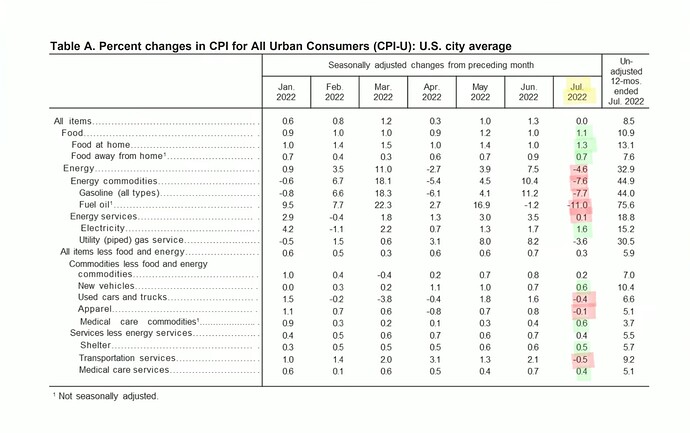

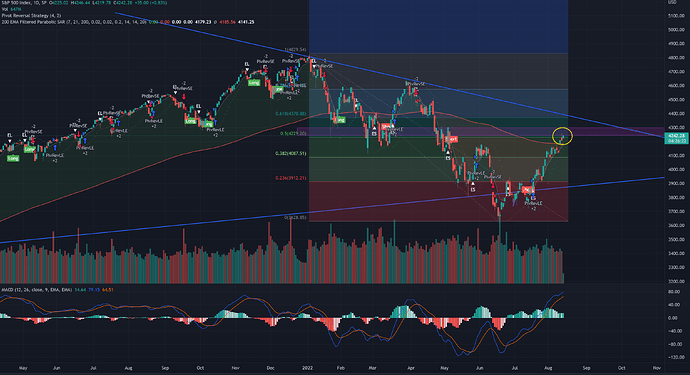

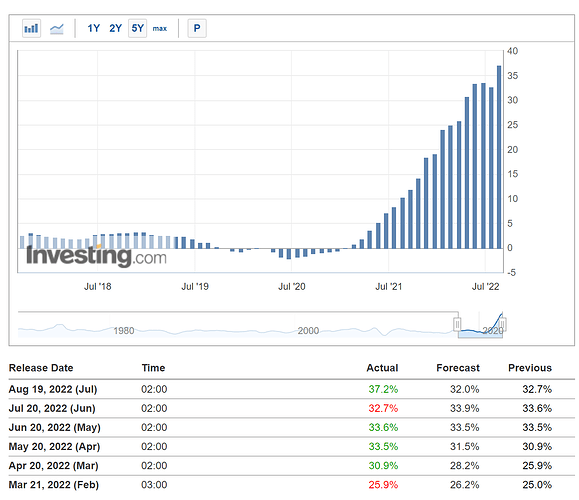

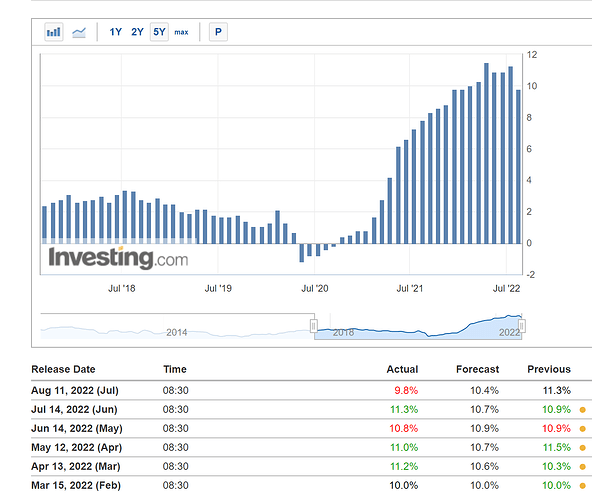

I also want to throw out some perspective on this last CPI print yesterday for anyone reading this.

I was on the wrong side of this trade, I received a fresh pie in the face. Not a huge deal, Im up nicely on the week. However, this was a pre market data drop that I believed would move the market in a big way. 2%+ one direction or the another. If I wanted real exposure to this news I needed to hold positions overnight. I believe for whatever reason this has become the boogeyman. I get it, it isnt for everyone based on your trading strategy and risk tolerance but lets remember their are many different trading strategies, and many ways to think about risk.

I’m really not interested in only speculation before and after news drops. I’m here to trade, I honestly could care less if people “got it right” but didn’t trade it, or even worse, share after the market moves how they “knew” it would happen but they haven’t said anything publicly leading up to the event and had no positions.

Right or wrong my thoughts and positions are in the open for everyone to see, I intend to trade major events that move markets. Im going to be right sometimes and wrong sometimes, just like everyone else.

As MacroAlf says “If you want to know how someone thinks about the market, don’t ask for their opinion, ask to see their positions”

Ill be playing the trend (yes calls if that’s what’s on the menu) until we see a reversal. One of the easiest ways to lose money is to try to time a reversal perfectly. As I have said before, you don’t have to catch the first candle or even the first day. I’m looking forward to seeing how everyone is playing this volatility.

Hope everyone has a great day