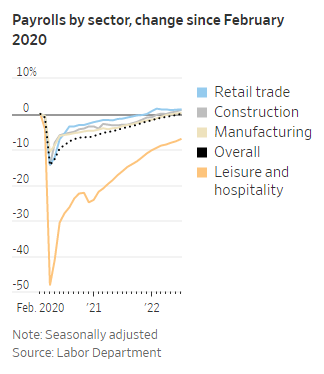

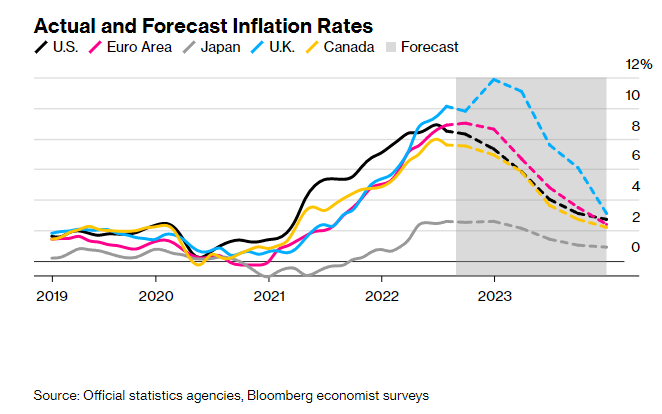

So, after rewatching J Pow’s speech at Jackson Hole and also reading the transcript carefully. It seems that the market is finally believing that the fed is going to keep raising rates, and hold them there until inflation comes back down to around 2%.

Let’s examine some data…

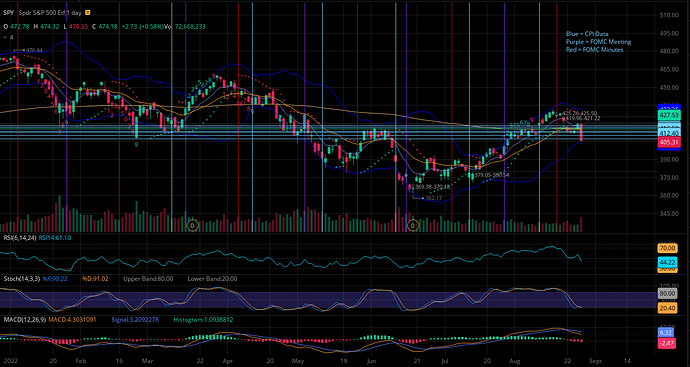

SPY for 2022 with CPI data, FOMC meetings (rate hike day), and FOMC Minutes dates:

Sorry for all the horizontal lines, those are my support/resistance and I didn’t want to delete them.

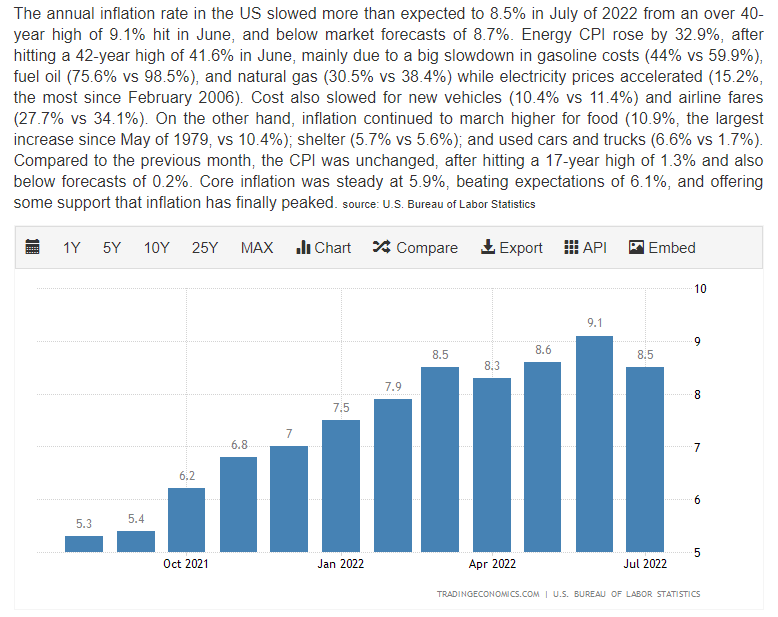

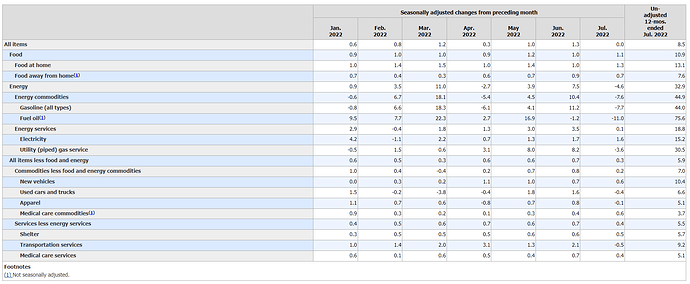

Now let’s take a look at CPI, keep in mind the time lag (July data is released in August):

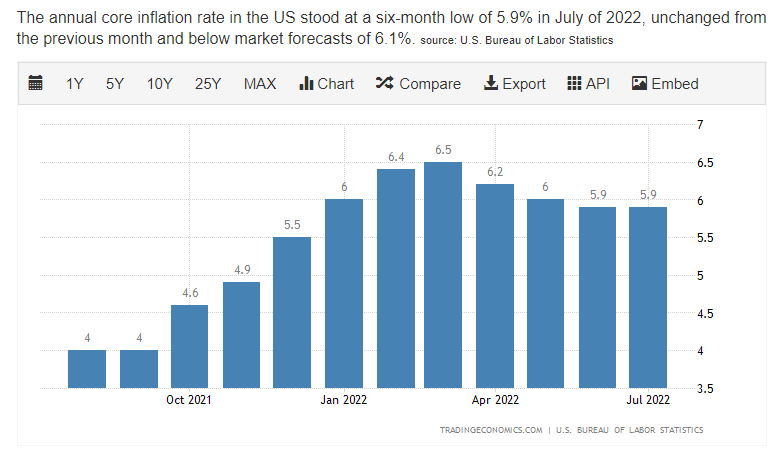

Also here is CORE inflation for reference:

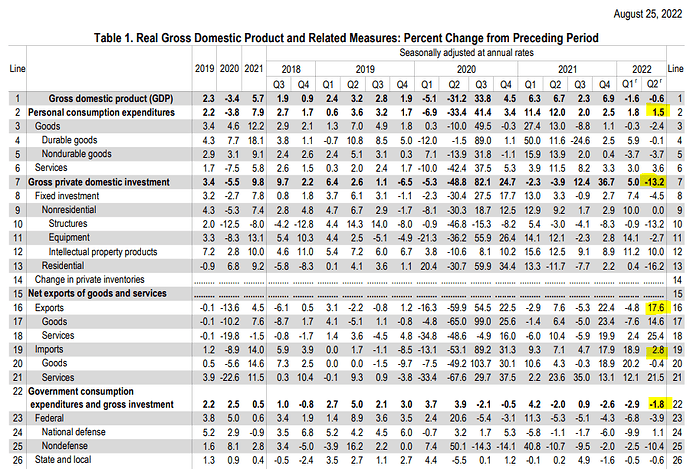

Let’s start with the blue line on 3/10 which was CPI data for February. Inflation has been creeping up and is now at 7.9% (Core 6.4%), the fed realizing this is not transitory. A few days later, the purple line on 3/16 was the Fed meeting where they hiked the rate a modest 25bps (discount rate now at 50bps, the first increase since they slashed the rates back in march 2020 cuz of COVID). The market thinks this isn’t bad, a little rate increase and all will return to normal eventually, let’s fucking RIP!

4/6 on the red line is the FOMC minutes, the market likely finally got the first glance that the fed was starting to show concern about high inflation, but no big deal yet, everything will be okay.

The comes the blue line on 4/12 with the next CPI release for March data. It came in at 8.5%, up 0.6% from previous month (Core 6.5%, up 0.1%). Market held for a couple days then was like “oh shit this is bad inflation is still going up” and started a downtrend.

Now the purple line on 5/4 was the next Fed rate hike, a whopping 50bps, biggest single rate hike since May 2000! J Pow means business and the market spiked that day, then was like, WTF raising rates is bad for stonks, and dumped the next day and started a downtrend to the next CPI data.

Now on 5/11 we had April’s CPI data of 8.3% (Core 6.2%)… could inflation have peaked? Maybe? Just maybe? Market becomes cautiously optimistic trading sideways until…

5/25 red line is FOMC minutes, and apparently the market took whatever was in there thinking things weren’t that bad, maybe inflation did peak, so the market went up a little, then started to trade sideways.

Next CPI was the blue line on 6/10, the market pulled back a couple days before, likely de-risking just incase inflation didn’t peak. So the May data showed 8.6%, or an increase of 0.3% from previous month, and a new high. But Core inflation dropped to 6.0%! Gas and food prices have been skyrocketing with no end in sight! Uh oh, fear and panic, this is BAD! Market shits itself hard!

A week later on 6/15 we have the purple line with the FOMC rate hike, a new whopper of 75bps! Now the biggest single rate hike since 1994!!! J Pow means business and they are gonna nip things in the bud! The market was happy that day and went green. But then the next couple days it tanked… oh yeah these rate hikes are bad for business! Market bottoms at 362.17 (OUCH!)

Now over the weekend the market got to thinking, maybe this last 75bps (for a total discount rate of 1.75%) is a good thing, it’s gonna fight inflation bringing prices down and stonks gonna go up! Gas prices finally peaked back on 6/14, and diesel on 6/19. Maybe things finally topped out? So the market started a slow climb with a lot of volatile dates of uncertainty.

So now we are at 7/6 with the red line for FOMC minutes. Seems that J Pow has got it under control, let’s just chill and see what next CPI data is like in a few days.

7/13 is next CPI data for June. ARE YOU KIDDING IT’S 9.1%?!?!?! Core did manage to decrease another 0.1% to 5.9%, so there’s that. Oh don’t worry, Pappa Biden says this is all just temporary due to “Putin’s Price Hike” and he’s doing all he can to bring down gas & food prices post haste! Don’t worry, it’s all transitory, just ignore gas & food, CORE inflation went down!!! Market believes what Biden is shoveling, and says stonks only go up!

Now on 7/27 the purple line is the next FOMC meeting. Another 75bps banger! We are now at a discount rate of 2.50%. Unanimous vote, the Fed means business! J Pow and crew feel confident they can get inflation under control, gas prices have been dropping from the mid-June peak, food prices are still up there though. Market thinks the worst is behind, and continues on its roaring comeback! RISE! RISE! RISE!

8/10 comes rolling around with the blue line showing July CPI data. Everyone is expecting good numbers, cuz after all gas has been going down, right? HALLELUJAH it dropped to 8.5%, but oh wait Core is being stubborn still at 5.9%. Biden says, “FORGET ALL THOSE SILLY NUMBERS, ALL YOU NEED TO KNOW IS WE HAD ZERO INFLATION IN JULY, ZERO!!!” And the market bought it, and continued to run like Forrest Gump.

Day before FOMC minutes on 8/16 the market makes a recent peak of 431.73. Apple hit a new recent high of 176.15, being a mere $6.00 away from its all-time high!!!

8/17 and we get the latest FOMC minutes. Nothing to see here people, same old Fed talk, gonna fight inflation. Market thinks fed is going to go soft now that inflation is easing up (even though it’s really not) and maybe not even have to hike rates so much, some even think they might do an about-face and LOWER rates before the end of the year or early next year (HAHAHAHA!).

Market held up for one more day, then decided to cool off a little. Maybe it was the minutes, maybe it was just technical from going overbought on the daily RSI, maybe it was a little de-risking with the Jackson Hole conference coming up.

8/26 and we get Jerome Powell giving a now infamous 10 minute speech at the Jackson Hole conference with all the global central bankers. He re-iterates the feds commitment to bringing inflation down to 2% and that means continuing to RAISE RATES AND HOLD THEM THERE AS LONG AS NECESSARY to prevent inflation from becoming entrenched in our economy like what happened in the 70’s. One single month of CPI data was not nearly enough to convince the fed of a trend, he said it will take several months of clear data. The market finally got the hint, went oh shit J Pow means business and this is gonna suck Yong’s balls because supply is so tight and demand is still red hot. And SPY decided to shit $14.20 during market, and another $1.46 AH to end up at 403.85. Two solid weeks of the market running up in ignorance and stupidity, was wiped out in a single day.

So now that brings us up to today, 8/27, the day after. Where does the market go from here? That’s honestly a great question. On one hand, the market has a VERY short memory so it might find that secret stash of cocaine and decide next week we gonna party like an 80’s action flick and forget all our problems. On the other hand it seems maybe it’s gonna cool its jets a little with the realization the party is over, the pain train is coming, and people better buckle in cuz it’s gonna get bumpy.

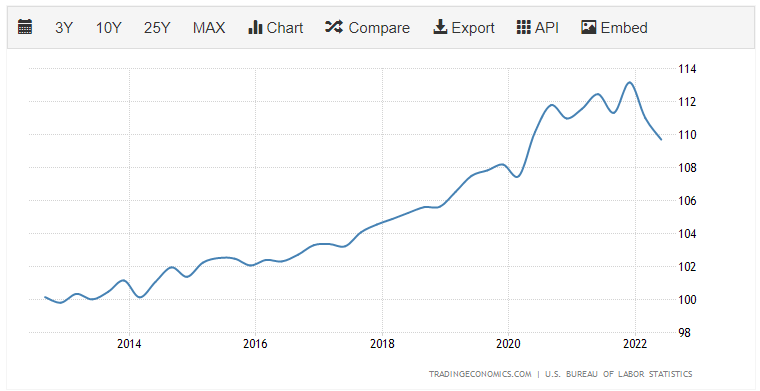

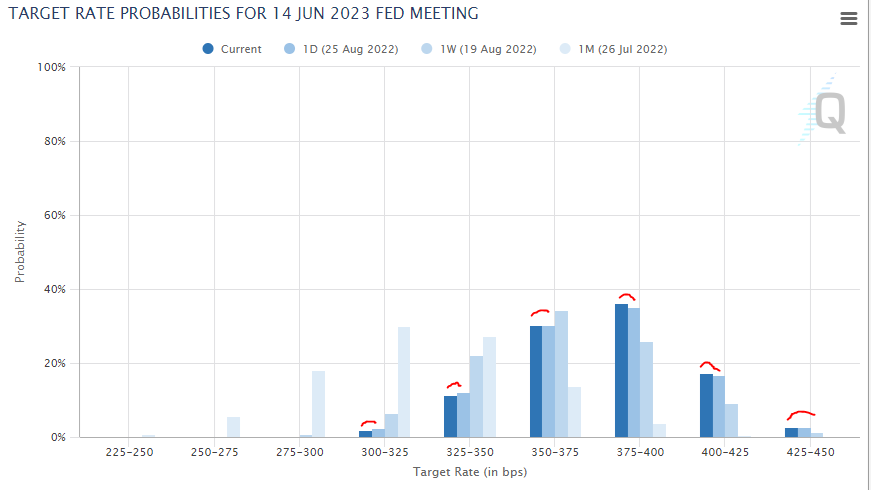

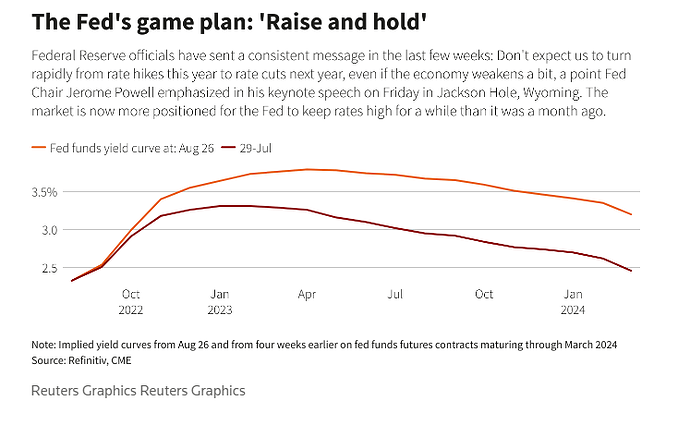

Even Reuters is finally getting on board. One could argue that the Fed never changed their target rate or time-frame, I kept seeing the same info every FOMC minutes drop. I guess people just didn’t believe them. You can see in the chart below that the “fed funds futures contracts maturing through march 2024” are now taking into account a higher rate over a longer period of time. This is the smoking gun of why the market dropped yesterday, the market finally capitulated that the fed means business and the rate hikes and beatings will continue until morale improves!

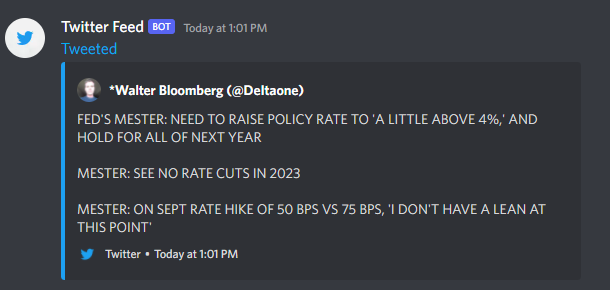

Quite frankly, I still think this chart is still a smidge low and I believe the Fed is going to push 4% to maybe even 4.25% at its peak due to global conditions that will continue to keep energy & food supplies tight through 2023.

Why do I think that even this chart is underestimating necessary rates? First, BECAUSE I LISTEN TO WHAT THE FUCKING FED HAS BEEN SAYING FOR MONTHS! Take the tweet below. All the fed people have been talking a MINIMUM of 4% target, all have said they are going to diamondhand that rate through 2023 because if they don’t they KNOW inflation will simply reverse course and start coming back up. The chart above showing the futures traders still are not completely on board. I guess ignorance is bliss.

Other reasons… first, crop yields are looking very challenging globally due to major drought and extreme heat conditions. The Russia/Ukraine was has already caused a shortage due to so many countries in that region dependent on Ukraine grain. The war has also sent fertilizer prices sky high, many farmers did not use as much fertilizer (or switched to other crops that didn’t need as much) which will further reduce yields on top of the drought conditions. If fertilizer and diesel prices are still sky high come planting season in 2023 we could see even higher food prices. I won’t even get into the conservation schemes some countries are trying to get their farmers to participate in instead of growing crops.

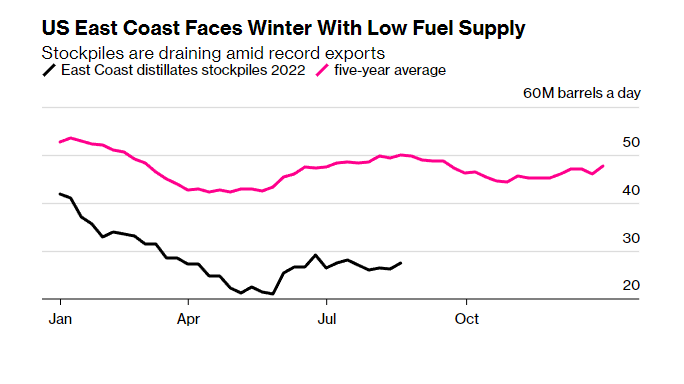

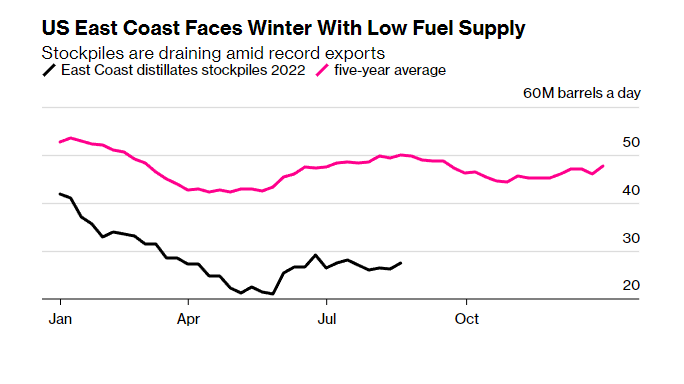

Second, energy supply & demand. We’ve recently seen that OPEC is still unable to meet recent quotas, but to add more insult to injury they are talking about CUTTING production to keep prices up if an Iran deal is made and their oil makes it to the market. “The impression remains that Saudi Arabia is not willing to tolerate any price slide below $90.” In the US, Biden’s emergency SPR release will also end on October 31st. Supplies in the US are obviously not where they need to be, and with Europe willing to pay a premium prices are going to be going up this winter.

I just noticed that Diesel prices went up over 20-cents in the past week here. I think gas prices jumped the same amount too.

Interesting Bloomberg Article: New York Fuel Supply Is So Low It Triggered White House Warning

The New York area is running so low on fuel that the Biden administration is warning of government action to address exports and suppliers are resorting to expensive US tankers to restock the region.

As US fuel demand soars, market forces alone may fulfill the Biden administration’s wish to curb exports. Domestic diesel consumption rises at this time of year, drawing down stockpiles, as Midwest farmers snap up supply to power machines that harvest crops. The approach of summer in South America, the largest overseas buyer of US diesel, means rising hydropower generation will potentially trim the region’s need for US fuel.

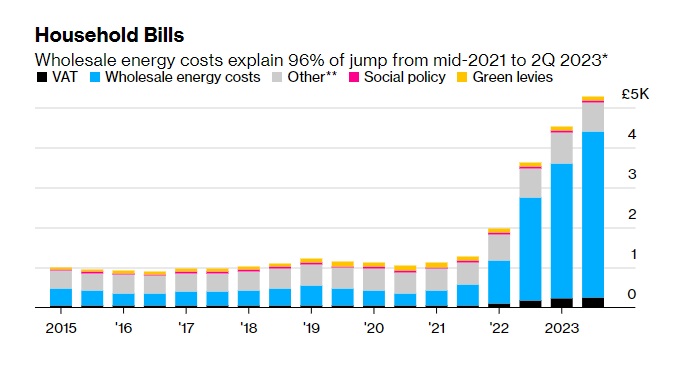

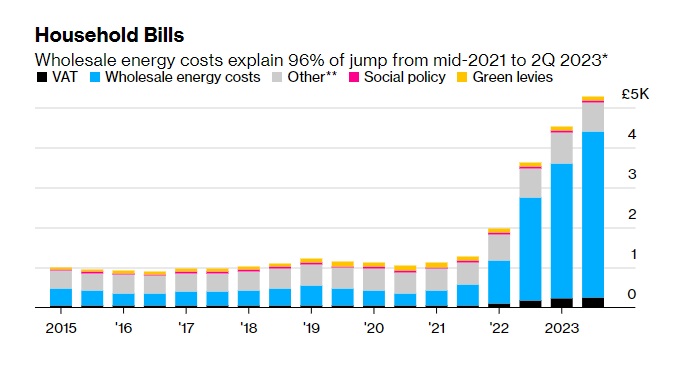

Europe’s energy prices have SKYROCKETED and with future uncertainty with Russia who knows where they can go. Check the chart below, not only are these energy prices unsustainable for residential consumers, businesses will be unable to operate and likely will be forced to shutdown!

Okay, I think I’ve ranted enough and probably got a little off topic… So what’s the next big factors the market is bracing for?

September 13, 2022 - August CPI report

September 21, 2022 - Next Fed Rate Hike (50-75bps expected) & J Pow press conference

Some source data: