Interesting article about one of the biggest bears around and what he is saying:

In almost Shakespearean fashion, perma-bear and well-known pessimist Jeremy Grantham said the markets are in a superbubble in a Wednesday note, and warned of significant turmoil ahead.

What is a superbubble? Well, let’s get into it.

A typical bubble occurs when prices grow quickly while investors ignore serious hazards, which eventually causes the bubble to burst and subsequently prices to fall. In those typical situations, indexes increase to two standard deviations over the most recent price average.

Grantham says the number increases to 2.5 or more in a superbubble. When stocks recovered from their early pandemic lows, the market was at that point in 2021.

“Only a few market events in an investor’s career really matter, and among the most important of all are superbubbles,” Grantham said. “These superbubbles are events unlike any others: while there are only a few in history for investors to study, they have clear features in common.”

One of those characteristics is the bear market bounce that occurs during the initial derating stage of the collapse but before the economy has demonstrably started to worsen, as it typically does when superbubbles deflate.

“Prepare for an epic finale — If history repeats, the play will once again be a tragedy. We must hope this time for a minor one,” the GMO CEO said.

The History Of Superbubbles: Of course, the lifelong pessimist is alluding to the great financial declines of 1929, 1973 and 2000. In each decline, the market recovered about half of its losses before freefalling to new lows.

In each of the previous three instances, a bear rally helped to recover more than half of the market’s initial losses, drawing naive investors back just as the market began to decline once more.

The rally this summer has been a perfect fit for the pattern.

From the November low in 1929 to the April 1930 high, the market rallied 46% — a 55% recovery of the loss from the peak.

In 1973, the summer rally after the initial decline recovered 59% of the S&P 500’s (NYSE:SPY) total loss from the high.

In 2000, the tech bubble, the Nasdaq recovered 60% of its initial losses in just two months.

In 2022, at the intraday peak Aug. 16, the S&P had made back 58% of its losses since its June low.

“Thus we could say the current event, so far, is looking eerily similar to these other historic superbubbles,” Grantham said.

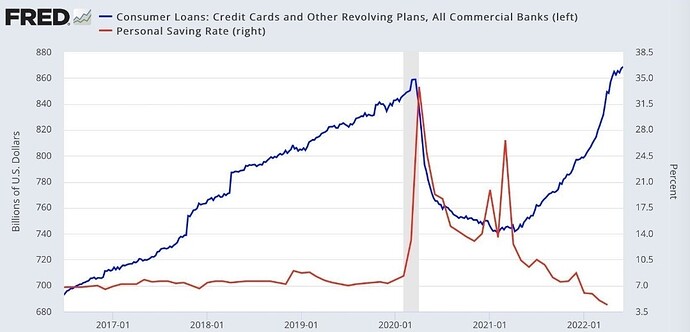

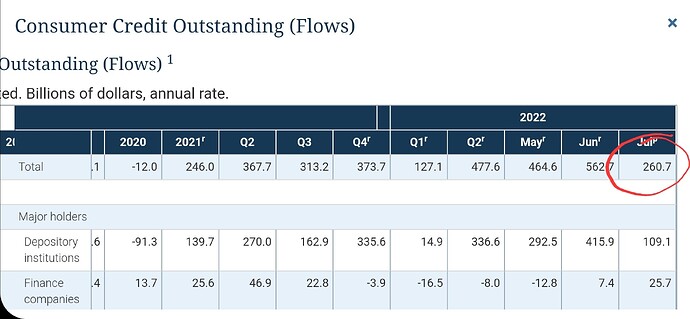

The Last Word: The three main asset classes — housing, equities and bonds — were all severely historically overpriced at the end of last year, according to Grantham, making the present superbubble the most perilous combination of elements that caused past superbubbles.

“Given all these negative factors, it is unsurprising that consumer and business confidence measures are testing historic lows,” he wrote. “And in the tech sector, the leading edge of the U.S. (and global) economy, hiring is slowing, layoffs are rising and CEOs are increasingly bracing for recession.”