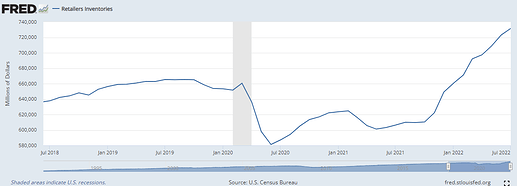

I read this on twitter the other day, and started googling around for FEDEX indicator and had seen some old articles referencing it. Figure I’d include the guys thread, and after seeing the violent reaction that FDX brought to the markets (granted vix was high on a green spy day prior to the drop as well, which seems like it was going to be explosive up or down), I think there is some merit to the idea, albeit a different market environment today with QT going full blast this month…

This is from TheShortBear on twitter, I can link him if you want, seems like an insightful fellow

$FDX earnings and its meaning for the FED.

Let us go back in history.

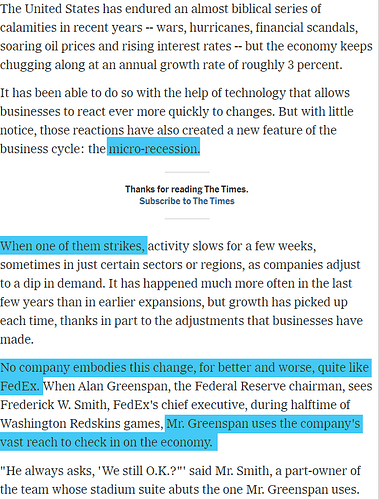

Alan Greenspan

Mr.Greenspan was the 13th Chair of the Federal Reserve

In office. He served from August 11, 1987 – January 31, 2006.

20y of experience.

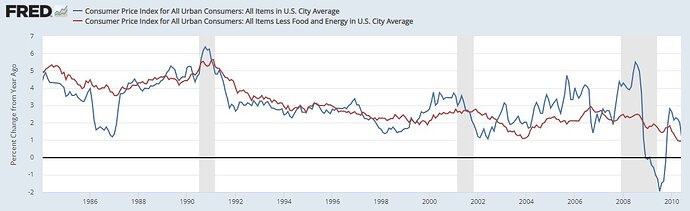

He managed to keep the inflation in check under 6% during the 20y he served as chair.

Which tools did he use?

The FedEx indicator.

The FedEx indicator is based on an easy idea.

Most items need to be shipped, thus demand is reflected by the shipping rate and general earnings quality of the shipping company.

Mr.Greenspan’s policies were directly reflecting within shipping.

The FED has one major tool to influence the economy. Demand support or tightening to keep inflation in check.

He used FedEx as a gauge to analyze the impact of his policies which he got right from the source.

FedEx used to be Federal Express.

Now that we know FedEx is a tool to analyze demand, how can we use it?

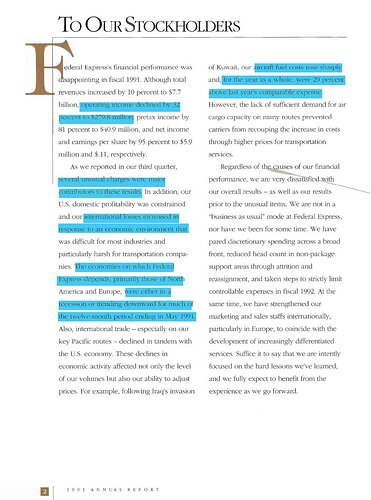

Let us look at the earnings for the highest inflation rate within his tenure, 1991.

Federal Express 1991 earnings, CPI is at 6% and topping.

•10% increase in revenue

•32% decline in income

•Fuel cost increased 29% over the last year

•International and domestic demand decline

The CPI declined and did not come back for 20y

earnings: Earnings Report

Let us compare to today.

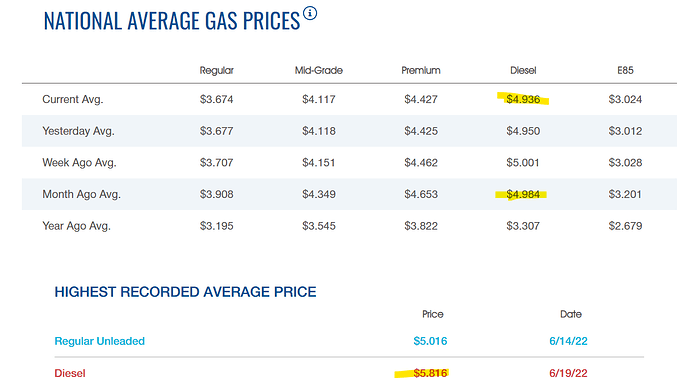

FedEx 2022 earnings, CPI is at 8.3% and topping.

•5% revenue increase

•19% loss in income

‘FedEx highlighted a 30% increase to their margins as a result of passing through fuel surcharges to the U.S. consumer’

Incredibly similar statements in a similar inflationary environment.

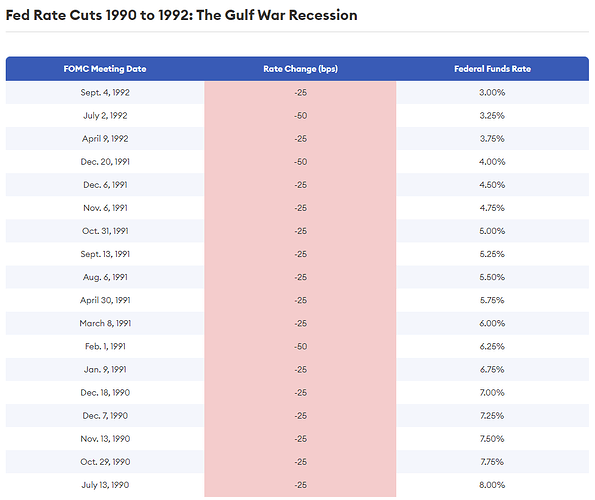

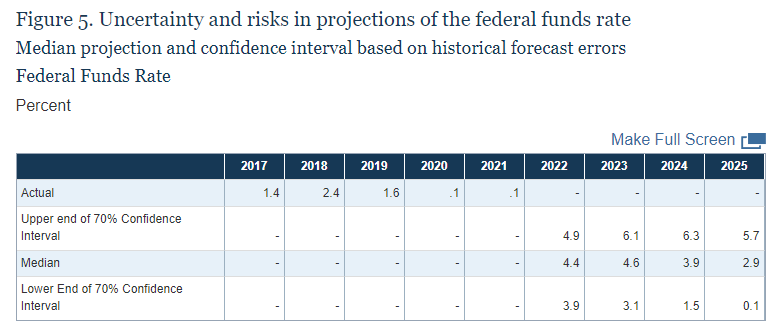

Where were we within the rate cycle?

We cut rates continually by 25bps and once by 50bps in February 1991 and December 1991.

Look at the date of the annual date above.

How did the market react?

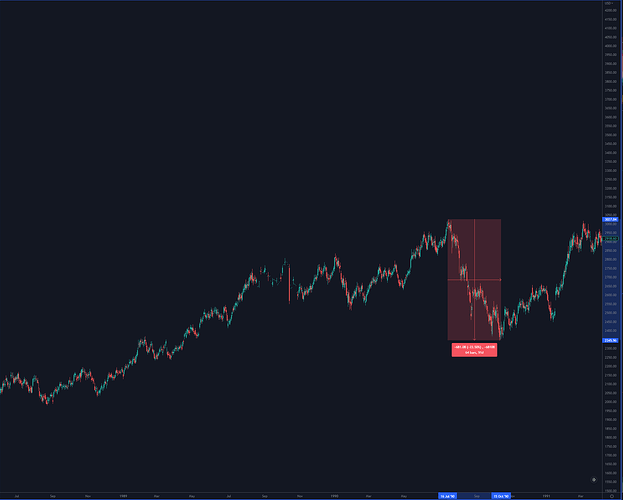

The Dow Jones corrected 22% and bottomed out.

See any similarities?

All in all the FedEx indicator is a tool we can use to gauge demand.

1991 was a very similar situation.

As the demand dropped, the FED backed off, despite 6% inflation. The FedEx earnings gave an accurate representation of demand and inflation.

We prospered for the next 20y.