Just want add some quick thoughts on the CS situation. This has potential to be a pretty big event depending on the validity of the CDS speculation.

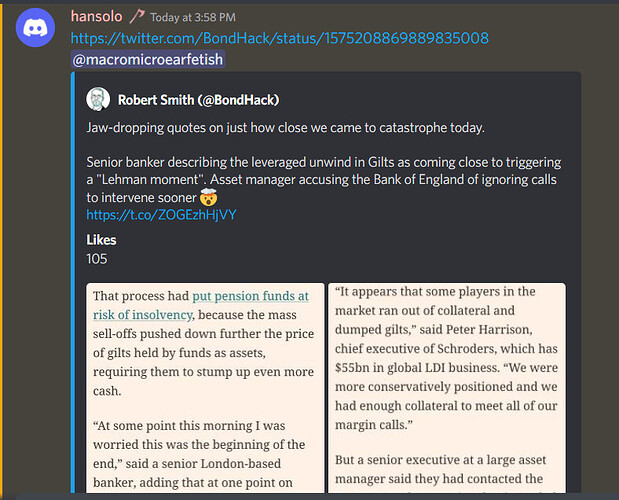

CS is unbelievably over leveraged and this speculation comes just after the BOE intervention. The BOE intervention was triggered by a massive margin call tied to fixed income. Most of these pension funds have borrowed money to invest as rates allowed them to do so and still collect yield. The problem is bonds have continued to get slaughtered at a level only seen one other time in history, 76 years ago during World War II.

When fixed income is getting margin calls that requires an intervention from a central bank we should all pause. We have spent the last 10 years fine tuning globalization. Trade, resources, financial markets, etc. We are all intertwined in ways previous generations never thought would be possible. This includes financial markets.

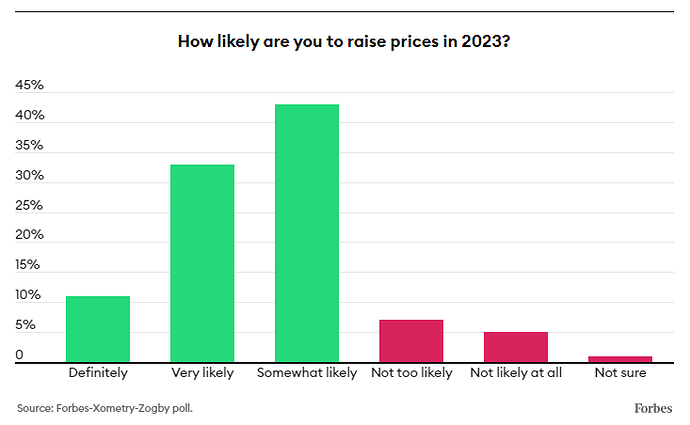

This is all to say, we need to be paying close attention to these things.

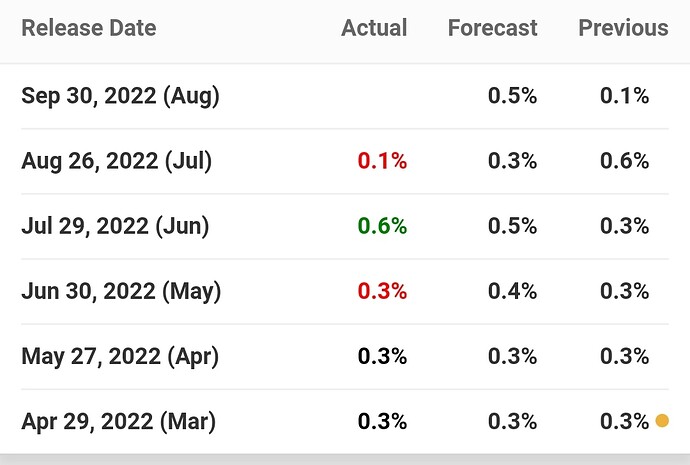

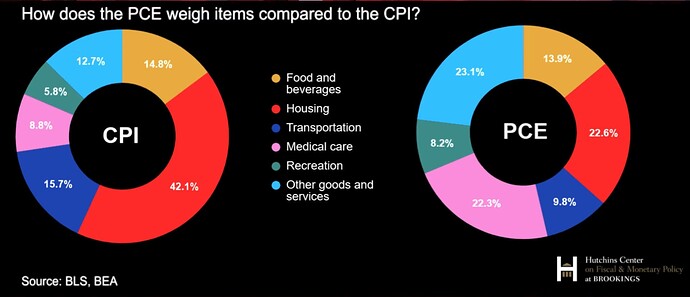

I also want to point out why all pivots are not created equal. Remember we have 2 mandates.

The type of soft landing Greenspan was trying to engineer in the 90s is an example of lowering rates in anticipation of where the market would be in the future relevant to inflation. This is an example of a fed pivot speaking towards our 1st mandate, inflation.

When Bernanke had an emergency rate cut in Oct 2008, this was because we were in a worldwide financial crisis, its aim was to calm fears and add liquidity to the market. This is an example of a fed pivot that speaks to our 2nd mandate. Unemployment and crisis intervention.

This is why a bullish reaction to the BOE news made no sense. This isnt a soft landing achieved and the worst is behind us. What this tells us is we have stress in our global financial markets that is starting show cracks that demands real intervention. Macro is in charge here, and will be for awhile. News like CS and potential interventions are only a result.

The question we should be asking ourselves is what had caused bond prices to drop to the point where a large pension would get a margin call like this? In fixed income, a market designed for safety?

Im going to continue to scalp strong trends both directions, in and out quickly and swing mainly the downside. Im still playing indexes but Ive had better hit rates and gains playing individual names both directions so im going to continue that until it doesnt work. Im not playing any FD’s and that has been a game changer, much easier to let plays form and run. Dte, strike, and position sizing is how I have been navigating risk. Moving around daily depending on what the market is doing. Always cutting losers as early as possible if things dont go as planned.

We need to pay attention to the fed, data, global news, and how they all relate to equities and the real economy.

Also, looking at TTD and their 853 P/E ratio. Anyone familiar with this company?