This is a bit of a hodge-podge post with a couple of streams of thought.

Tl;dr:

- Correlations between equities and bonds, and equities and USD seem to have decoupled since the March banking crisis

- Recession still isn’t here; we may have to consider reinflation as a pitstop

- S&P fwd yields suggest the worst is behind us

Decoupled correlations

Correlations that we relied on through 2022 and into the beginning of 2023 are no longer holding:

- Noted the correlation break with liquidity measures in the Market Liquidity Tracking discord thread

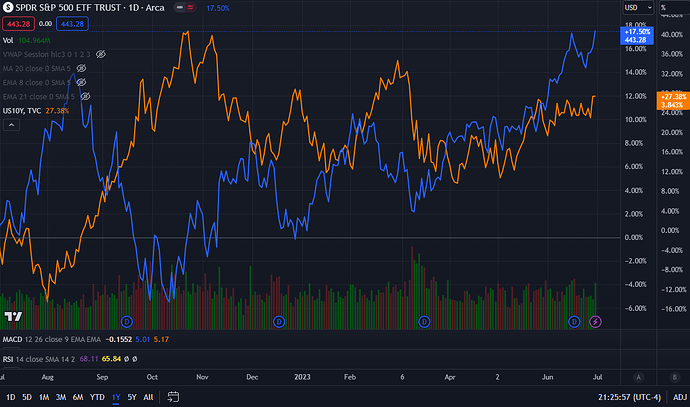

- 10Y and other bond yields are no longer clearly inversely correlated with stocks.[1] (Image 1)

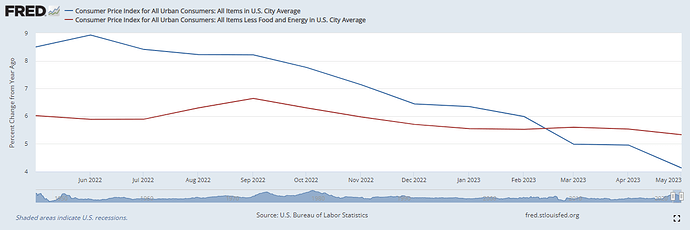

- DXY has also stopped showing an inverse correlation with SPY. (Image 2)

[1] Note that stocks and bond yields are usually positively correlated (because stocks and bonds are negatively correlated - the basis of the 60/40 portfolio), but that relationship broke in 2022 as interest rates unpinned from near-0, resulting in decimation of bond values.

It looks like the correlations broke after the March mini banking crisis. I do not know if this is a temporary disconnect and a mean reversion will occur, or if this is a new regime.

We know bonds are pricing in a recession, based on the cuts expecpted over the next year and change. If we believe a recession is very likely, then it stands to reason that equity markets are the ones that will need to correct.

Will Recession narrative give way to Reinflation?

But what if a recession gets pushed back out quite abit? Or does not happen, even? (Thus achieving emmacualte disinflation …) A delayed recession seems increasingly likely, as the economy continues to be strong, along with the labor market. And the Fed is in no hurry to keep bringing pain, since they seem to be in a 25bp-raise-then-skip pattern now.

In that case, it is rates that will have to at least keep steady, if not rise more. And thus the historical relationship of “stocks up, bond yields up” is restored.

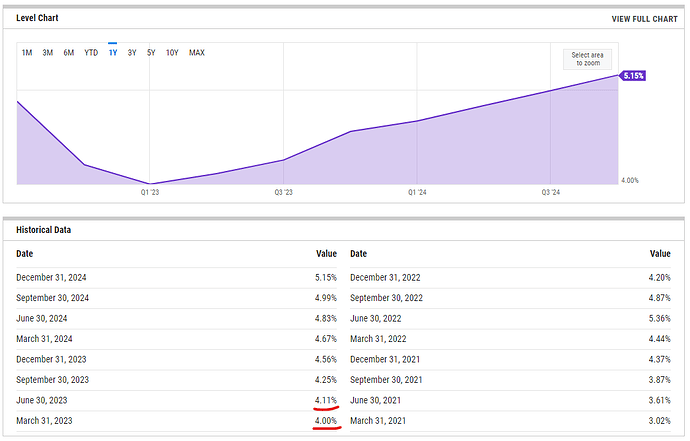

Let’s take it one step further - what if inflation itself becomes sticky? We’re seeing signs of that, with core CPI remaining in the 5.x range for months, even as headline inflation goes down.

(Source)

The effects of reinflation are not something we have looked into much. By the way there are base effects in play, with June 2022’s 1.2% MoM CPI giving way to July 2023’s 0.0%.

Recession should still happen though, due to all the lagged effects of rates rising 5% in one year. Mostly through the credit channel.

Stocks feel good aboout themselves

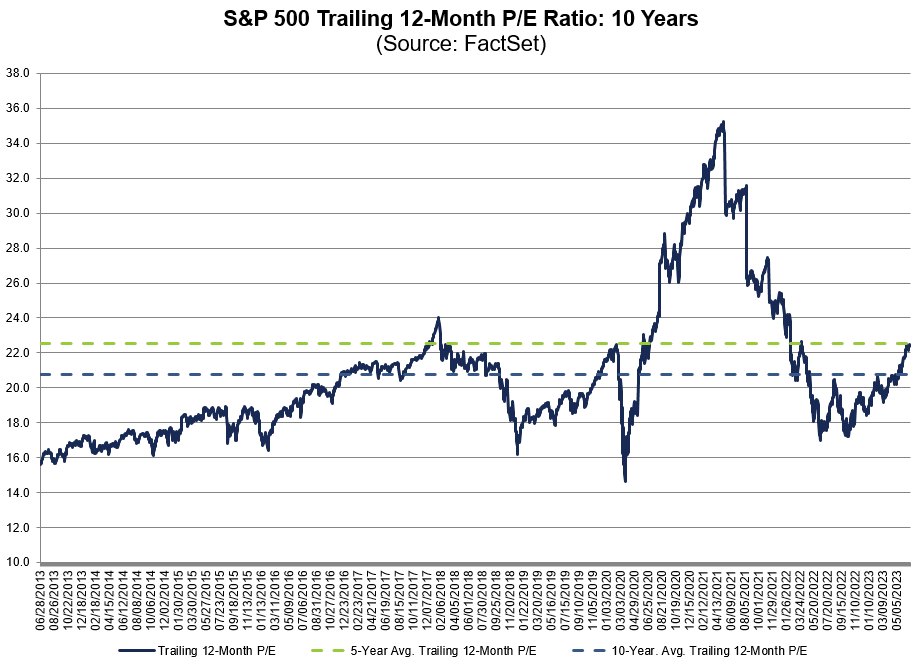

Not saying stocks are responding to a reinflation pivot from recession-based one, just that it won’t hurt the rally that is currently underway. S&P forward yield estimates suggest better days:

S&P 500 Earnings Yield Forward Estimate is at 5.15%, compared to 4.99% last quarter and 4.56% last year. This is higher than the long term average of 4.39%.

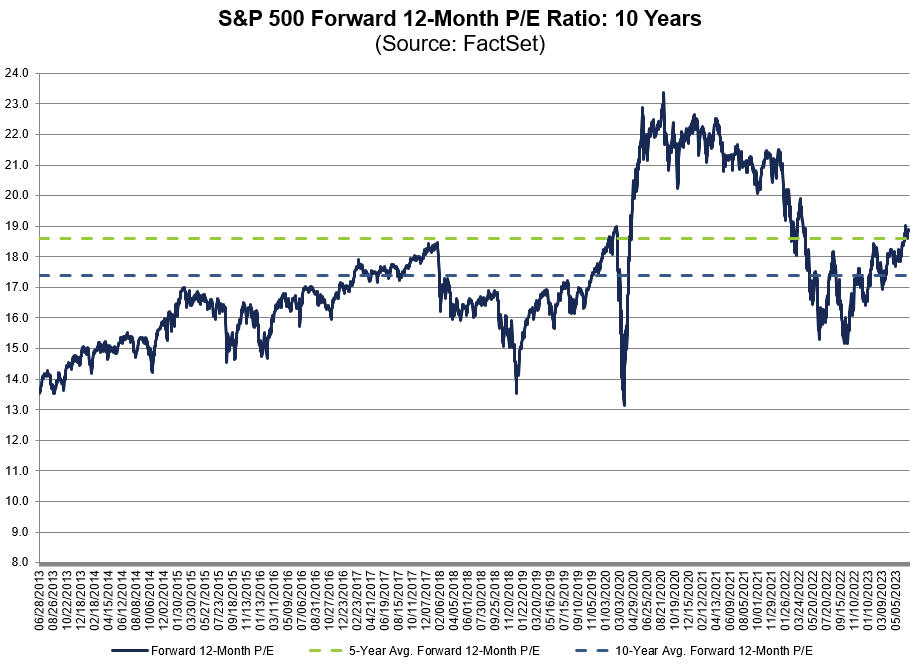

With PE following suit:

The trailing 12-month P/E ratio for SPX of 22.5 is equal to the 5-year average (22.5) but above the 10-year average (20.7).

(source)

The forward 12-month P/E ratio for SPX of 18.9 is above the 5-year average (18.6) and above the 10-year average (17.4).

(source)

Caveat: I’ve taken liberties seamlessly moving between talking about the economy and the market, and recession and (re)inflation. That leaves room for lag effects, not to mention errors.