@Yong took the liberty of starting the July thread. Who would you like to be this month - hot girl, or George?

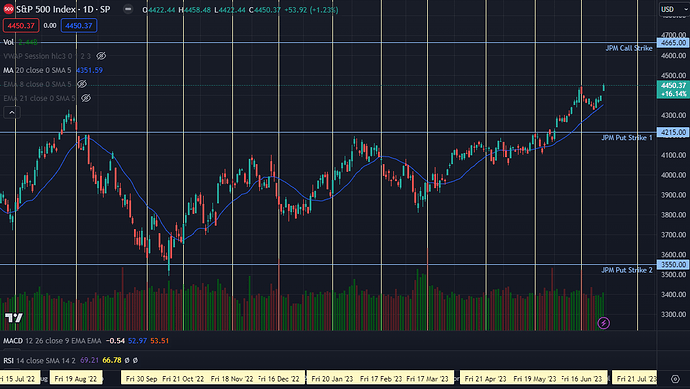

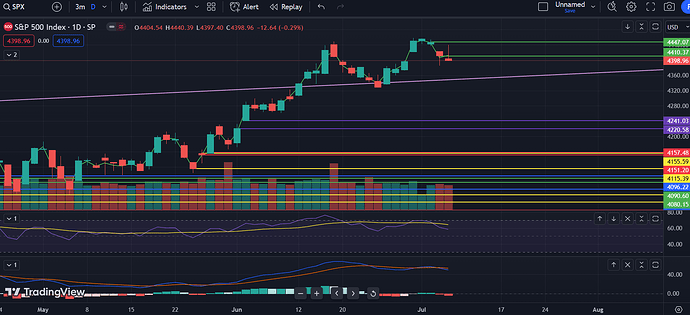

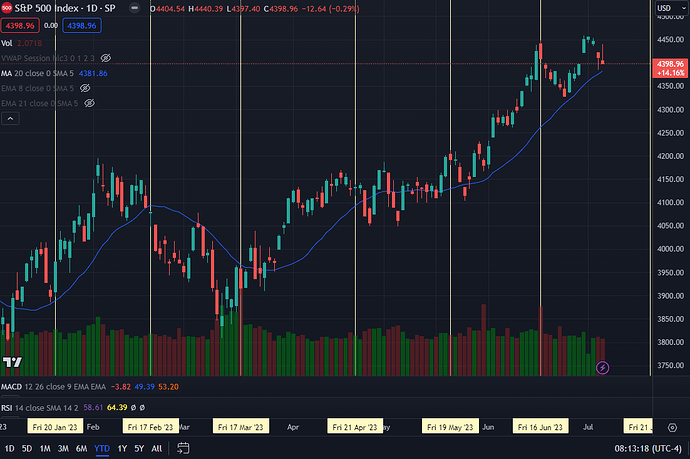

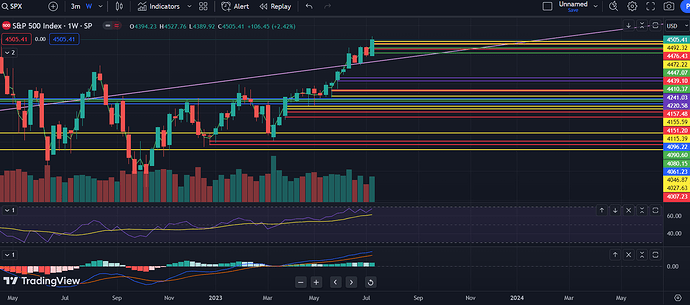

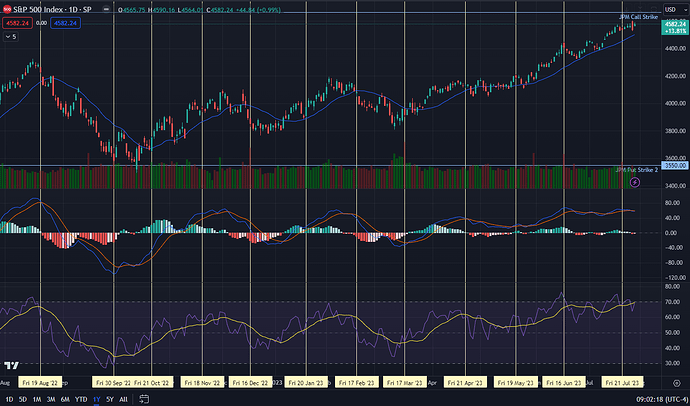

Last summer, things were pretty chill. This summer might get a bit more messy. We’re in the middle of what looks like the beginning of a strong rally. Some are calling it beginnings of the blow-off-the-top that will finally allow the market to correct. Others note that there is nothing inherently wrong with the economy, and therefore there is no reason for the market to be anything by ebulient.

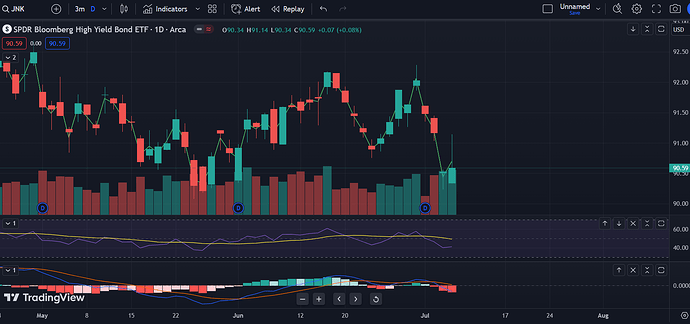

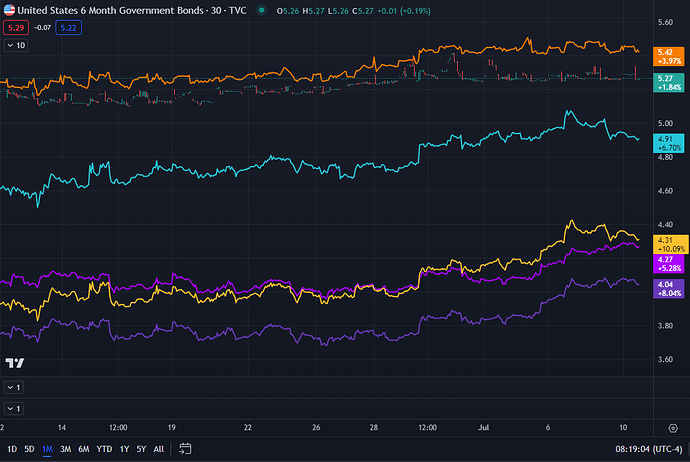

It’s all a bit complicated, but the good news is we may still have sufficient clarity to trade, even as mommy-equities and daddy-bonds fight and figure things out.

I’ll be playing the next 2.5 weeks with a bullish mindset until some major bearish signal materializes. Reasons:

- Positive momentum, and the lack of any proximate potentially-bearish catalyst.

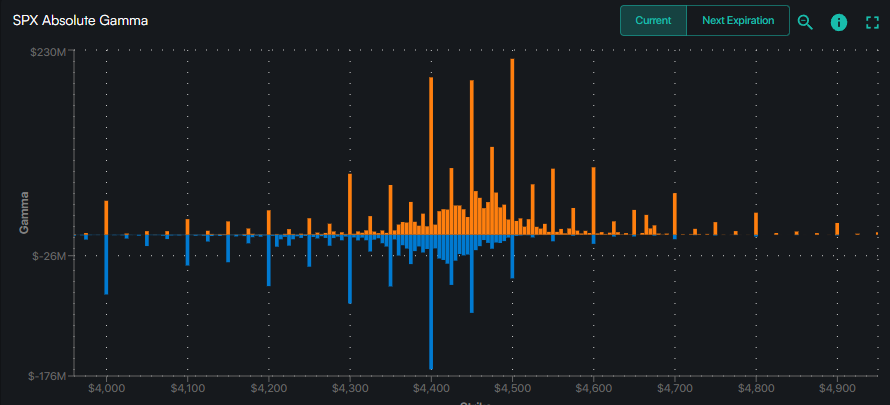

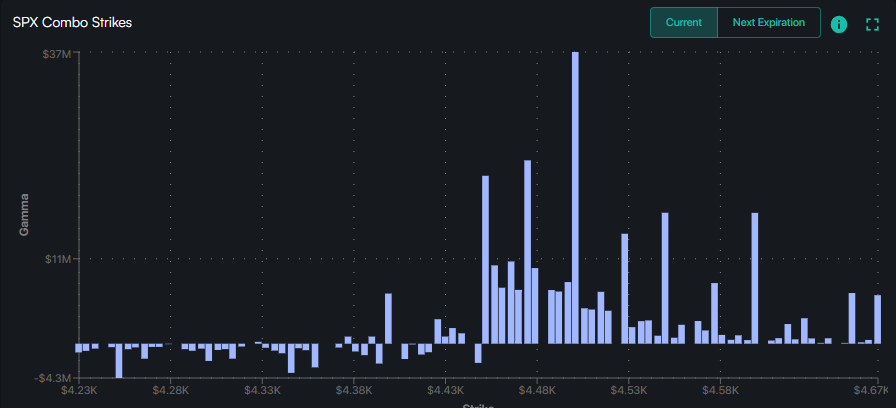

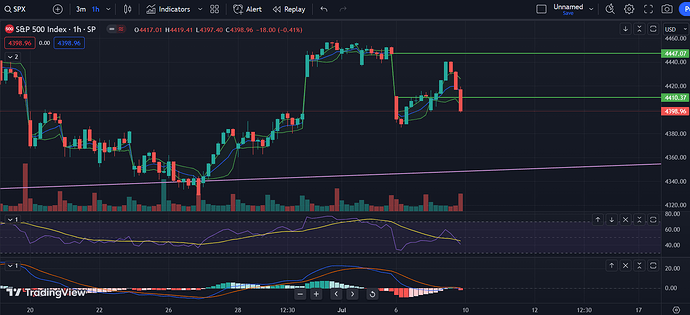

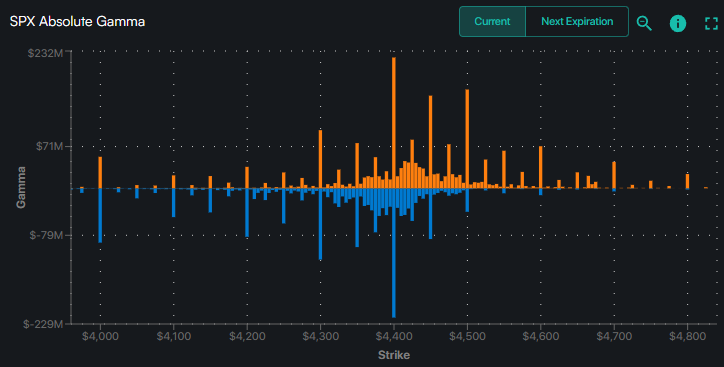

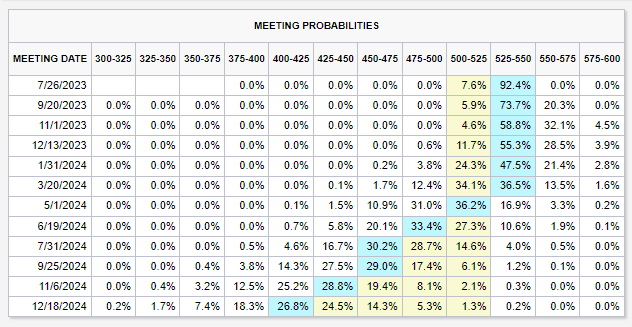

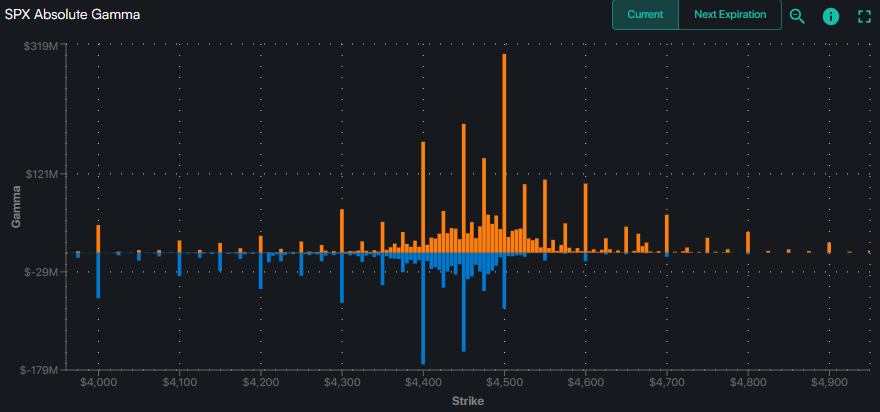

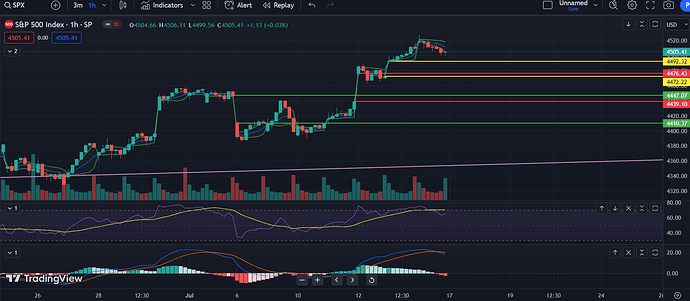

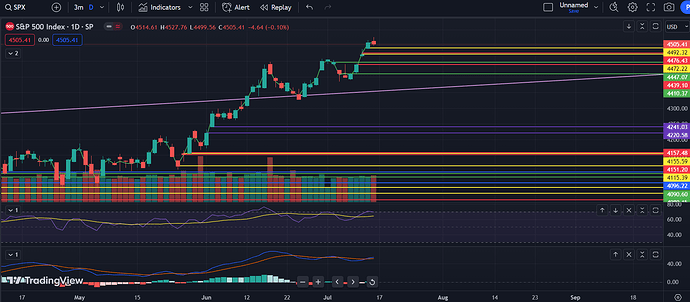

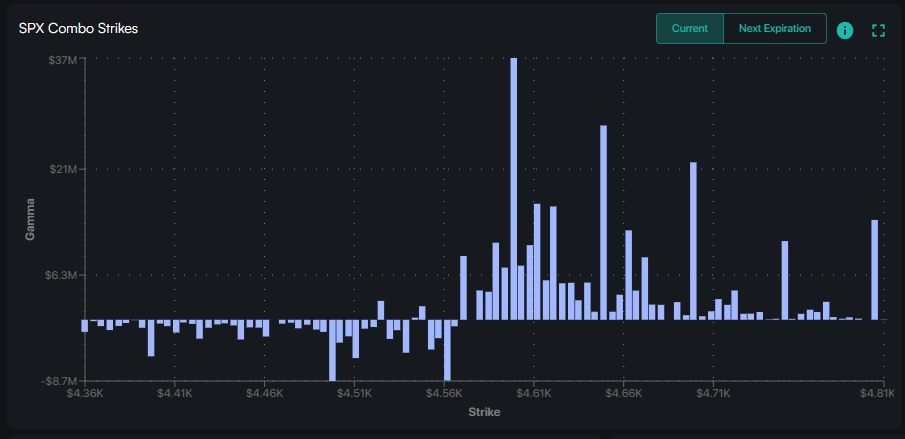

- SPX call wall is at 4500 - will need it to roll higher though to keep moving up.

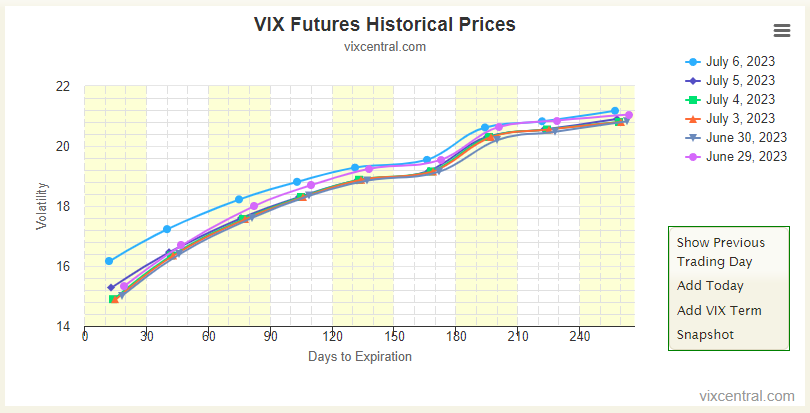

- VIX is going lower and lower. Sure, part of it is because of 0DTE, but part of it is also because folks are taking of hedges because they don’t see as much risk anymore.

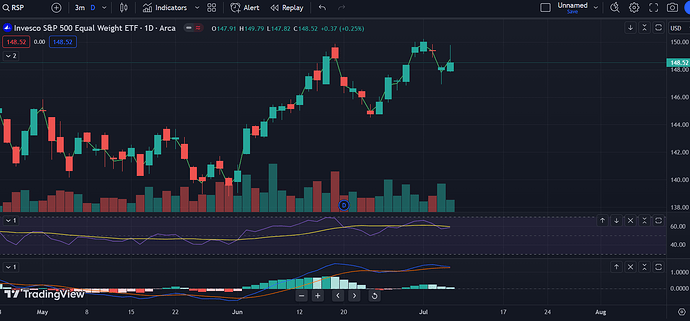

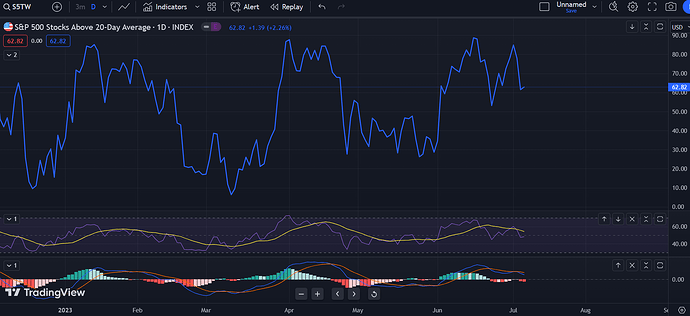

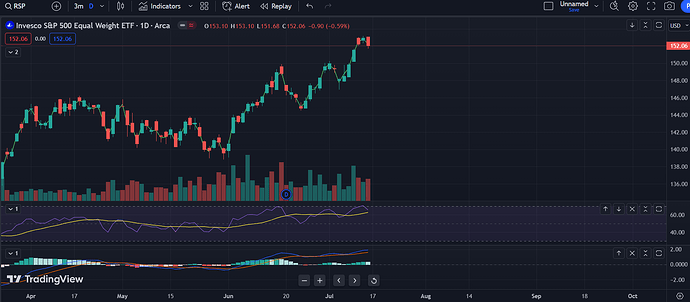

- Breadth is returning to markets - its not just the 7 FAANG++ stocks that are moving the indices.

- Picking up a fair bit of FOMO on Fintwit - folks don’t want to be left behind

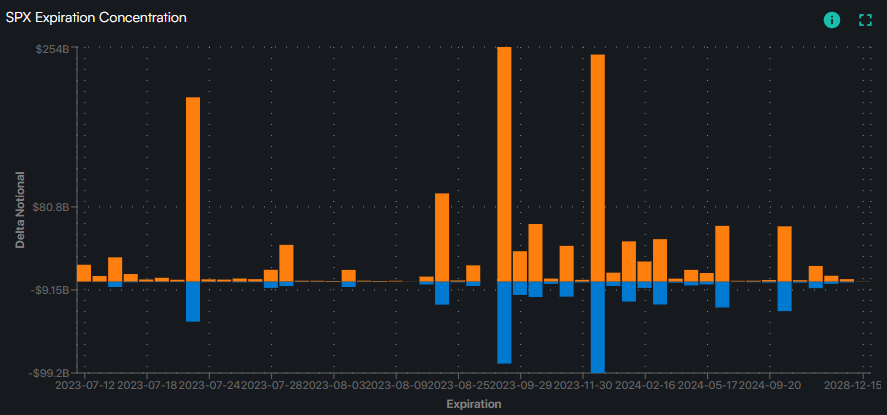

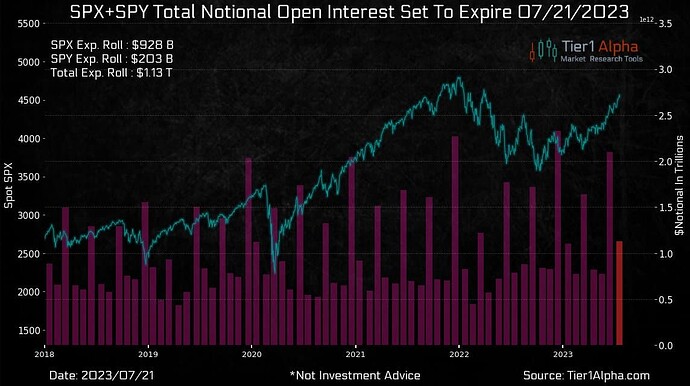

I note 2.5 weeks and not 3 because markets might soften a few days before July opex on 7/21.

In the immedaiate term, would be nice to get a pullback to the 4400 level tomorrow to load up on bullish bets, after that gap-up on Fri. Mon is a half day when we can expect liquidity to be low, and Tue is the 4th. With this long holiday over, expecting traders to come back quite hungry.