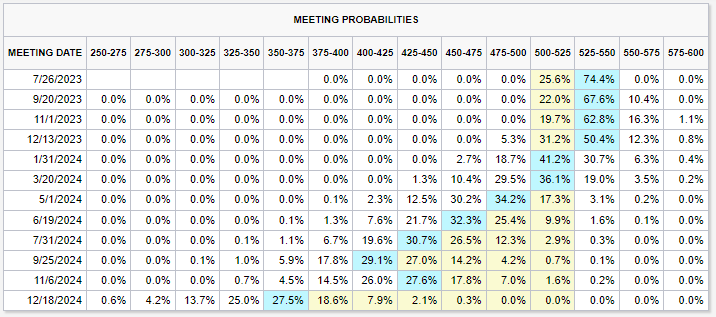

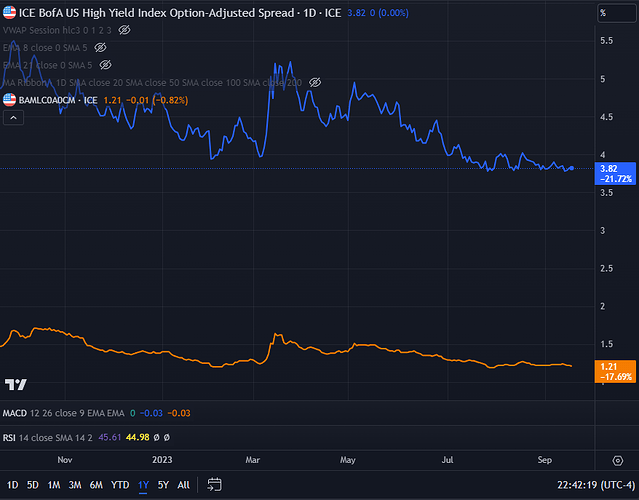

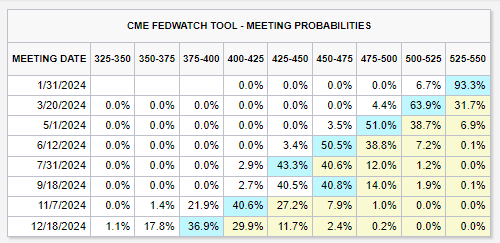

@brutus yes indeed, higher rates for a longer period of time, compared to what the market is pricing in as per the future fed fund rates:

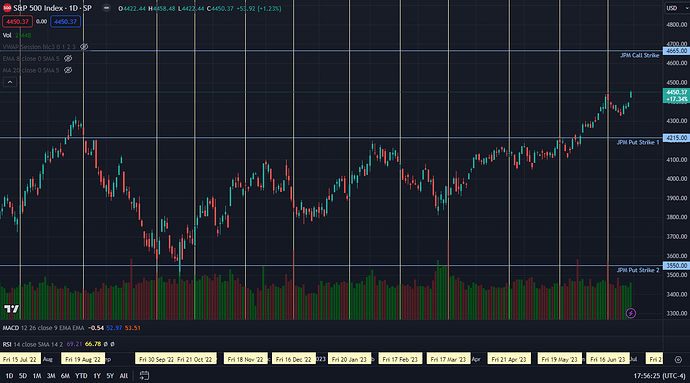

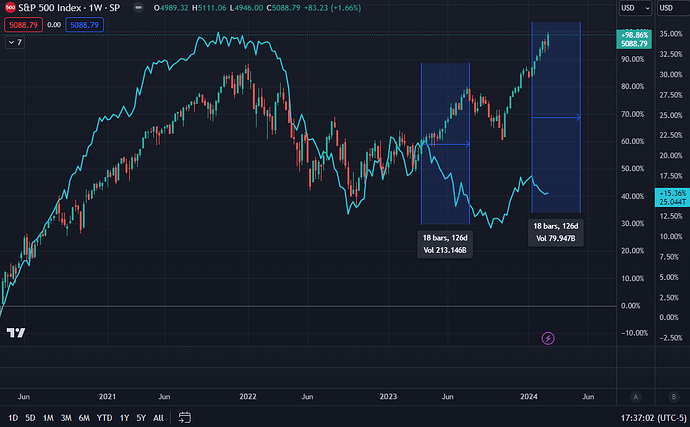

Sharing this for situational awareness. 9/29 JPM collar trade rolled into 4665C, 4215P and 3550P strikes. This won’t matter much until Aug, but the market’s had an odd way of ending close to these strikes time and time again.

If one were to read the tea leaves … 4650 by Sep, or higher for a bit and then back down to 4200 by then? ![]()

This is a bit of a hodge-podge post with a couple of streams of thought.

Tl;dr:

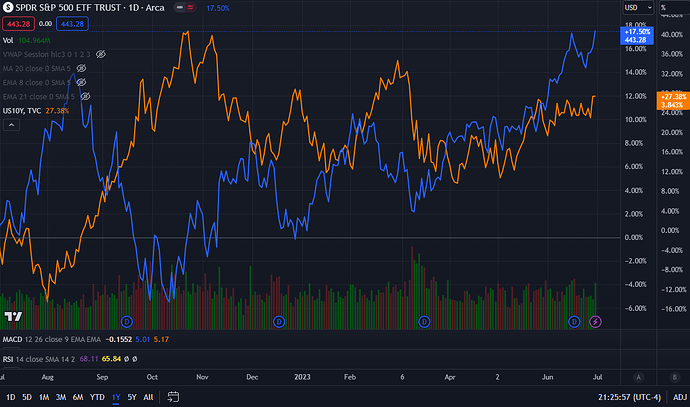

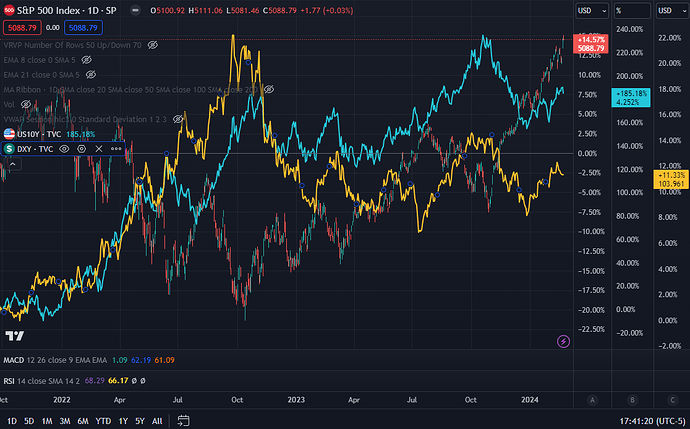

- Correlations between equities and bonds, and equities and USD seem to have decoupled since the March banking crisis

- Recession still isn’t here; we may have to consider reinflation as a pitstop

- S&P fwd yields suggest the worst is behind us

Decoupled correlations

Correlations that we relied on through 2022 and into the beginning of 2023 are no longer holding:

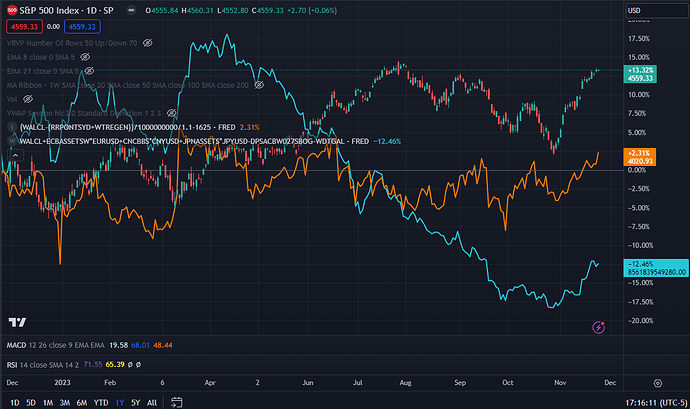

- Noted the correlation break with liquidity measures in the Market Liquidity Tracking discord thread

- 10Y and other bond yields are no longer clearly inversely correlated with stocks.[1] (Image 1)

- DXY has also stopped showing an inverse correlation with SPY. (Image 2)

[1] Note that stocks and bond yields are usually positively correlated (because stocks and bonds are negatively correlated - the basis of the 60/40 portfolio), but that relationship broke in 2022 as interest rates unpinned from near-0, resulting in decimation of bond values.

It looks like the correlations broke after the March mini banking crisis. I do not know if this is a temporary disconnect and a mean reversion will occur, or if this is a new regime.

We know bonds are pricing in a recession, based on the cuts expecpted over the next year and change. If we believe a recession is very likely, then it stands to reason that equity markets are the ones that will need to correct.

Will Recession narrative give way to Reinflation?

But what if a recession gets pushed back out quite abit? Or does not happen, even? (Thus achieving emmacualte disinflation …) A delayed recession seems increasingly likely, as the economy continues to be strong, along with the labor market. And the Fed is in no hurry to keep bringing pain, since they seem to be in a 25bp-raise-then-skip pattern now.

In that case, it is rates that will have to at least keep steady, if not rise more. And thus the historical relationship of “stocks up, bond yields up” is restored.

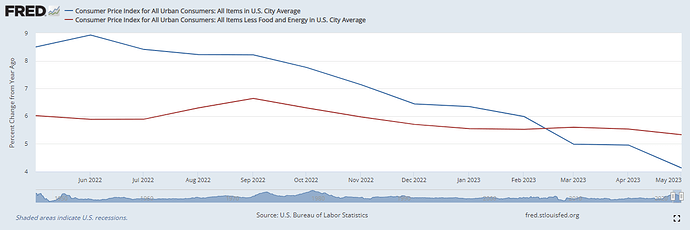

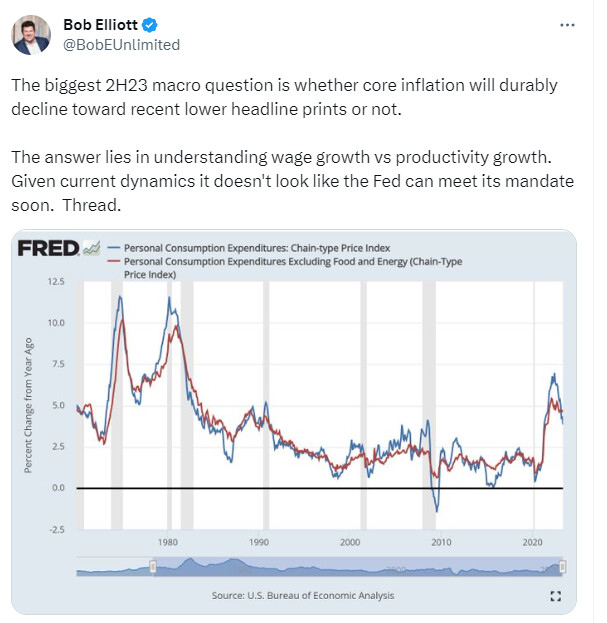

Let’s take it one step further - what if inflation itself becomes sticky? We’re seeing signs of that, with core CPI remaining in the 5.x range for months, even as headline inflation goes down.

(Source)

The effects of reinflation are not something we have looked into much. By the way there are base effects in play, with June 2022’s 1.2% MoM CPI giving way to July 2023’s 0.0%.

Recession should still happen though, due to all the lagged effects of rates rising 5% in one year. Mostly through the credit channel.

Stocks feel good aboout themselves

Not saying stocks are responding to a reinflation pivot from recession-based one, just that it won’t hurt the rally that is currently underway. S&P forward yield estimates suggest better days:

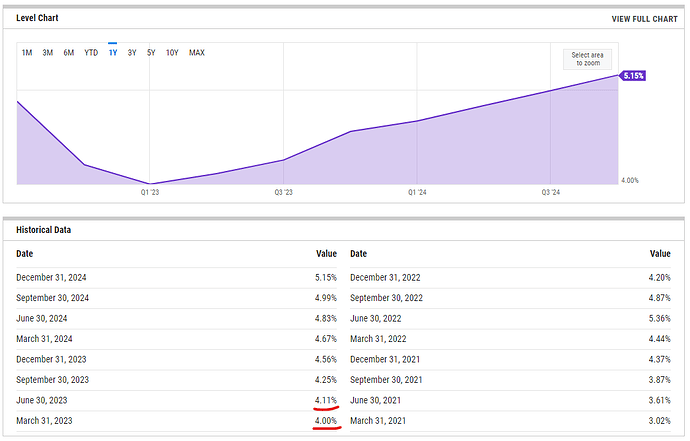

S&P 500 Earnings Yield Forward Estimate is at 5.15%, compared to 4.99% last quarter and 4.56% last year. This is higher than the long term average of 4.39%.

With PE following suit:

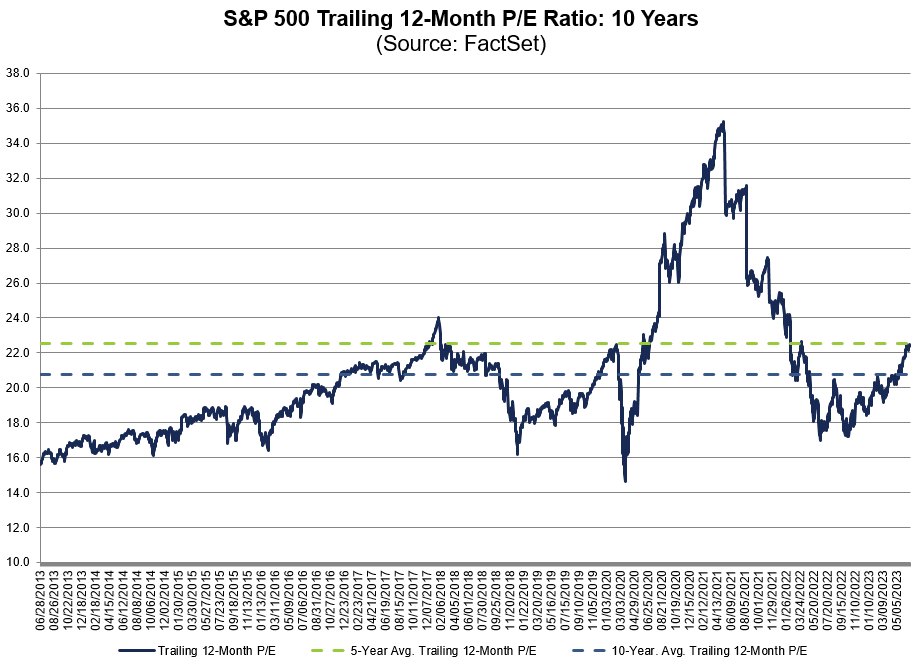

The trailing 12-month P/E ratio for SPX of 22.5 is equal to the 5-year average (22.5) but above the 10-year average (20.7).

(source)

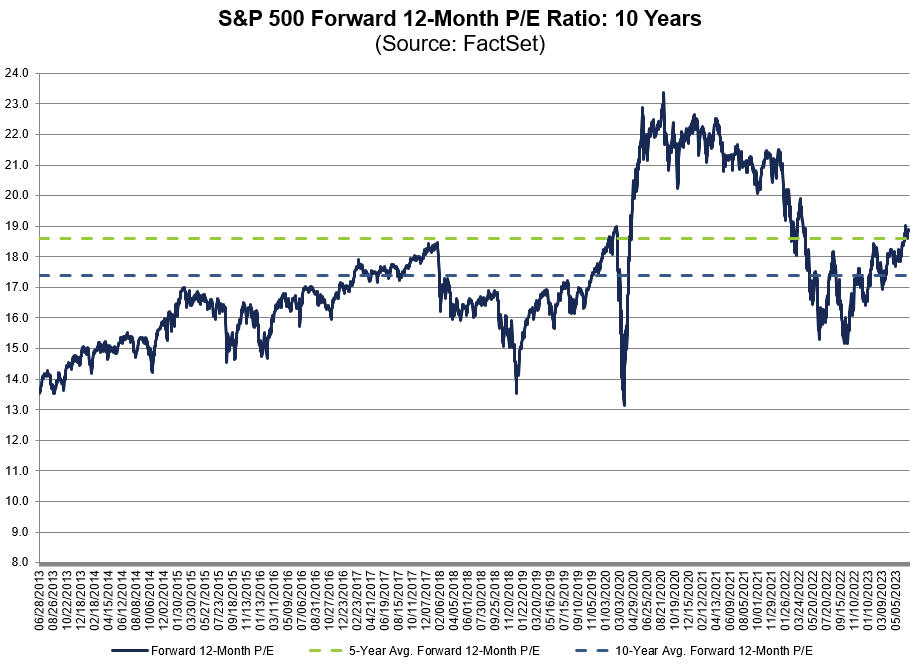

The forward 12-month P/E ratio for SPX of 18.9 is above the 5-year average (18.6) and above the 10-year average (17.4).

(source)

Caveat: I’ve taken liberties seamlessly moving between talking about the economy and the market, and recession and (re)inflation. That leaves room for lag effects, not to mention errors.

Another great thread from Bob “Unlimited”:

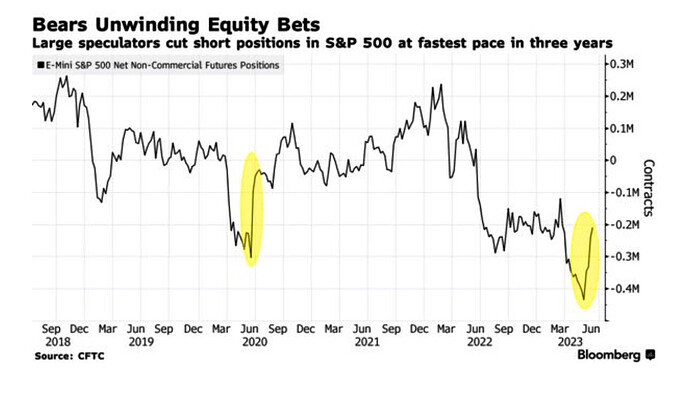

Massive slowdown in consumer credit. Expanded by $7.2B in May, much slower than $20B est. & $20.3B in prior month. Auto and student loans actually fell, while credit cards saw slower growth.

Bank credit had slowed down too. If this trend continues, should affect growth significantly soon, if not already.

(Source)

Guess we just kinda wait and sit on the sidelines with cash.

I didn’t think much when I saw this piece 2 days ago, where some prof made the case for a 3% inflation target:

But then today, Nick the Fed Whisperer said this:

Officially, the Fed’s target for inflation is 2%. With inflation running well above that number, officials are still focused on whether to raise rates one more time this year. But that is a relatively small consideration compared with the bigger question of how long to keep rates at that high level.

Fed officials could try to get to 2% quickly, such as by the end of next year, by raising rates higher and only slowly reducing them as the economy weakens. That would risk a sharper downturn and possibly kill the chances of achieving the soft landing.

On the other hand, if they’re satisfied that inflation is slowing durably, they could hold them at their current level and consider trimming rates later next year. That would take more time to get to the inflation target—around three years.

What if getting to 2% isn’t worth the pain? Another strain of thinking says the Fed should accept a rate around 3% as the new target. Powell and other Fed officials say moving the goal posts like that isn’t an option.

The challenge of finishing the fight against inflation will likely be a big topic of debate for central bankers when they gather for the Kansas City Fed’s annual retreat in the mountains of Jackson Hole, Wyo., where Powell is set to speak Friday.

While Nick suggests the Fed does not consider 3% as an option, this has now introduced the thought into the public domain.

The Fed is not like the BoJ, and so is as anti-surprise as possible. Since the next target consideration is in 2025, it would make sense for him to “start thinking about thinking about raising the inflation target.” And JH - where policy wonks discuss policy - would be a perfect venue for this.

Let’s keep an ear open for this on Fri:

- If he so much as hints at a 3% target, it will begin the unanchoring process of inflation expectations, and all kinds of bearish reactions.

- If he dismisses this notion as vigorously as before, markets will likely breathe a sigh of relief, which would be bullish.

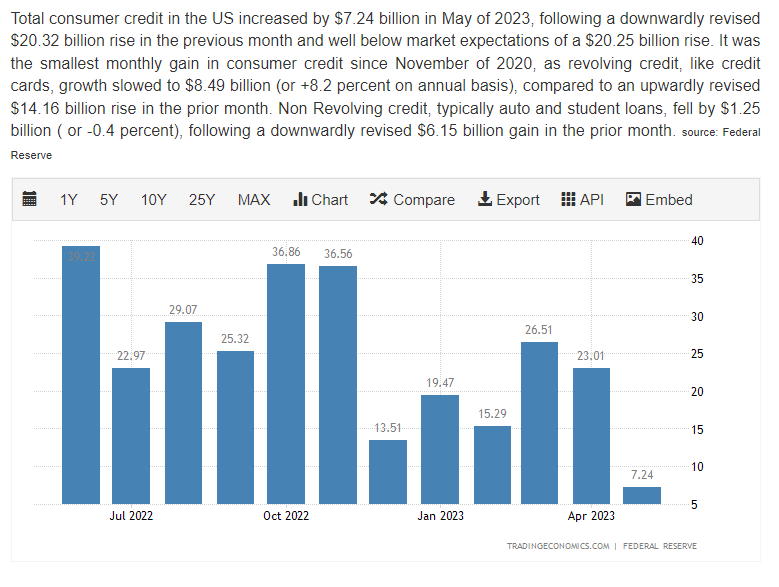

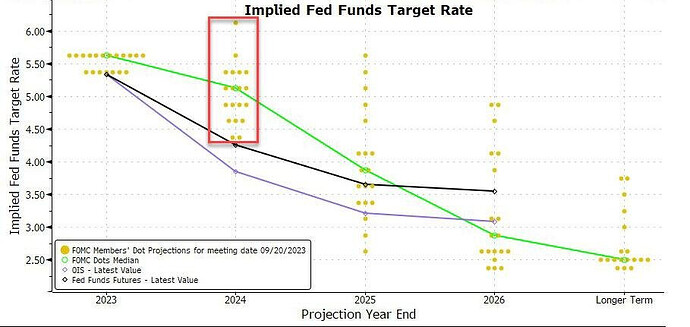

JPow hurt market right in the feels today by noting that the Fed expects end of year rates for 2024 and 2025 fed fund rates to be 50 bps higher than their estimate from just 3 months ago.

Whether reality will work out this way or not is a different matter; for now, market seems to be pricing this in somewhat seriously. Wanted to put a few things on our radar to track over the next few days to see if this pain persists. If it does, things count get toasty.

- Yields have spiked 15bps as of 2pm EST - this is a rather sharp move in such a small amount of time, bond world.

- 2Y has not been this high since 2006 - 16 years ago. 10Y is not too far behind. This will add pressure to the credit market, as well reduce amount of collateral available (through bond value impairment).

- DXY was already roaring higher, and this “higher for longer” seems to have added fuel to the move. As we know, DXY and markets are inversely correlated. Not only that, but a strong dollar causes issues for foreign markets in all kinds of ways, most stressful of which is likely the effect on the JPY and JGBs.

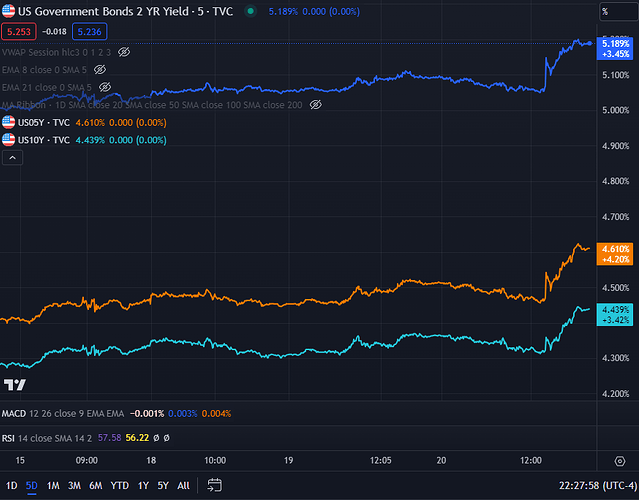

Is all this about to cause some kind of meltdown? Not imminently, if credit spreads are to be believed. Both investment grade and junk spreads are at the lowest levels over the last year. Until this starts twitching up, systemic things are probably under control. And all that is required is a correction in the equity markets to

All in, JPow seems to have turned up the heat fairly successfully post-FOMC. Let’s see if it lasts more than a day or two.

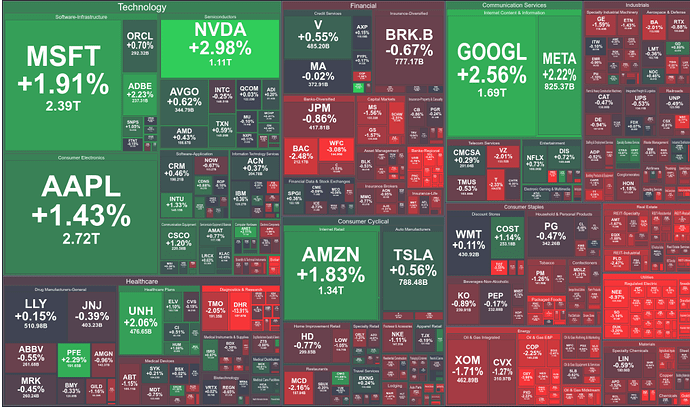

Interesting day today. XLU (Utilies) for clobbered, and Gold got hurt too. But markets were mostly flat, even though yields kept going higher, along with DXY. The winners… MAG7.

Is the current thinking:

“Yields will likely go higher, so no point in buying too many bonds yet. Not really getting recession-y vibes, and USD stronk, so gold is undesirable. Might as well revert bac to what worked the first half of the year - park money in primarily tech behemoths which are kinda immune to main street concerns like debt, unemployment, etc. because they are flush with cash and only need a few server shepherds. So pivot from Main Street, and to the best of S&P!”

Confirmation will be if S&P and Nasdaq keep rising even though most stocks are flat or red at first, followed by catchup.

S&P Heatmap:

Top S&P tickers:

Sector ETFs:

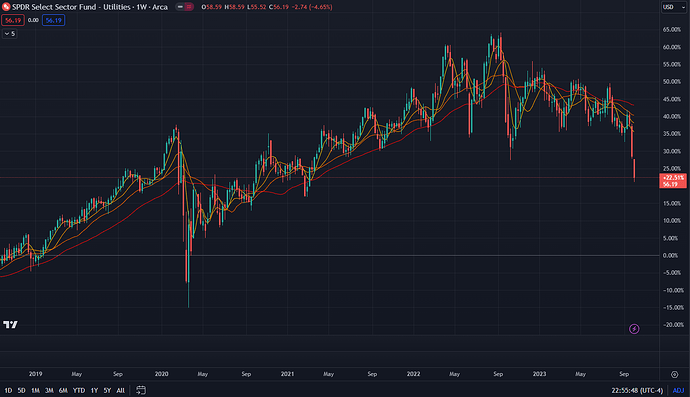

That XLU jackknife… far away from all SMAs, and even below pre-covid highs.

XLU is cyclical though, so there should be a nice entry point in the near future, as yields taper off.

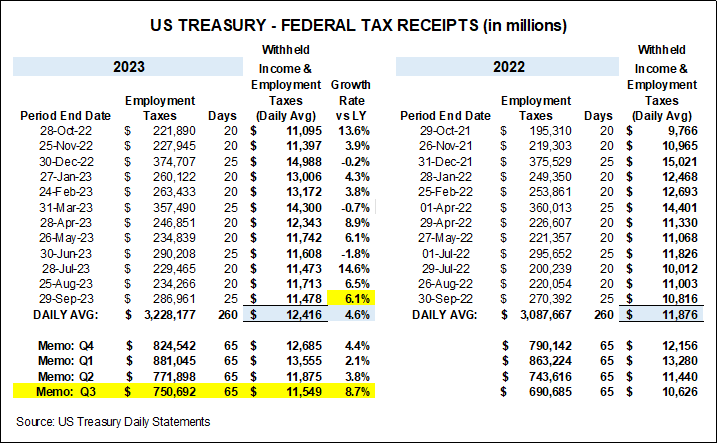

Went looking for some data to understand the JOLTs report. Looks like labor market not doing badly at all - YoY growth in tax receipts significantly higher in Q4 in the last 12 months.

Some more context from Bob “Unlimited”: x.com

All signs point to a solid labor market.

This suggests that the stock market is not responding to recession concerns, which would result in a long-term decline, but more to higher rates that are pricing in this strength, making it more likely that the correction is short-term.

Excellent interview with Andy Constant on wtf just happened this week.

Tl;dw:

- By keeping supply of bonds more or less the same, Yellen took pressure off of the long end.

- Powell was counting on that to do some of his work for him; now that is somewhat undone as 10Y falls from 5% to 4.5%.

- However, while the effect on the stock market is immediate, the impact on the real economy will take longer to show up. But companies will take this easing to keep growing and fire less.

- Eventually, Powell will have to keep hiking because financial conditions are not restrictive as they need to be.

- Other tidbits on Druckenmiller and impact on elections included.

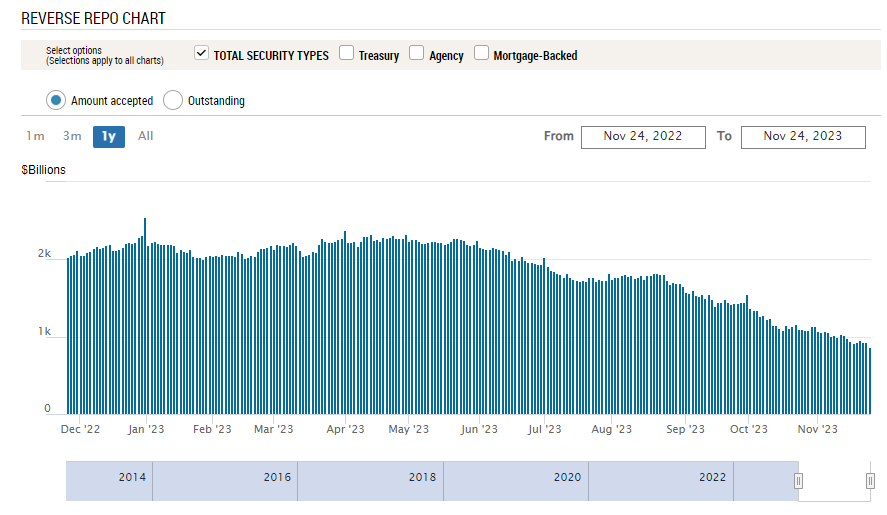

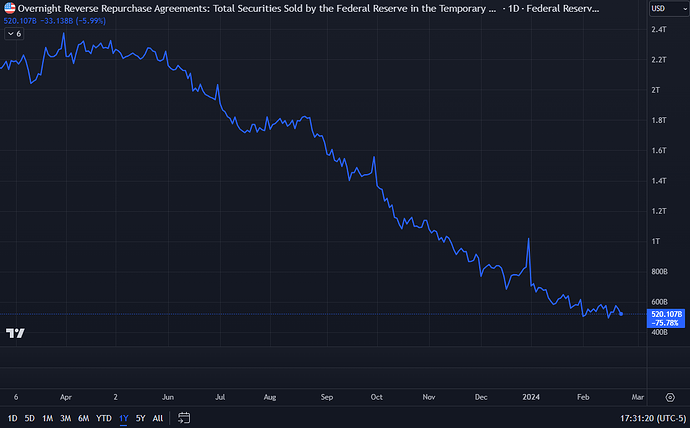

Reverse repo balance is down to about 865B from > 2.2T just six months ago. This has supported the bill and note sales. Extrapolating though, this liquidity is drained in Q1 2024?

Underlying central bank liquidity has also been supportive, and correlating again:

Interesting that CB BS is going up though… need to dig into why.

Fed will publish their dots this FOMC. Last time they did that in Sep, it caused a dump because they had priced in only one rate cut in 2024. Markets currently have 4-5 cuts priced in.

If Fed members estimate 2 or 3 cuts this time around, adjusting lower from Sep, market will see that as confirmation of its view and likely rally on it. But if Fed members remains steadfast, that would likely be bearish for markets.

(Source)

Great thread on the situation of the labor market. For now, it supports the narrative of a soft landing. The challenge is to make sure that it doesn’t do a touch-and-go, and soars again. (Look at that AHE…)

If this continues, it is difficult to see how that March cut happens.

Liquidity might become important again.

-

The BTFP facility is ending on Mar 11, which provided much needed liquidity to distressed banks. Banks will still have access to the overnight facility for funds, but not at the nice, preferential terms the BTFP offered.

-

The RRP has down to 500B, from its high of 2.4T, and will likely reach a steady state, if it hasn’t done so already. This reduces funds for the shorter term bonds, and that money might have to come from other places money is parked, including stocks.

-

We saw how the last two auctions were not good - 30Y and the 20Y TIPS. These might be early signs of additional liquidity issues.

Generally, we see the markets move in tandem with liquidity for the most part. Any dislocations like the ones in Q2 2023 were closed eventually. We seem to be in a similar period of dislocation.

Rates and DXY have both gone up, by the way. Which this isn’t necessarily a liquidity thing, it can add to the pressure lower liquidity can have on equities.

Clearly, market is paying no heed to these - for now. The reconciliation should make for some nice volatility.