Also, note for the week: There are several big economic reports this week that will shift the markets starting on Wednesday (CPI), Thursday (PPI, FOMC minutes release), Friday (first of large banks report Q1 earnings). I’m going to be (mostly) risk off heading into Wednesday.

Bob “Unlimited” says there won’t be a recession, labor market still too tight for small businesses, they are raising prices now, and the credit crunch is more of a Wall St problem, not a Main St one.

Details here: https://twitter.com/BobEUnlimited/status/1645763404735434755

![]()

That actually is the way my wife who has a big small business says. I keep asking how they are doing with employment and profit. They can’t fire anyone because of no replacements and cont to make money than pre 2020 bc they just pass it on to customers. They have a pluming supply business which I thought would be an indicator of housing starts and labor market. So far still crushing it and paying sub par employees high wages.

People seem to find my musings helpful so I figured I’d jot down a couple thoughts before I started coding again as it’s rare these days I’ve followed long enough to really form an opinion one way or another.

Recession Confirmed Kinda

We saw in the FOMC minutes that several FED members are seeing a mild recession by years end. This is the first time I believe that we’ve had admission of this and while it’s certainly not the same as JPow admitting recession in a speech, it is a data point that should be paid attention.

Inflation Looks to Be Easing

Most data recently has pointed towards lessening inflationary pressures. While we still have holdouts yelling about Core and Services, those screams have been ongoing since the start. There is a key difference between being the last to come down and being a force preventing inflation coming down. Historically these “sticky” inflation points are moreso the former and not really an indicator that policy isn’t working.

What’s it all mean and why is the market up?

Well I’m sure to a lot of people the market being up today is confusing as all hell, but it makes logical sense:

A recession is part of the current “picture” the market has priced in. It would be foolish to think otherwise and I believe the term “mild” is key as it points to what I believe will be considered a “soft landing”. By most accounts, thus far at least, it looks as though the fed is accomplishing this goal rather well.

This is where we hit balloon theory and a return to baseline. Mild recession confirmation is a confirmation of the currently priced in scenario giving the “all clear” for resumption of normal market movements. Now this was simply built upon by PPI this AM showing further reduction in inflation and jobless claims increase showing more but not too much more weakness in the labor market.

So in an environment where inflation is now starting to take a backseat to recession it’s pretty easy to jump straight to “bad news is bad”. DO NOT DO THIS as it of course isn’t that clear cut. I know to some of us that identify as bears, the confirmation of that switch can feel like vindication but I can assure you that pursuing that is a sirens song. Instead we should be looking for big misses since as we covered before, the market already knows recession is possible and has priced that into a lot of companies that are going to report. It would be expected that marginal misses are going to be bullish in this environment just as they have been. This means the catalysts for “legs down” will likely fall to the companies suffering outside what is considered to be normal. Same goes for data, “not that bad” is good.

We should be looking carefully at earnings and companies that are likely being hammered by the current economic conditions. That is what is about to take focus. This is also the time where we could start shifting toward a return to “bear market” activity in having larger legs down as the unforeseen effects of recession come home to roost. This makes these areas a prime spot for LONG FUCKING DATED bearish positions.

Final thought

I would be interested to see what the market did upon FED confirmation of recession historically. JPow’s admission of things typically comes 1-2 months after we start to hear them show up in FED member commentary. FED members had signaled inflation wasn’t transitory before him, FED members signaled for slowing rate hikes before him as well so there really isn’t a reason to think this time would be different. So that means we’re likely a month or two out from confirmation of recession from the big guy himself. This has the potential to be the last “Jackson Hole” moment he’s got in him in this current cycle depending on his wording. This is the most important thing to listen for from him in coming talks in my opinion.

Back to work for me, happy trading and I’ll see ya soon.

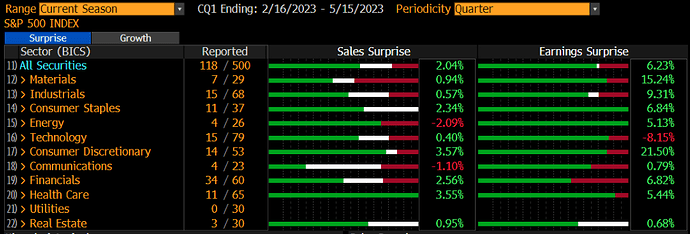

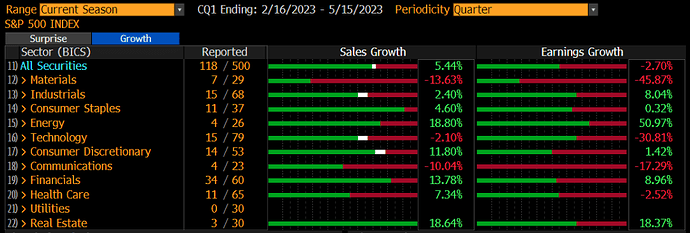

For the 118 of the S&P’s intrepid 500 that have reported earnings thus far, only earnings growth is negative (-2.7%). Sales growth positive, and positive sales and earnings surprises. To the extent the positive surprises are the delta between what is priced in and what market will now react to, difficult to see earnings tip it over, assuming this trend continues.

(Source)

Since a recession seems to be around the corner, would be good to prep for tickers we can play during the slowdown. I don’t think it is time to pull the trigger on these yet, but perhaps in another month or two, once we have confirmation.

We can create threads for each in the forum if they do not exist already:

- Gold - GLD or IAU

- Gold miners - GDX for regulars, GDXJ for juniors

- Silver - SLV

- Silver miners - SIL for regulars, SILJ for juniors

- Bitcoin - BITO

General thesis is: Silver will likely be the most lagged to catch on, but SILJ will probably rise most explosively when it does. The gold ones will likely be the most conservative. BTC will likely be somewhere in the middle. @TheHouse have already been playing Gold a bit, so will look to you for guidance!

All three - gold, silver and BTC - have the feature of being anti-fiat. With the ongoing push for de-dollarization on top of the economic slowdown, they also hedge against USD/DXY going down.

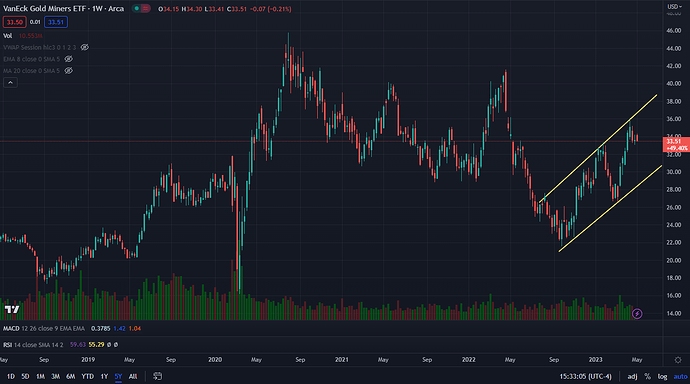

For a buy signal, I’m looking at GDX, in addition to a recession confirmation. GDX is in a nice channel. If markets rise a bit more and gold falls, we could get to the bottom of the channel, which would be a nice entry point.

Re: Bitcoin, feels like it’s the gold for the crypto-familiar, and it’s got a small market cap (0.5T vs 1.5T for silver and 13T for gold), so will move fast when it catches a bid from folks fleeing to safety.

What else could we add to this list?

I’m all about it! Been trying to keep the BTC thread alive, let me know if there is anything in particular you want me to review on it.

Please do keep it alive! There will be times when it is the obvious play, and the situational awareness we get by regularly following tickers will be beneficial when it comes to pull that trigger!

Id be happy to add some GOLD commentary, will see if we have a thread.

Right now Im generally watching DXY for shorter movements and I still think a recession narrative is bullish for the gold/precious metals sector. I currently have a longer position on and have been playing shorter swings when things are moving. I also think there is a bull case for gold in regards to geopolitics and currency developments around the world, both landscapes brings potential catalysts with them so there should be plenty to discuss.

Thanks @The_Ni !

Imo I think we should also take a look at these companies for failures and/or recovery.

15 companies that might go belly up:

Date written: 10/6/22

1: Bedbathil Beyond = - $3.53 billion (discontinued)

-

Tuesday Moming = - $35 milli

-

The Real Real = -$600 million

-

Way fair = -$3.054 billion

-

Digital Brands -$6.25 million

-

Rite Aid = -$2.7 billion

-

Victorias secret = -$0.98-Billion

-

99 cent only = -$900 million

-

Best Buy = - $ 1.184. billion

10: Toys R US = -$|.86 billion

-

Capri=-$1.4@billion.or -$. 1.20 billion

-

Tailored Brands = - $48.99 million (delisted Aug 2020 look to see who acquired them and calculate the risk)

-

Chuck E. Cheese = -$1-2 billion (im calling RIP on this one forever

)

) -

Brooks Brothers = -$ 600 million 2020 closing soon and will have new owner (calculate risk and I’ll also be calling this a RIP

)

)

NFP median estimate for tomorrow is at 195K:

Granted, the last few months have been revised lower after the initial print, but if this comes hot, could increase the odds of another 25bps hike.

Sentiment and the narrative is changing fast. From bearish to bullish, over the last few weeks.

Found this contrast amusing.

GS:

Zero Hedge:

Saw some conversations on supply chain. What we’re seeing (and it’s correcting somewhat in basic commodities but some stuff is still infrequent like distilled water, wheat, etc which is more key plays and infrastructure issues) is what’s known as the Bullwhip effect. Here’s an article. Super interesting if you’re into understanding supply chain logistics The Bullwhip Effect and the Supply Chain

Returns of various asset classes:

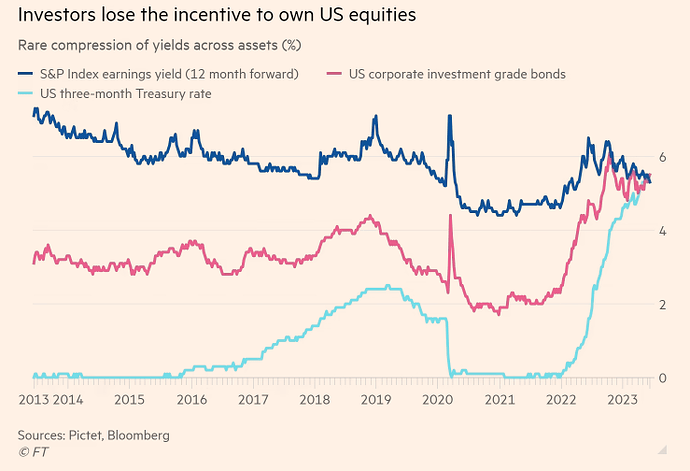

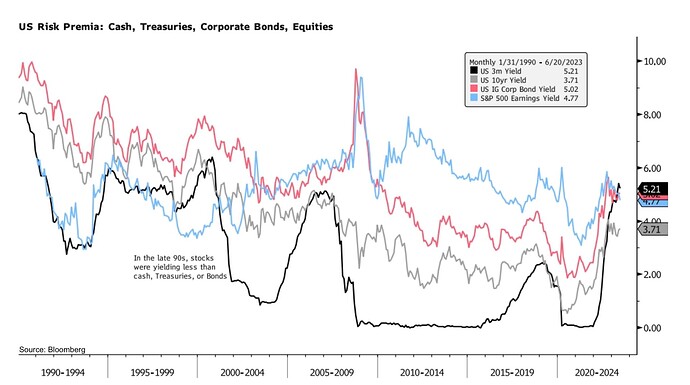

S&P 500 (medium risk) → 5.3%

Corporate bonds (low risk) → 5.3%

Treasury bills (no risk) → 5.3%

(Source)

Totally natural normal stuff, this evaporation of risk premium for riskier assets. Nothing to see here ![]()

Sorry to be a dumbass but what are you implying here?

The risk is basically all converging. So basically bond yields are starting to equal the same return yield (or payout) as the SPY etf essentially. Which is really weird cause spy has been on a fucking tear. This causes most investors to rebalance their portfolio in favor of the less volatile and safer asset (in this case being T-bills) if this trend continues you should begin to see money pouring out of equities and into bonds. But that’s yet to be seen ala spy is at 437

Thanks Navi, appreciate the explanation ![]()

Nice thread from Bob “Unlimited”, making the case for “higher for longer”:

What does “higher for longer” mean? Interest rates will stay higher for longer than expected?