I really love this thread and I think it could be insanely valuable to Valhalla. We have the ability to get ahead of data and anticipate where equities will go and what the economy will do in a very intentional and systematic way. I want to talk about the fed a bit then talk about how I discern data points from the perspective of the real economy and or sentiment, but first, Something I have been wanting to say about macro trading:

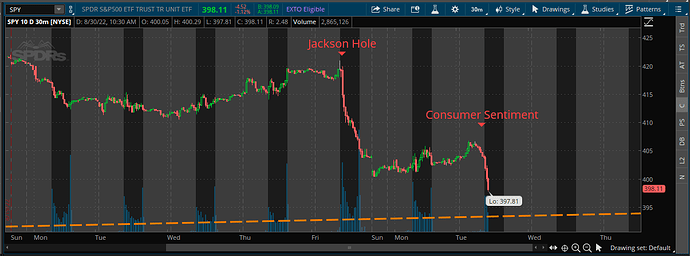

IMO Valhalla wins when we try to understand what is actually happening in the market instead of reacting to the market. The best trading days I have had this year were broad market declines based on Macro, literally anyone could have bought puts in almost anything and made money. No callout necessary. Look at the Beakmap from last Friday or today for instance, you could have throw a dart at it and wherever it landed would have made money scalping puts with the conviction and understanding of the move. Although targeting specific names has value, outside of ER’s trading macro has less to do with the individual names declining on a single day as it has to do with why they are declining in the first place. Then from that, you find the easy targets, usually starting with a sector first. Hopefully we can all learn from each other here and get a little better at understanding this wild market every day. This is why I love Valhalla and why I am here.

The fed is pulling what levers they can to fight inflation without cratering the market. They have 2 mandates, one is stepping up in times of crisis and the other is to manage inflation. We are seeing #2 now, will most likely see the other within the next 12 months.

If we think about this from 2 camps it looks like this.

#1 The fed is hawkish and tightens to control inflation. Great, we wont have roaring inflation like we saw in the 70’s. But as destructive as high inflation can be to the economy, tighter monetary policy or deflation is equally as destructive to balance sheets thus equity markets due to less cocaine in the system (credit) Less credit or leverage means less buying power or demand to go around.

#2 The fed doesn’t do enough to get a hold of inflation. This means most American’s continue to be squeezed by high prices in areas they need, like housing, food, and energy. Excess dollars or discretionary income get funneled to select sectors while the rest of the market suffers.

In both cases, any purchases that were made during the cocaine frenzy need to be paid back. This could be homes, cars, credit cards, business loans, in store revolving accounts, etc.

Regardless of what the fed does now there is pain ahead in the form of a recession, this pain most likely will be longer and harder than most expect. Again, where is the bull case here? Where is the demand going to come from? From my research into every bear market, recession, and black swan event from the last century and further, I believe we are headed into a global contraction that will last 12-36 months in the real economy. This has more to do with the global increased standard of living, the financial health of everyday Americans, and the global credit impulse the last decade than what the fed is currently doing. I say this because I believe the data shows we were already contracting well before anyone was paying attention to CPI and FOMC meetings.

So how do we play a potential catalyst?

I believe the challenge and opportunity is to understand what the data is saying about the real economy while understanding how the market will react as they may or may not be in alignment.

Here is an example I alluded to above.

Eventually we will see and confirm that inflation has “peaked”. Could have already happened honestly. We know without a shadow of a doubt historically and mechanically this means contraction. The Federal Reserve does not actually print money, they buy and sell government notes that increase or decrease bank reserves that can be used as collateral by depository institutions to lend more money to the private sector and eventually consumers. Its this lending of money through fractional reserve banking that ultimately “creates” money.

The road of deflation can shock the system. By taking away this expansion of credit, businesses are left with high labor costs that were driven up by higher and higher COL the last few years, luckily revenue and earnings allowed them for the most part to absorb these higher expenses. When deflation happens, businesses still have the higher labor costs, but now don’t have the synthetic revenue and earnings that they have seen from the fiscal and monetary policies of the last 10 years.

This is how contraction actually happens. Instead of a Lehman blowing up, its a long period of time where our productivity “catches up” to the wages and spending we have normalized.

The fed and our government may have contributed to the problem by fueling the supply of cocaine, but it really is average everyday American and the reckless financial institutions that are to blame for this phenomenon.

When faced with this challenge, business have to cut back. They do this in the form of managing expenses. This causes a deflationary spiral as business cut back labor costs. Those that have jobs may see less hours, or pay freezes while some businesses choose to cut employees altogether. This means less money or less economic activity that ripples through the economy. People cut back spending either because they have to or because they are scared about the economic future, either way the spiral continues.

Now I wanted to lay out this reality in detail to show how equities have the potential to fall out of alignment with data about the real economy.

If news came out that inflation “has peaked” I believe the market would take that as a sign that the worst is behind us. They would be wrong for the reasons I mentioned above. The market would likely rip, only to be punished when companies and consumers continue to report tighter economic conditions. This is exactly what the fed hopes to achieve, because their narrative is the only control they have in the short term. Any changes to monetary policy takes 6-9 months to work though the plumbing, not the day decisions are made. Markets are forward thinking, but not always accurate in what is to be expected.

So when I see economic data come out, its always from these two perspectives. What does the data say about the real economy going forward? (Always thinking of credit impulse and corporate balance sheets) and What does the data say to the markets? (Thinking sentiment and fed psychology)

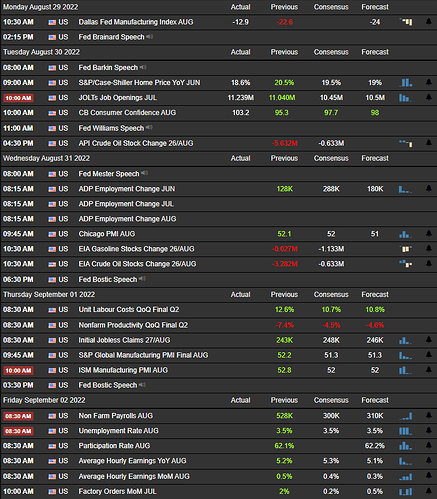

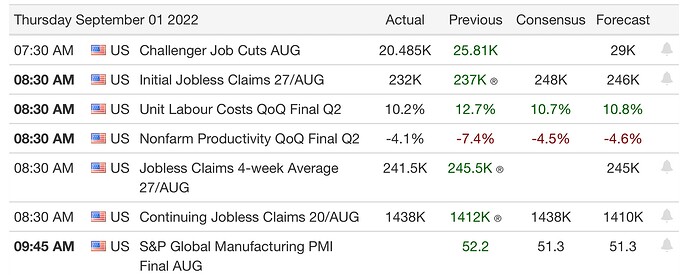

I would love to have this thread serve as an area to discuss upcoming data events.

We can use it to discuss the fundamental side with the sentiment side, as both speak to the same or potentially different trades.

Where I see both eventually being forced to come into alignment and my highest area of conviction is any data point that speaks to future earnings and labor. Primarily Q3 and Q4 this year.

Looking forward to this thread and continued discussion as always.