This thread is for general discussion and analysis of the listed commodity.

Article today talking about nuclear power:

RBC upgraded CCJ to Sector Outperform and the price target from CA$30 to CA$50. That and current events (war, bill in congress) contributing to the volatility.

There’s a good thread started by @SADO here: Uranium to Uranus

Daniel, shall we continue the discussion here, perhaps?

I guess it would make sense to keep the old thread up as I linked and wrote general info, but sure, we can move the trade discussion here.

Holding mostly cash as sector is volatile due to no ban news and averaging into $LEU May 30c

Perhaps @moderators could merge the two threads, if that that option is available?

If this OP gets wiki’ed, then anybody would be able to move relevant info from the other thread into this one.

Might not be a bad idea to sweep through some of these Discussion threads and do the same to all. IIRC We have 3 or 4 “general” oil discussion threads.

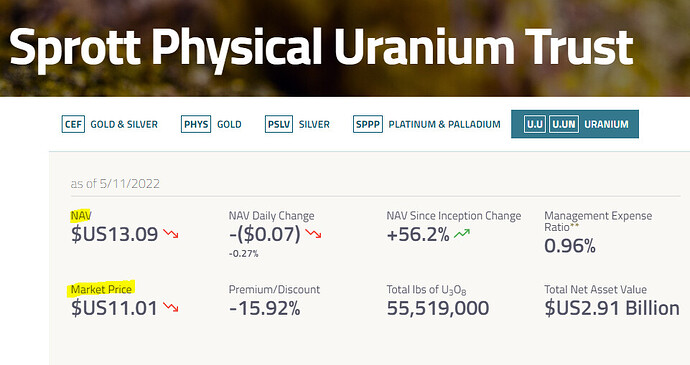

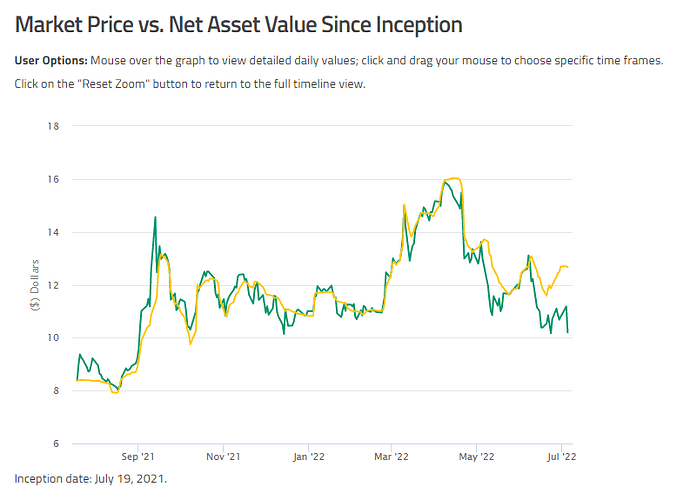

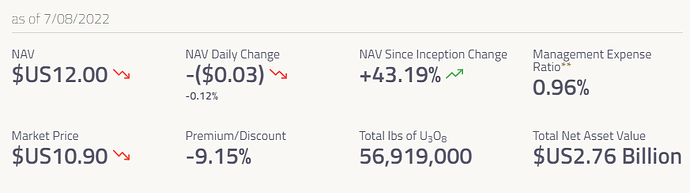

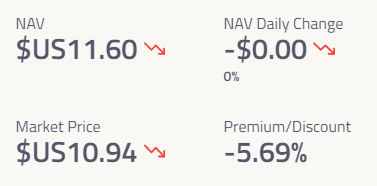

For uranium bugs - is it normal for NAV (C$13.09) to trail share price C($11.01) by this much for the Sprott Physical Uranium Trust (OTC ticker is SRUUF and diff in USD - $11.98 vs $10.78)?

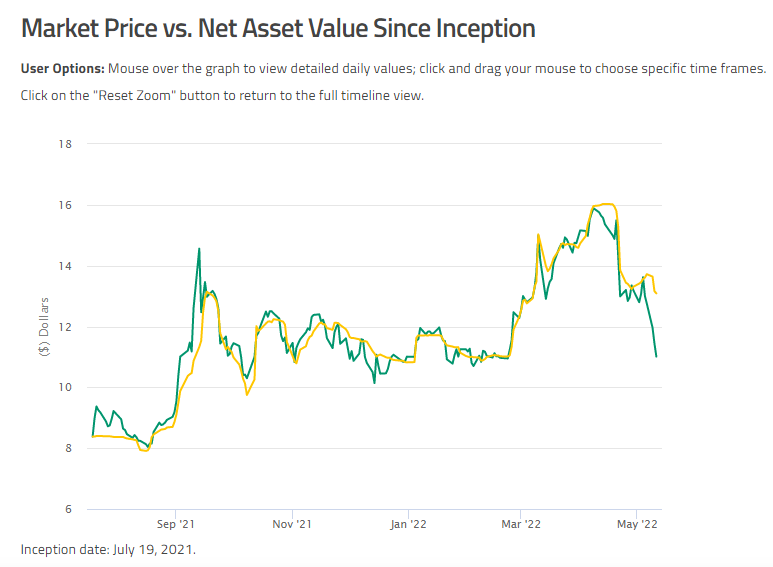

The disconnect does seem to be a recent phenomenon.

To the extent that we’re generally bullish on uranium, and this should revert, nice arb opportunity here perhaps?

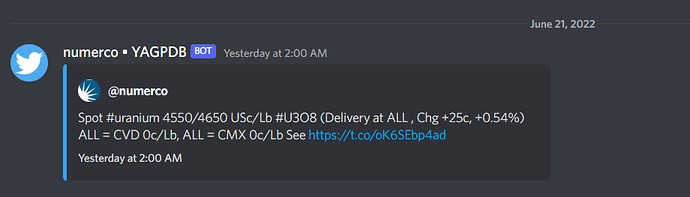

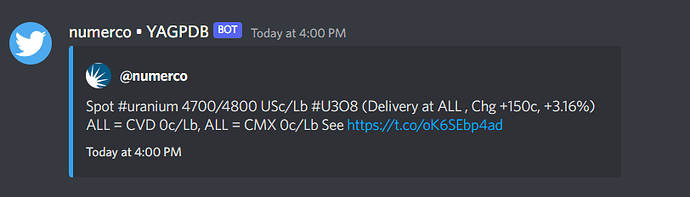

Uranium is on the uptick again.

Also, the difference between spot and NAV for SRUUF seems to have corrected itself:

UEC aquire UEX - Uranium Energy Corp Announces Acquisition of UEX Corporation to Create the Largest Diversified North American Focused Uranium Company (edited)

EU approve green label for nuclear.

SRUUF is trading at an almost 20% discount to NAV:

The $10 level has been an important support in recent times. Got a starter position at that $10 price point, will load more if it holds the line.

SRUUF tends to disconnect from NAV when there is a selloff in the markets. It’s not the biggest Fund out there, and its closed-ended, so the disconnect can be sizeable, like now. We can see it snapping back to NAV though when the selloffs are done:

One caveat with this - its considered a foreign passive fund and has some additional IRS paperwork requirements. One extra form, I think. For a 20% arbitrage… feels worth it.

NAV and price seem to be converging - NAV moving down, price moving up. Probably time to exit tomorrow with ~10% gains, if it holds.

(Source)

NAV spread is back to 18% again. Might go in again, though feeling a little hesitant given its broken the $10 line.

Topped up a bit more on SRUUF.

To take advantage of the NAV gap, but also because of news like this:

At somepoint, other governments may follow suit. What with Russian sanctions not going anywhere, there just isn’t enough other power sources. Germany has bucked the trend for now, opting for coal fired plants, but a few more such decisions and it might be a decent tailwind for uranium.

NAV on this is closing in and spot prices are also on a downtrend, so closed the position for ~15% gains. Didn’t wait for the remaining 5%.

Will keep an eye out for this arb opportunity opening up again in the future.

Biden / administration stance moved to emergency for green energy last week.

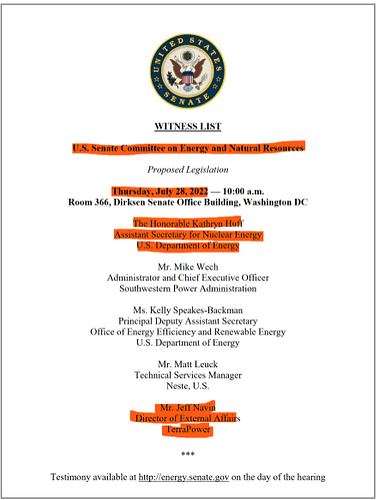

This weeks thursday 28th is vote on uranium ban bill.

Watch this:

Top tickers to watch: UUUU, UEC, LEU

Live: